- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Hims & Hers Health (NYSE:HIMS) Soars 184% As Personalized Wellness Sector Gains Traction

Reviewed by Simply Wall St

Hims & Hers Health (NYSE:HIMS) recently recorded a staggering 185% increase in its stock price over the last quarter. This exceptionally high return occurred amidst significant activity within broader markets, where the S&P 500 reached record highs and then slightly declined. While notable macroeconomic trends like fluctuating interest rates and inflation discussions pepper economic discourse, HIMS's meteoric rise stands out. The company’s focus on personalized health and wellness services resonates in an expanding sector, differentiating it from fluctuations impacting broader indices like the Dow Jones. In contrast to other major stocks such as Walmart and Palantir, which faced declines due to weak outlooks and external pressures, Hims & Hers capitalized on an increased demand for its offerings. This emphasis on personal health aligns well with prevailing consumer trends, effectively positioning the company as a prominent player amid dynamic market conditions.

Click here to discover the nuances of Hims & Hers Health with our detailed analytical report.

Over the past three years, Hims & Hers Health has seen an outstanding total shareholder return of 1,347.16%, a very large increase compared to industry and market trends. In the last year alone, the company's shares surpassed the overall US Healthcare industry and market, which experienced a decline of 7% and a gain of 23.7%, respectively. A crucial driver for this growth includes a series of innovative product launches such as the "Weight Loss by Hims & Hers" program and hair care solutions introduced in 2023. The company's product expansion clearly resonated with consumers, aligning with personal health trends.

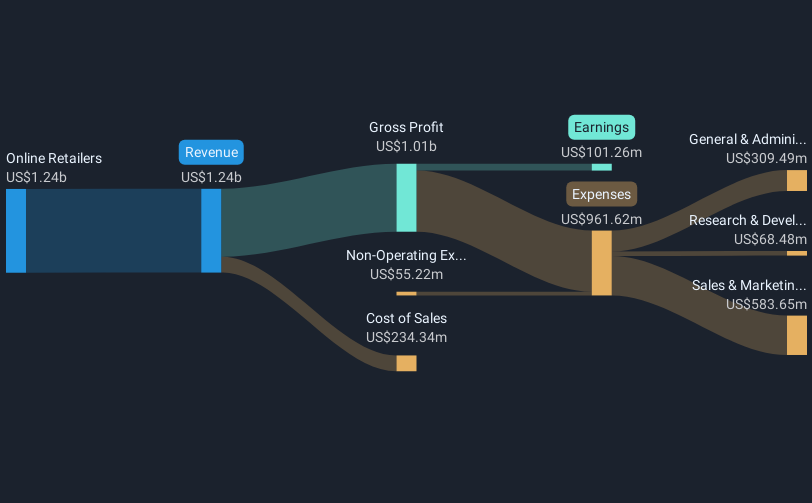

Significant financial milestones also contributed to the impressive returns. The Q3 2024 earnings report revealed revenues reaching US$401.56 million with a transformation from a net loss to net income of US$75.59 million, setting an optimistic tone for future performance. Shareholder value was further enhanced by a share repurchase program, buying back shares at a total of US$30.03 million, and inclusion in key indices like the S&P 1000, which boosted investor confidence and market visibility.

- Discover whether Hims & Hers Health is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Analyze the downside risks for Hims & Hers Health and understand their potential impact—click to learn more.

- Hold shares in Hims & Hers Health? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives