- United States

- /

- Healthcare Services

- /

- NYSE:HCA

A Fresh Look at HCA Healthcare's (HCA) Valuation After Operational Gains and Upcoming Earnings Release

Reviewed by Simply Wall St

HCA Healthcare is set to report its quarterly earnings this Friday before the market opens, drawing investor attention. The company has demonstrated steady revenue growth and operational improvements ahead of this announcement.

See our latest analysis for HCA Healthcare.

HCA Healthcare’s share price has been powering higher in 2025, hitting new highs as operational improvements and positive earnings anticipation continue to fuel momentum. The stock’s 48% year-to-date share price return stands out, and its 1-year total shareholder return of 8.5% adds longer-term context. This shows that short-term excitement is now beginning to align with a solid multi-year track record, despite some regulatory bumps along the way.

If you’re watching how market leaders are adapting and want to find other healthcare stocks with growth potential, see the full list for free in our See the full list for free..

With HCA’s rapid share price appreciation and solid earnings track record, the key question now is whether the stock remains undervalued at these levels, or if markets have already priced in the company’s future growth prospects. Could there still be a buying opportunity?

Most Popular Narrative: 5.7% Overvalued

The latest consensus narrative sees HCA Healthcare’s fair value at $417.52, coming in below the last close price of $441.19. This implies analysts are calling the stock moderately rich compared to their outlook and expectations.

HCA Healthcare has been experiencing broad-based volume growth across various categories, including inpatient admissions, emergency room visits, and cardiac procedures, indicating potential for future revenue growth as demand for healthcare services continues to rise.

Curious what’s fueling the market’s confidence in these numbers, even as recent growth tapers? The secret sauce of this narrative is a bold forecast on both top and bottom line expansion, with margin and PE assumptions that might surprise. Want to see which future financial leap powers this price? Click through to get the checks and balances behind this valuation.

Result: Fair Value of $417.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes or declining outpatient volumes could easily shift analyst sentiment and create challenges for the outlook of HCA Healthcare’s continued earnings growth.

Find out about the key risks to this HCA Healthcare narrative.

Another View: What Does the Market Multiple Suggest?

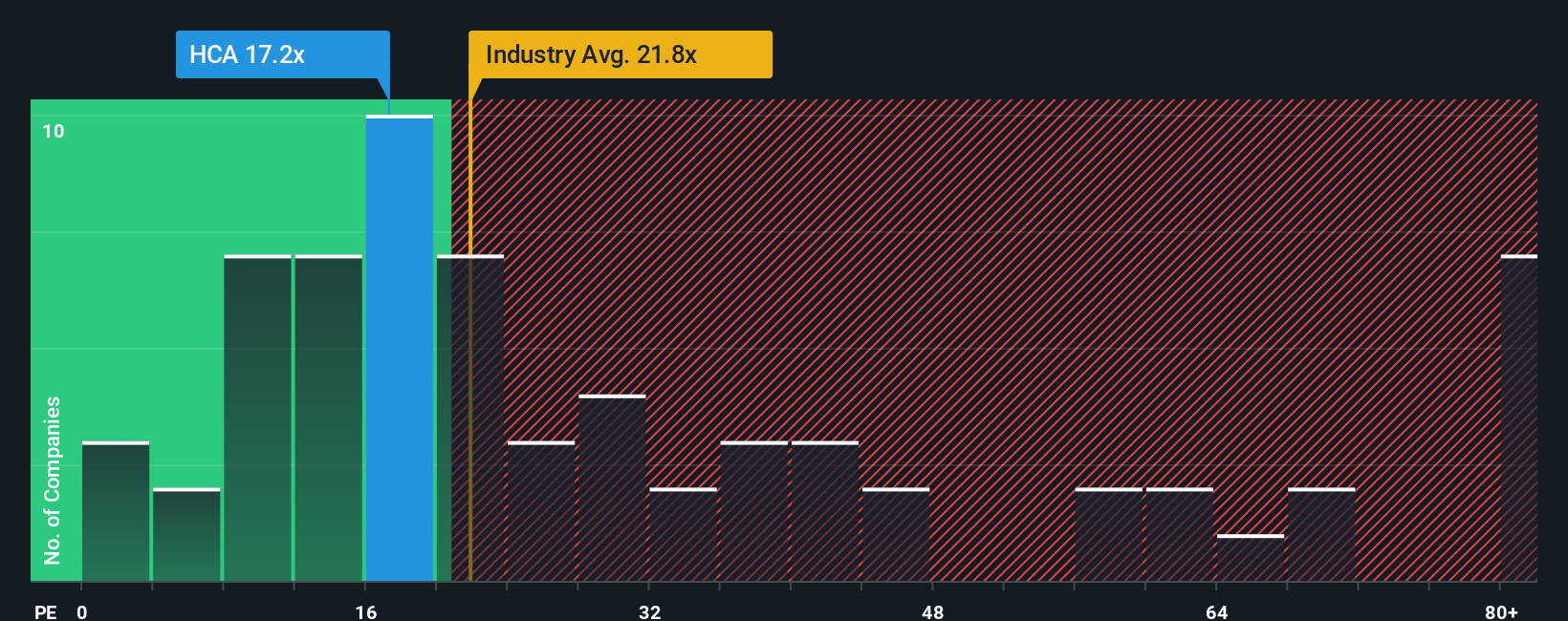

While the consensus narrative finds HCA Healthcare overvalued, our comparison of its price-to-earnings ratio tells a different story. HCA trades at 17.3 times earnings, well below both the US Healthcare industry average of 21.5 times and a calculated fair ratio of 27.3 times. This significant gap suggests the market may see less risk or more opportunity than the consensus narrative implies. Is the current price a reflection of investor caution or an underappreciated opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HCA Healthcare Narrative

Feel that your perspective or research might tell a different story? You can quickly build your own interpretation in just a few minutes. Do it your way

A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors don’t just stop at one opportunity. Give yourself the advantage by using our screeners to target unique, high-potential stocks that others might miss.

- Maximize your income potential by pinpointing strong yield plays among these 17 dividend stocks with yields > 3% with dividends over 3% and solid track records.

- Spot the next wave of AI-driven success by picking from these 26 AI penny stocks, which are transforming industries with innovation and explosive growth.

- Capitalize on powerful trends in revolutionary finance when you investigate these 80 cryptocurrency and blockchain stocks, as these are riding the surge in blockchain and cryptocurrency markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCA Healthcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCA

HCA Healthcare

Through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives