- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Does Humana’s 11.3% Surge Signal a Rebound or Just More Volatility for 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Humana stock? You are not alone. Investors have been watching the company's roller coaster ride with keen interest, trying to figure out if the current price represents opportunity or risk. Over the past week, for example, Humana shares have bounced back impressively, climbing 11.3%, a move that stands out especially against a tougher month in which the stock dropped 7.9%. Year to date, returns are up 12.3%, and if you look back one year, the stock’s up nearly 20%. But step back even further and the picture gets a bit more complicated, with a 41.9% dip over the last three years and a 31.6% decline over the past five years.

What is driving these wide price swings? Some of the recent gains have been linked to broader market optimism around health insurance providers and potential shifts in healthcare policy, fueling hopes that risk perceptions may be easing. Whether that optimism is warranted is up for debate, but one thing is clear: volatility is likely to persist as investors weigh new information against longer-term industry changes.

So, what about valuation? Humana currently scores 3 out of 6 on a key undervaluation checklist, suggesting it is undervalued in half of the metrics analysts consider most important. That means there is reason to think the current price is attractive, but also reason for caution. Let’s break down those valuation approaches. Then, stick around, because there is an even smarter way to think about what Humana is really worth.

Approach 1: Humana Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and then discounting them back to today's dollars. This approach helps investors look beyond short-term noise and focus on the business's underlying financial engine.

For Humana, the most recent twelve months have produced free cash flow of $2.07 billion. Analyst estimates suggest steady growth over the next five years, with projected free cash flow climbing to $3.74 billion by 2029. For years beyond that, projections are naturally less certain and rely on systematic extrapolation.

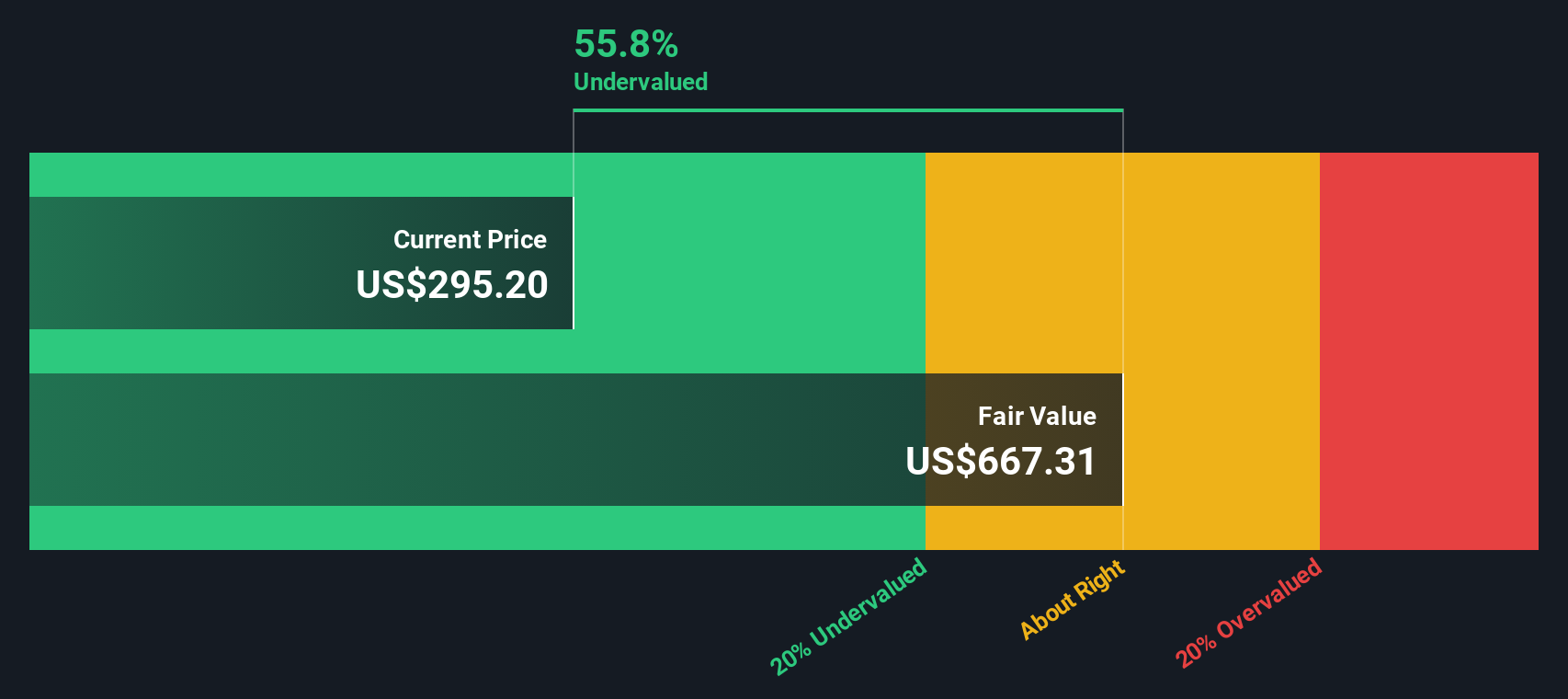

Taking all these cash flows and discounting them to present value using a two stage Free Cash Flow to Equity model, the DCF suggests an intrinsic value of $667.31 per share. With the current price sitting at a 57.5% discount to this value, the model sees Humana as significantly undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Humana is undervalued by 57.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Humana Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is perhaps the most widely used metric for valuing profitable companies because it directly connects a company’s stock price to its earnings power. For businesses like Humana that are generating consistent profits, this ratio can help investors quickly gauge how much they are paying for each dollar of earnings.

However, what counts as a “normal” or “fair” P/E ratio is not set in stone. Expected earnings growth, profitability, and business risks all play a part. Rapidly growing or lower-risk companies typically command higher P/E multiples, while slower-growing or riskier firms tend to trade at lower multiples.

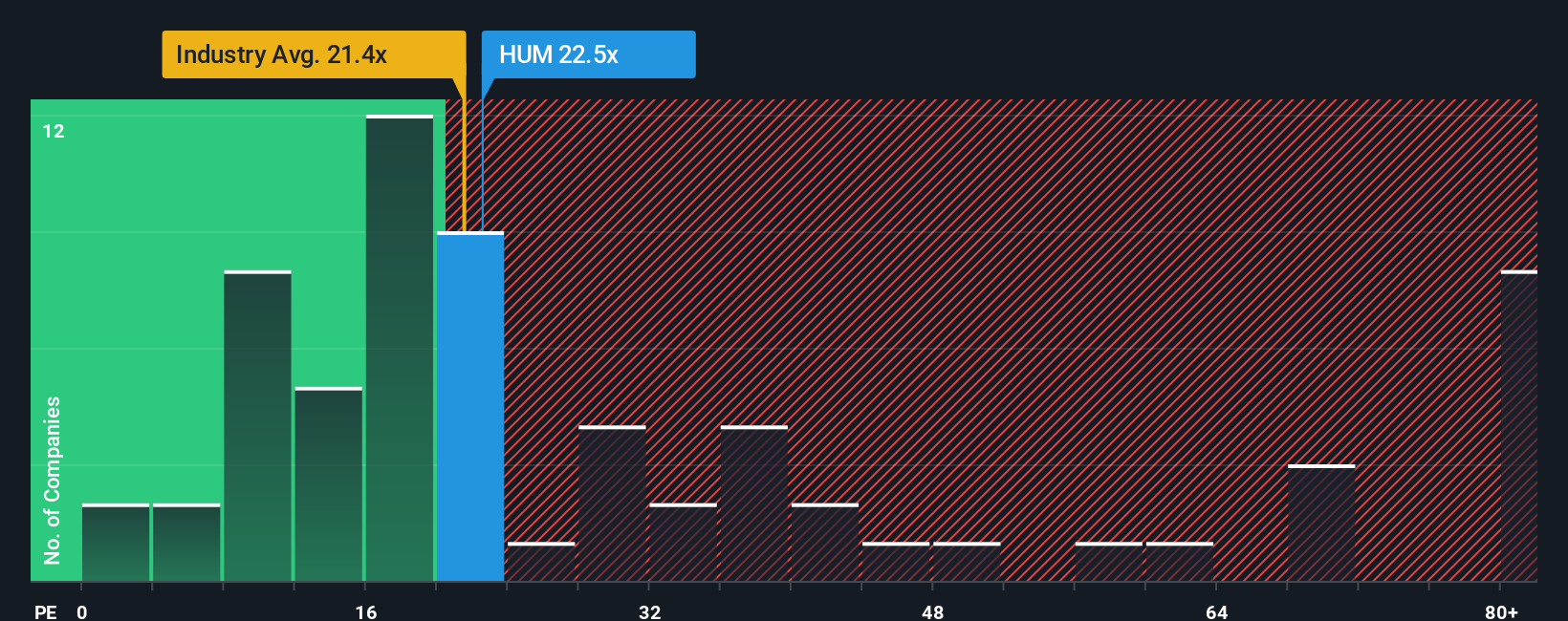

Humana currently trades at a P/E of 21.7x. This lines up almost exactly with the peer average of 21.5x and the healthcare industry’s average of 21.4x. Simple averages, though, can miss the full picture. That is why Simply Wall St has developed its proprietary “Fair Ratio,” which looks across multiple factors such as earnings growth rates, profit margins, Humana’s place within its industry, its market cap, and relevant business risks. For Humana, the Fair Ratio stands at 38.9x, suggesting the company should be valued significantly higher than where it currently trades.

The Fair Ratio offers a more dynamic, tailored benchmark than a straight average comparison because it adapts to factors that matter most for a given company. In this case, with Humana’s actual P/E multiple well below its Fair Ratio, the stock appears undervalued according to this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Humana Narrative

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. Narratives are a simple, dynamic way for you to shape your view of Humana by connecting its story, your perspective on future revenue, profit margins, and risks, directly to a forecast and a fair value. Instead of relying solely on numbers and ratios, Narratives let you explore and debate what you think matters most, whether it is major strategic moves, regulatory shifts, or industry trends. All of this takes place within the Community page on Simply Wall St, where millions of investors share their outlooks.

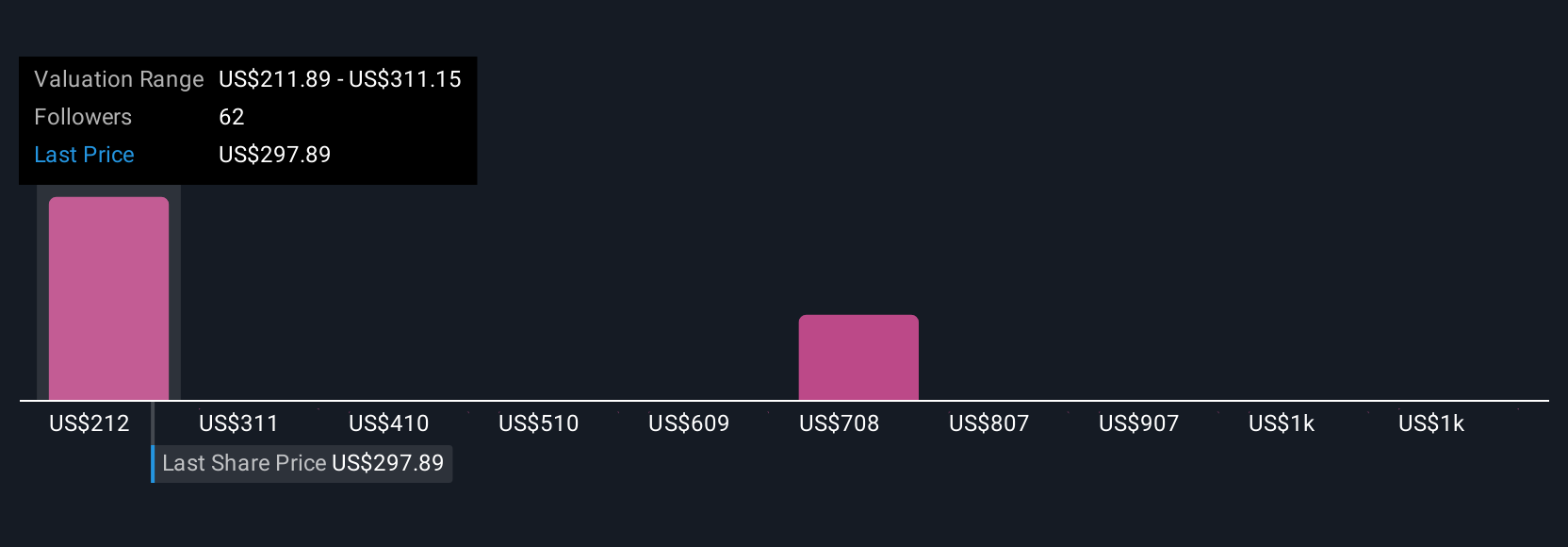

Each Narrative ties a company’s story to a clear financial forecast and translates that into a personalized fair value, so you can quickly see if the current price looks attractive or not. As new earnings, news, or policies emerge, Narratives are updated in real time, giving you a living valuation that adapts as quickly as the market. For example, some investors see upside in Humana and forecast a fair value as high as $353 per share, while more cautious participants set their target at $250. Narratives empower you to cut through the noise, align on a story, and decide with confidence when to buy or sell.

Do you think there's more to the story for Humana? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives