- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Does Nyxoah's Patent Lawsuit Alter the Bull Case for Inspire Medical Systems (INSP)?

Reviewed by Sasha Jovanovic

- Earlier this month, Nyxoah SA and Nyxoah, Inc. filed a lawsuit against Inspire Medical Systems in the U.S. District Court for the District of Delaware, alleging that Inspire IV and Inspire V devices infringe three patents and seeking both injunctive relief and damages.

- This legal action introduces a layer of technology and intellectual property risk that could influence Inspire Medical Systems' future operations and market position.

- We'll examine how the newly filed patent lawsuit presents fresh risks to Inspire Medical Systems' investment outlook and growth trajectory.

Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

Inspire Medical Systems Investment Narrative Recap

At its core, the case for being an Inspire Medical Systems shareholder rests on belief in robust growth for surgically implanted sleep apnea therapies, especially as Inspire V gains adoption and new reimbursement rules take hold. The recent patent lawsuit introduces a material technology and IP risk, which touches directly on the key short-term catalyst, broad Inspire V rollout, and is now arguably the biggest risk to the company's trajectory due to potential delays or limitations on future sales.

The FDA approval of Inspire V earlier this quarter was poised to accelerate revenue growth by addressing prior bottlenecks in onboarding, training, and Medicare billing, which had temporarily slowed the transition and procedure volumes. Now, the patent litigation could complicate this rollout at a time when center adoption and patient pipeline expansion were expected to rebound, leaving the short-term outlook less certain.

By contrast, investors should also keep in mind that patent risk isn't just a legal matter but could impact...

Read the full narrative on Inspire Medical Systems (it's free!)

Inspire Medical Systems is forecast to reach $1.3 billion in revenue and $103.6 million in earnings by 2028. This outlook depends on analysts' assumptions of a 14.5% annual revenue growth rate and a $50.5 million increase in earnings from the current $53.1 million.

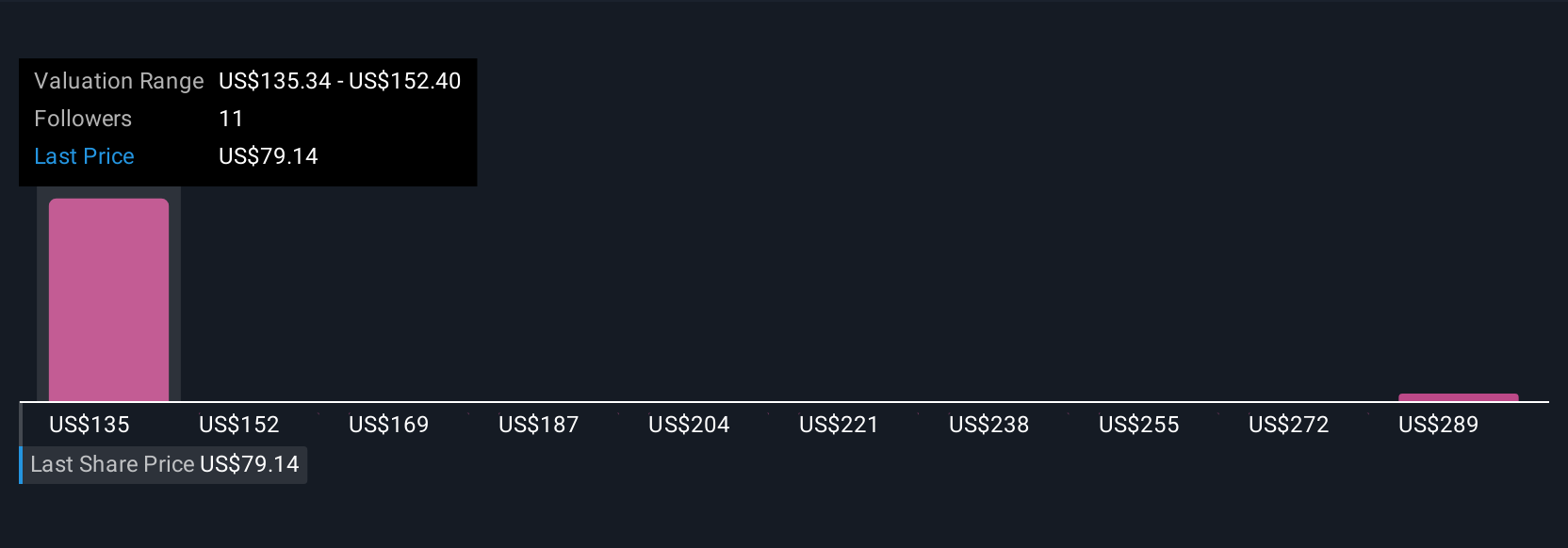

Uncover how Inspire Medical Systems' forecasts yield a $135.13 fair value, a 75% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided six fair value estimates for Inspire, ranging from US$93.33 to US$305.94 per share. With this spectrum of analysis, the accelerating rollout risks linked to the Inspire V system highlight how market and technology challenges can drive very different outlooks, inviting you to explore several alternative perspectives before making up your mind.

Explore 6 other fair value estimates on Inspire Medical Systems - why the stock might be worth just $93.33!

Build Your Own Inspire Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inspire Medical Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inspire Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inspire Medical Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives