- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Inspire Medical Systems (INSP): Assessing Valuation After New Inspire V Clinical Results and Improved Patient Outcomes

Reviewed by Kshitija Bhandaru

Inspire Medical Systems (INSP) just released data from its Inspire V clinical study, highlighting superior patient outcomes and faster procedure times. The findings were announced during major medical meetings this week, offering investors a closer look at the system’s performance.

See our latest analysis for Inspire Medical Systems.

After a tough run earlier this year, Inspire Medical Systems’ share price has shown a bit of short-term recovery, with a 3.8% gain over the past week. Still, momentum remains subdued in the bigger picture, as its 1-year total shareholder return is down 61% and the stock trades well below its previous highs, suggesting that despite positive product news, investors remain cautious about the long-term outlook.

Curious about other opportunities in healthcare? Now’s a great time to explore companies innovating in this space with our hand-picked list: See the full list for free.

With strong clinical trial results, a hefty discount to analyst targets, and shares trading far below their highs, the key question remains: is Inspire Medical Systems undervalued right now, or is the market already factoring in future growth?

Most Popular Narrative: 38.8% Undervalued

With Inspire Medical Systems closing at $78.01, the most widely followed narrative places fair value dramatically higher, suggesting a significant valuation gap that may catch investors’ attention.

The recent delay in transitioning centers to the Inspire V next-generation system, including slower onboarding, delayed SleepSync implementation, and the Medicare billing update, are transitory issues. As these barriers resolve (with Medicare billing now live and most centers expected to complete onboarding by end of Q3), procedure volumes and revenue growth are positioned to reaccelerate in 2026 as pent-up demand is realized.

Wondering what justifies such a bullish fair value? This narrative banks on a future where a flood of new adoption, streamlined procedures, and a ramp-up in revenue growth collide. The key drivers behind the price target involve aggressive profit and sales projections, fueled by structural industry tailwinds. Curious about the exact assumptions analysts are making? The full narrative has the details investors are talking about.

Result: Fair Value of $127.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent rollout delays and the emergence of new, non-invasive sleep therapies could challenge Inspire’s projected growth and impact its long-term outlook.

Find out about the key risks to this Inspire Medical Systems narrative.

Another View: Is the Price Supportable By Multiples?

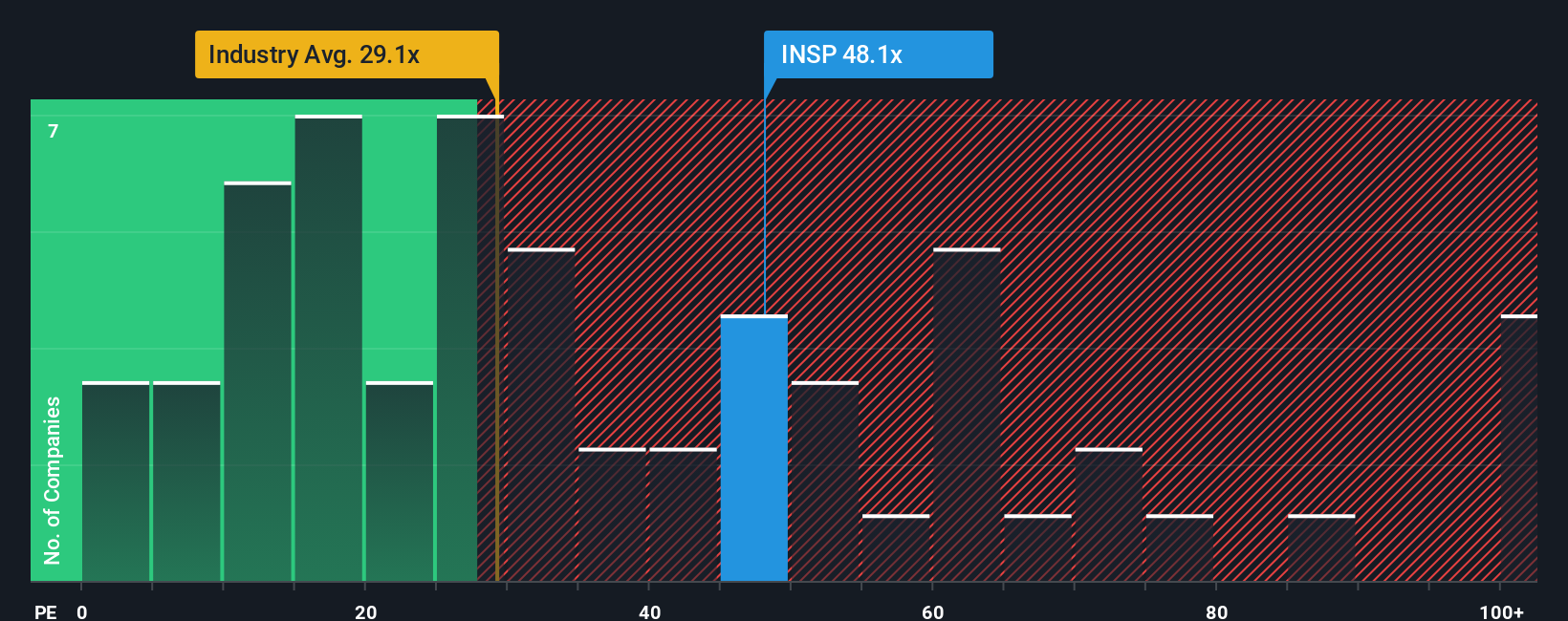

While Inspire Medical Systems looks undervalued according to fair value estimates, its price-to-earnings ratio tells a different story. At 43.4x, the company's ratio is higher than both the US Medical Equipment industry average (29.1x) and its peers (39.9x), and even above the SWS fair ratio of 35x. This suggests investors may be paying a premium for growth that could prove optimistic, or it could point to a risk if expectations are not met. Is the market too optimistic, or is it simply pricing in long-term opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Inspire Medical Systems Narrative

If you see the story differently or want to dig deeper into the numbers, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Missing out on new investment opportunities could mean leaving potential gains on the table. Use these hand-picked screens to zero in on what matters for your strategy.

- Catch the surge in artificial intelligence by checking out these 24 AI penny stocks, featuring companies at the cutting edge of automation and next-gen software solutions.

- Secure steady income streams by scanning these 18 dividend stocks with yields > 3% with yields over 3% and find opportunities for reliable, long-term returns in any market climate.

- Stay ahead of major industry shifts and see which breakthrough technologies are on the rise through these 26 quantum computing stocks, where innovation is transforming tomorrow’s landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives