- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Does the Medicare Star Rating Downgrade Challenge the Bull Case for Humana (HUM)?

Reviewed by Sasha Jovanovic

- Earlier this week, a Texas federal judge upheld the U.S. government's downgrade of Humana's quality star ratings for Medicare Advantage plans, resulting in cuts to bonus payments tied to these ratings.

- This ruling poses a material risk to Humana's future Medicare-related revenue streams and introduces new uncertainty around the company's earnings outlook.

- We'll examine how the upheld star rating downgrade could impact Humana's investment narrative and earnings projections going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Humana Investment Narrative Recap

To be a Humana shareholder, you generally need to believe in the long-term potential of Medicare Advantage and value-based healthcare, while accepting sensitivity to regulatory changes and government contracts. The recent Texas federal court ruling, which upheld the U.S. government’s downgrade of Humana’s Medicare Advantage star ratings, intensifies the biggest short-term risk: the possibility of near-term revenue and earnings pressure from reduced bonus payments tied to these ratings. This targets the core of Humana's growth thesis and will likely influence market sentiment in the short run.

Against this backdrop, Humana’s most recent earnings guidance revision, lowering full-year GAAP EPS to about US$13.77 and raising annual revenue expectations, reflects the “push-pull” between higher top-line ambition and more conservative profit expectations as reimbursement headwinds materialize. This pivot highlights how star rating risks are manifesting in financial guidance, making future results and management commentary especially important for investors watching short-term catalysts and downside scenarios alike.

Yet, with changes in reimbursement protocols looming, investors should be aware of ...

Read the full narrative on Humana (it's free!)

Humana's narrative projects $150.9 billion revenue and $3.3 billion earnings by 2028. This requires 7.0% yearly revenue growth and a $1.7 billion earnings increase from the current $1.6 billion.

Uncover how Humana's forecasts yield a $294.54 fair value, a 7% upside to its current price.

Exploring Other Perspectives

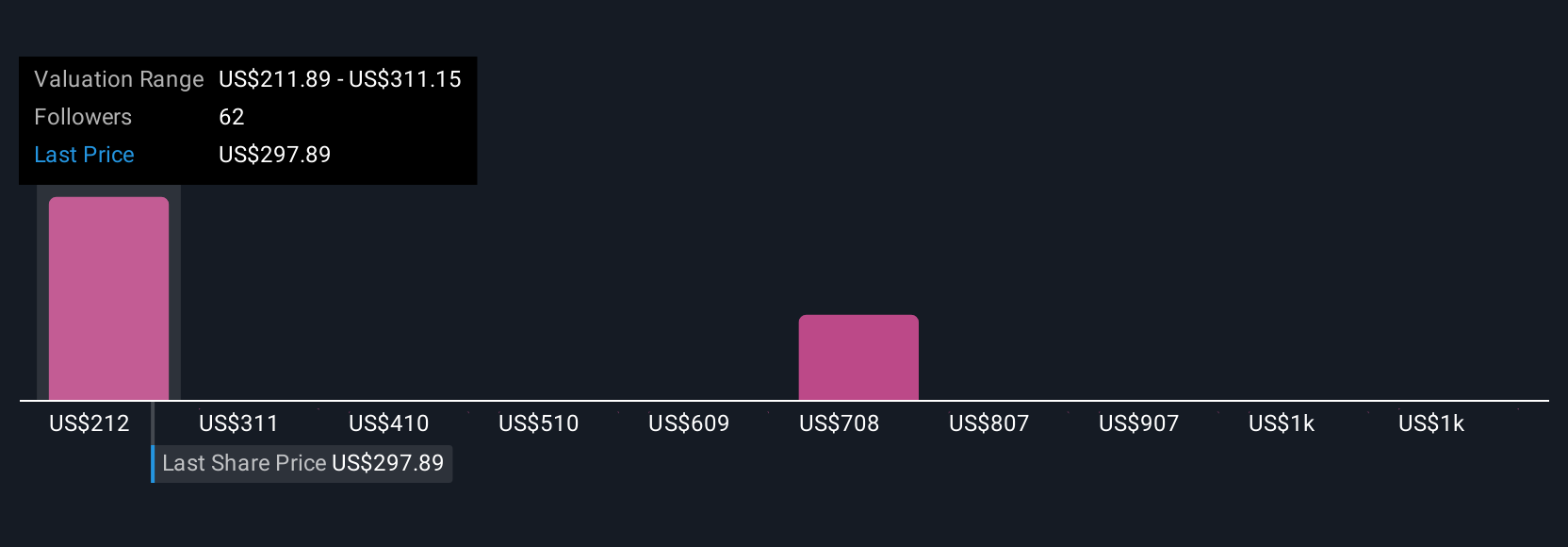

Ten Simply Wall St Community fair value estimates for Humana range widely from US$211.89 to US$1,204.45 per share. With fresh regulatory rulings now affecting bonus payments, your outlook on earnings stability shapes how you interpret this diversity of views.

Explore 10 other fair value estimates on Humana - why the stock might be worth over 4x more than the current price!

Build Your Own Humana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Humana research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Humana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Humana's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives