- United States

- /

- Medical Equipment

- /

- NYSE:INSP

How Investors Are Reacting To Inspire Medical Systems (INSP) Strong Inspire V Trial Results and Operational Gains

Reviewed by Sasha Jovanovic

- Earlier this month, Inspire Medical Systems announced new clinical outcomes data for its Inspire V system, including results from a Singapore trial and a successful limited US market release, presented at leading medical conferences in Indianapolis.

- An important insight is that surgeons achieved a 20% reduction in procedure times and higher therapy adherence, while US centers saw increased implant volumes and no serious adverse events.

- We'll look at how these Inspire V trial results and operational improvements may influence Inspire Medical Systems' investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Inspire Medical Systems Investment Narrative Recap

To be a shareholder in Inspire Medical Systems, you have to believe that operational improvements, like the recent 20% reduction in procedure times and higher therapy adherence from the Inspire V rollout, will accelerate adoption, lift volumes and help the company outpace competitive threats. This month’s clinical results and smooth limited release in the US support those key catalysts, though the current risk of onboarding or reimbursement delays has not been completely removed by these updates and remains the most important near-term concern. If these implementation hurdles persist, they could continue to weigh on growth momentum and financial recovery over the next several quarters.

Of the company’s latest announcements, the ongoing discussions around proposed Medicare reimbursement for the Inspire V CPT code are closely tied to the news event. Expanded reimbursement, especially if approved for 2026, could combine with improved surgical efficiency to drive wider adoption and higher implant volumes, both essential for regaining revenue momentum after recent guidance reductions.

In contrast, investors should also be aware that persistent onboarding delays and reimbursement pressures could ...

Read the full narrative on Inspire Medical Systems (it's free!)

Inspire Medical Systems is projected to reach $1.3 billion in revenue and $103.6 million in earnings by 2028. This outlook assumes a 14.5% annual revenue growth rate and a $50.5 million increase in earnings from the current level of $53.1 million.

Uncover how Inspire Medical Systems' forecasts yield a $127.47 fair value, a 58% upside to its current price.

Exploring Other Perspectives

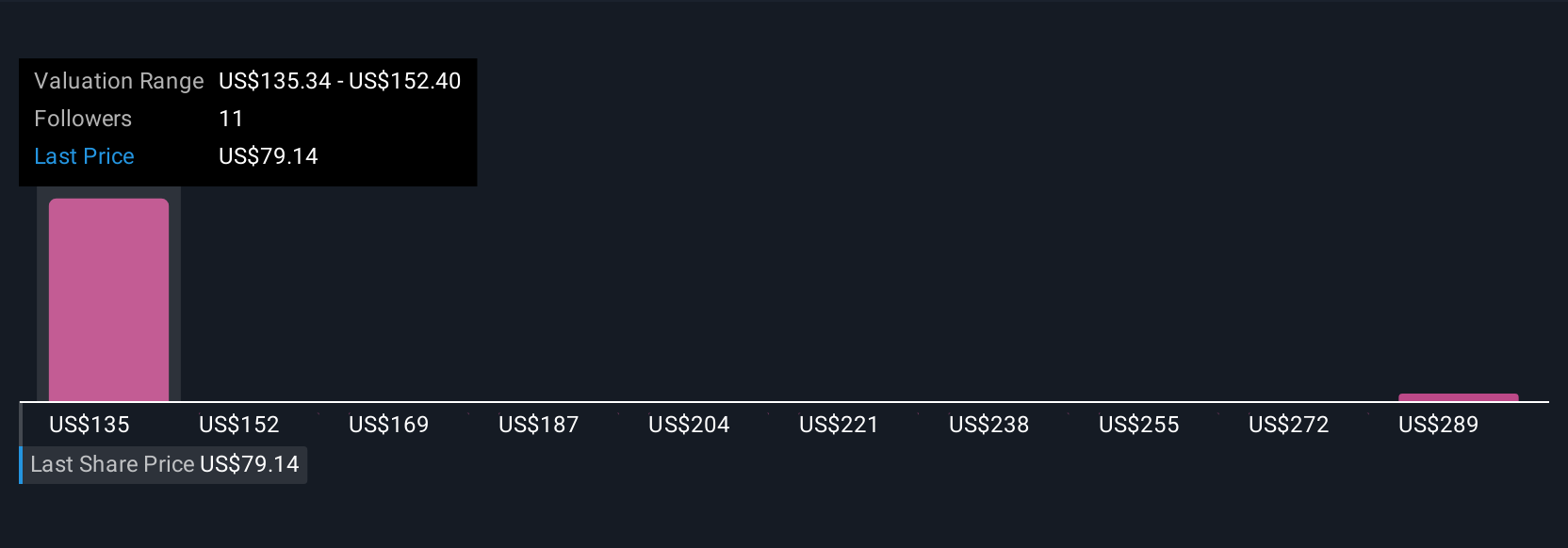

Eight community fair value estimates for Inspire Medical Systems span from US$93.33 to US$270.86, reflecting a wide gap in individual outlooks. As recent clinical outcomes fuel optimism for procedure volume growth, you may want to consider how improving operational results could affect these diverging expectations for Inspire’s performance.

Explore 8 other fair value estimates on Inspire Medical Systems - why the stock might be worth over 3x more than the current price!

Build Your Own Inspire Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inspire Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspire Medical Systems' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives