- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

Hims & Hers Health (NYSE:HIMS) Reports US$1.5 Billion Sales Growth and Files US$544 Million Shelf Registration

Reviewed by Simply Wall St

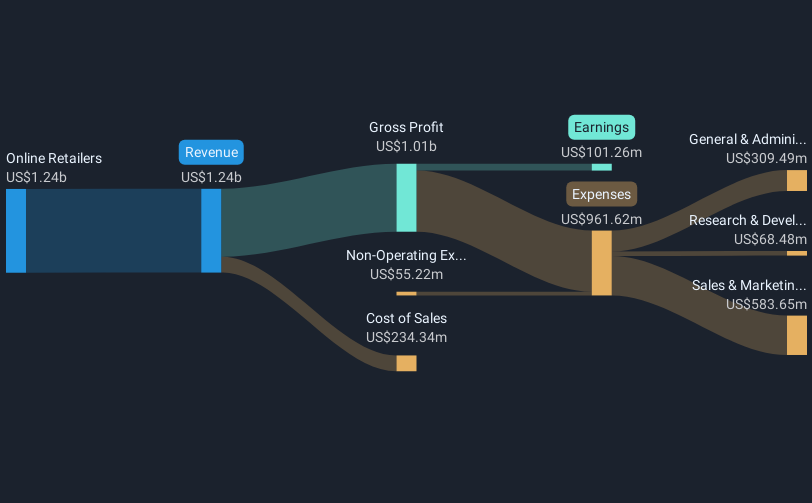

Hims & Hers Health (NYSE:HIMS) announced impressive financial results for Q4 2024, with sales surging 95% year-over-year and net income climbing sharply, reflecting improved profitability. These positive developments likely played a significant role in driving the company's share price up by 67% over the last quarter, despite the broader market experiencing declines. Furthermore, the company issued robust revenue guidance for 2025, which may have bolstered investor confidence amidst a volatile market backdrop characterized by a 3% drop in the S&P 500 and Nasdaq Composite. The shelf registration filing, aimed at raising substantial capital, further underscores the company's growth potential and strategic planning. While broader tech stock declines have pressured the industry, the resilience and growth trajectory outlined in the earnings report and guidance likely provided significant buoyancy to the stock, differentiating HIMS from some underperforming peers in a shaken market.

Dig deeper into the specifics of Hims & Hers Health here with our thorough analysis report.

Over the past three years, Hims & Hers Health's shares delivered a very large total return of 882.95%. This significant growth contrasts with the past year's US healthcare industry return of 11.4%. Several factors may have contributed to this impressive performance. Notably, the company's revenue guidance for 2025, forecasting between US$2.3 billion and US$2.4 billion, reflects its robust expansion plan. Additionally, the company achieved profitability, transitioning from a net loss a year ago to net income, highlighted by a US$26.03 million net income in Q4 2024.

Furthermore, product and service innovation could have fueled investor confidence. The introduction of new weight management products, such as meal replacement bars and GLP-1 injections, exemplifies this innovation. Finally, Hims & Hers Health's expansion through collaborations, like the partnership with Hartford HealthCare, helped strengthen its market position, potentially contributing to the stock's significant long-term returns.

- See whether Hims & Hers Health's current market price aligns with its intrinsic value in our detailed report

- Assess the potential risks impacting Hims & Hers Health's growth trajectory—explore our risk evaluation report.

- Hold shares in Hims & Hers Health? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives