- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Inspire Medical Systems (INSP): Evaluating Valuation as U.S. Expansion and Earnings Growth Draw Investor Focus

Reviewed by Kshitija Bhandaru

Inspire Medical Systems (INSP) has caught the spotlight as it expands its network of medical centers in the U.S., paired with notable gains in both earnings and free cash flow. Investors are starting to take notice of the company’s latest operational moves.

See our latest analysis for Inspire Medical Systems.

Following this positive momentum, Inspire Medical Systems’ share price has remained relatively subdued over the past year, with a latest close of $74.09 and a 1-year total shareholder return of -0.64%. The modest movement comes even as the company continues to invest in expansion and post strong financial figures. This suggests investors may be weighing the upside of operational progress against evolving risk perceptions in the sector.

Given how quickly the medtech landscape evolves, it makes sense to expand your watchlist. See who’s leading the way among healthcare innovators with the See the full list for free..

With steady earnings growth and a stock price well below analyst targets, investors now face a key question: Is Inspire Medical Systems undervalued, or is the market already factoring in the company’s future prospects?

Most Popular Narrative: 45% Undervalued

With Inspire Medical Systems trading at $74.09, the most watched narrative places its fair value far higher. This significant gap creates a real split between market moves and what analysts expect, highlighting the bold forecasts driving the narrative forward.

The recent delay in transitioning centers to the Inspire V next-generation system, including slower onboarding, delayed SleepSync implementation, and the Medicare billing update, are transitory issues. As these barriers resolve (with Medicare billing now live and most centers expected to complete onboarding by end of Q3), procedure volumes and revenue growth are positioned to reaccelerate in 2026 as pent-up demand is realized.

Want to know what’s fueling that steep fair value? The narrative hinges on a set of aggressive growth assumptions for revenue and profits, plus a future profit multiple that stands out even among high-flying medical device names. Which projection swings the value most? Unlock the details to see which number could make or break this outlook.

Result: Fair Value of $135.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational setbacks and potential declines in sleep apnea therapy demand could undermine the bullish outlook for Inspire Medical Systems in the near term.

Find out about the key risks to this Inspire Medical Systems narrative.

Another View: Multiples Suggest a Cautious Stance

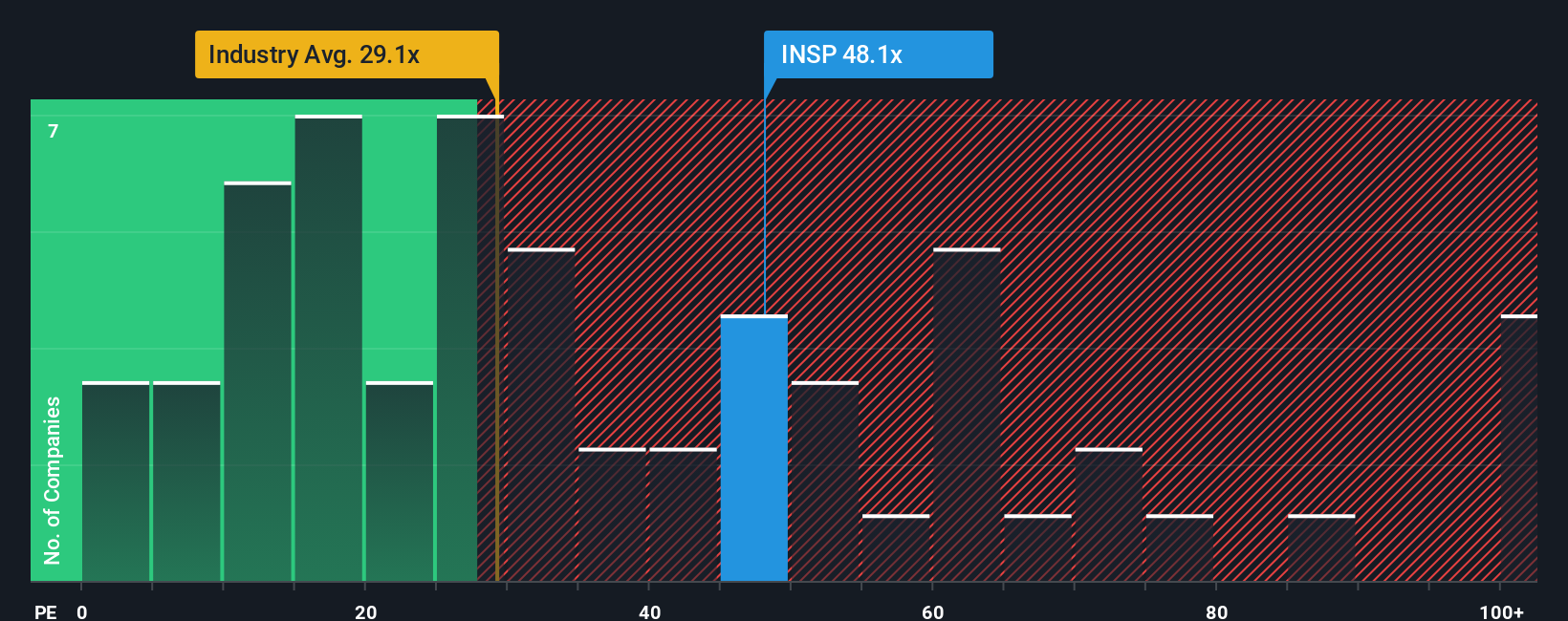

While the narrative approach hints at deep undervaluation for Inspire Medical Systems, a scan of its current price-to-earnings ratio presents a more cautious picture. Shares are trading at 41.2 times earnings, which is above the US Medical Equipment industry average of 30.1x and higher than its peer group at 40.4x. The fair ratio is 35.8x, suggesting the market may be overpricing growth expectations. This premium could signal optimism or set the stage for disappointment if headwinds persist.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If you see things differently or want to dig deeper, building your own perspective is fast and easy. You can customize the story in minutes with Do it your way.

A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

There is a world of compelling stocks beyond Inspire Medical Systems, each offering a different way to boost your portfolio's potential. Don't let great ideas pass you by while others take action first.

- Uncover companies poised to benefit from rapid advances in machine learning by checking out these 23 AI penny stocks, which stand out in the AI race.

- Supercharge your income strategy by exploring these 19 dividend stocks with yields > 3%, offering yields above 3%, so you collect rewards while you invest.

- Get ahead of the curve with these 26 quantum computing stocks, spotlighting trailblazers working at the forefront of quantum computing innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives