- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Inspire Medical Systems, Inc.'s (NYSE:INSP) Stock Retreats 28% But Revenues Haven't Escaped The Attention Of Investors

Inspire Medical Systems, Inc. (NYSE:INSP) shares have had a horrible month, losing 28% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

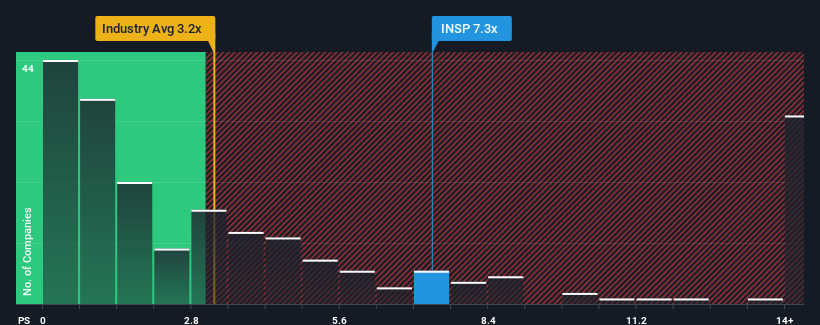

Even after such a large drop in price, Inspire Medical Systems' price-to-sales (or "P/S") ratio of 7.3x might still make it look like a strong sell right now compared to other companies in the Medical Equipment industry in the United States, where around half of the companies have P/S ratios below 3.2x and even P/S below 1.2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Inspire Medical Systems

How Inspire Medical Systems Has Been Performing

Recent times have been advantageous for Inspire Medical Systems as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Inspire Medical Systems.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Inspire Medical Systems' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 22% per annum as estimated by the analysts watching the company. With the industry only predicted to deliver 10% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Inspire Medical Systems is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Inspire Medical Systems' P/S

A significant share price dive has done very little to deflate Inspire Medical Systems' very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Inspire Medical Systems shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Inspire Medical Systems that you should be aware of.

If these risks are making you reconsider your opinion on Inspire Medical Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives