- United States

- /

- Healthcare Services

- /

- NYSE:HCA

A Fresh Look at HCA Healthcare's Valuation Following CareIntellect Launch With GE HealthCare

Reviewed by Kshitija Bhandaru

HCA Healthcare (HCA) has joined forces with GE HealthCare to launch CareIntellect for Perinatal, a cloud-based tool that aims to enhance maternal and fetal care. This collaboration leverages digital solutions to improve clinical workflows.

See our latest analysis for HCA Healthcare.

HCA Healthcare’s momentum has been impressive, with a 1-day share price return of 1.88% following the CareIntellect announcement and a strong 15.4% run over the past three months. While recent volatility included a minor dip last week, the stock’s year-to-date share price return of 40.52% reflects building investor confidence in its growth strategy. Meanwhile, the 5.12% total shareholder return over the last year points to a solid, if unspectacular, outcome for long-term investors.

If you’re interested in finding other healthcare stocks making waves with innovation, check out our curated list in See the full list for free.

With shares near all-time highs and growth initiatives attracting positive attention, the big question now is whether HCA Healthcare is undervalued or if the market has already accounted for all its future growth prospects.

Most Popular Narrative: Fairly Valued

With HCA Healthcare’s last close at $418.40 and the most widely followed valuation consensus at $417.52, the two figures are nearly identical, leading to lively debate about the company’s road ahead.

HCA's disciplined capital allocation strategy, which includes increasing facility and bed capacity as well as strategic acquisitions, is expected to drive long-term value creation and support revenue growth by meeting rising healthcare demand.

What is the secret calculation behind this almost perfect alignment of price and value? Uncover the core set of financial projections, margin shifts, and ambitious long-term growth targets that analysts believe justify today's market price. The full breakdown holds a decisive clue for anyone watching this healthcare heavyweight.

Result: Fair Value of $417.52 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory changes and rising professional fee costs remain potential headwinds that could challenge HCA Healthcare’s positive earnings growth trajectory.

Find out about the key risks to this HCA Healthcare narrative.

Another View: Discounted Cash Flow Perspective

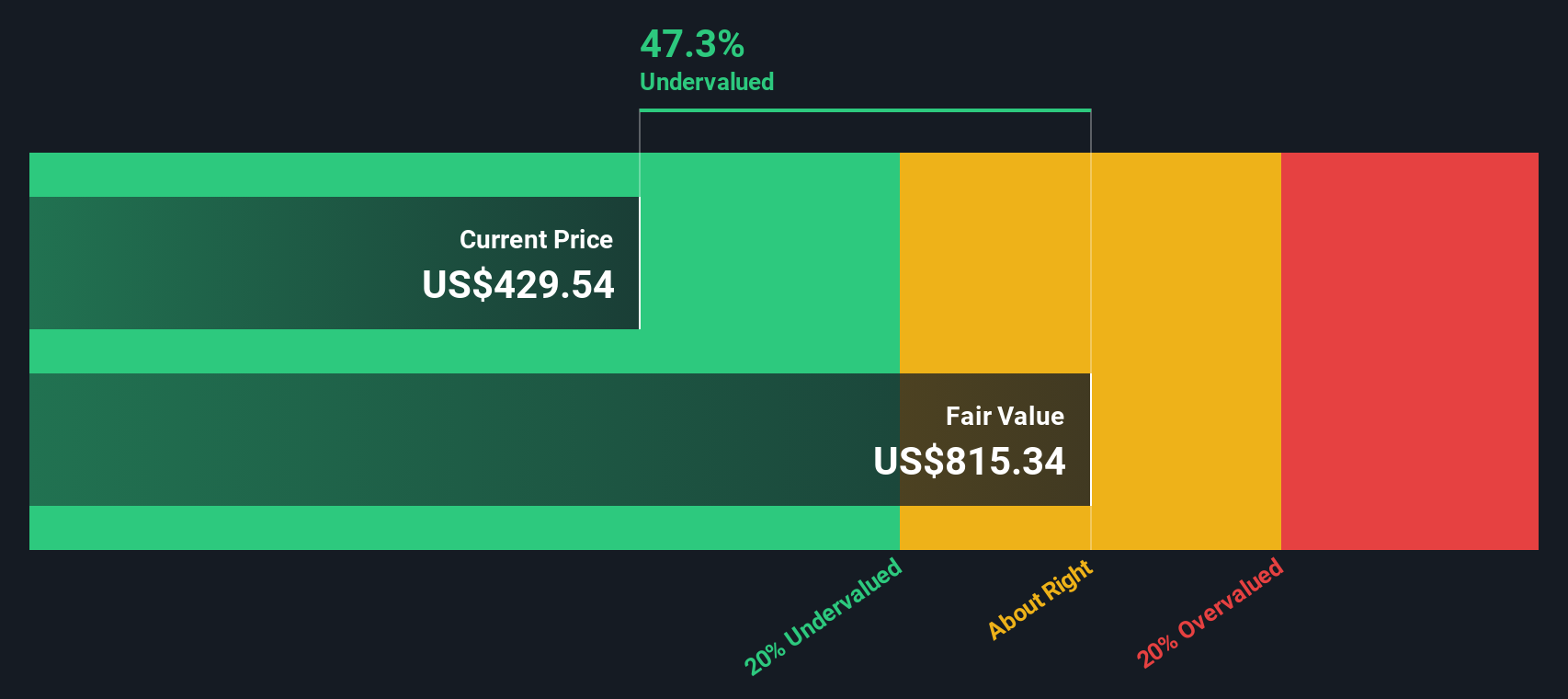

While most analysts see HCA Healthcare as fairly valued based on earnings, our DCF model presents a very different story. It estimates the company’s intrinsic value at $815.34 per share, nearly double the current price. This suggests potential undervaluation. Could this model be highlighting a missed opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HCA Healthcare Narrative

If you think there’s more to the story or want to dig into the numbers yourself, creating a custom narrative is quick and straightforward. Do it your way

A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always look beyond the obvious. Give yourself an edge by matching your interests to these high-potential stock picks handpicked from our exclusive screeners.

- Unlock growth opportunities and track potential market disruptors with these 25 AI penny stocks, which are shaking up the landscape in artificial intelligence.

- Boost your passive income by checking out these 18 dividend stocks with yields > 3%, which offer robust yields and healthy fundamentals for your portfolio.

- Tap into the next financial revolution by exploring these 79 cryptocurrency and blockchain stocks, which leverage blockchain innovation and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCA Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCA

HCA Healthcare

Through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives