- United States

- /

- Medical Equipment

- /

- NYSE:GMED

Globus Medical (GMED): Reassessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Globus Medical (GMED) has quietly turned heads with a roughly 47% jump over the past month and about 51% over the past 3 months, as investors reassess its growth story.

See our latest analysis for Globus Medical.

Even after this surge in the 1 month share price return, the stock is only modestly ahead on a year to date basis, and its 5 year total shareholder return near 50% points to a steady, not explosive, long term story with building momentum.

If Globus Medical's move has caught your attention, it could be a good moment to explore other healthcare names using our curated screener of healthcare stocks.

With solid double digit recent gains, healthy but not spectacular growth, and only a small gap to analyst targets, is Globus Medical still trading below its true potential, or are markets already pricing in its next chapter?

Most Popular Narrative: 2.4% Undervalued

With Globus Medical last closing at $89.03 against a narrative fair value of $91.20, the story leans toward mild upside grounded in execution.

Successful integration and synergy capture from the NuVasive and Nevro acquisitions are providing opportunities for increased cross-selling, cost efficiencies, and realization of deferred tax assets, which are expected to drive margin expansion, boost earnings, and enhance recurring cash flows in upcoming years.

Want to see what growth rates, margin lift, and earnings power this narrative is baking in, and how they justify a richer future multiple? The underlying assumptions may surprise you.

Result: Fair Value of $91.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, extended sales cycles for robotics and ongoing integration challenges from the NuVasive and Nevro deals could slow growth and delay margin expansion.

Find out about the key risks to this Globus Medical narrative.

Another Lens on Value

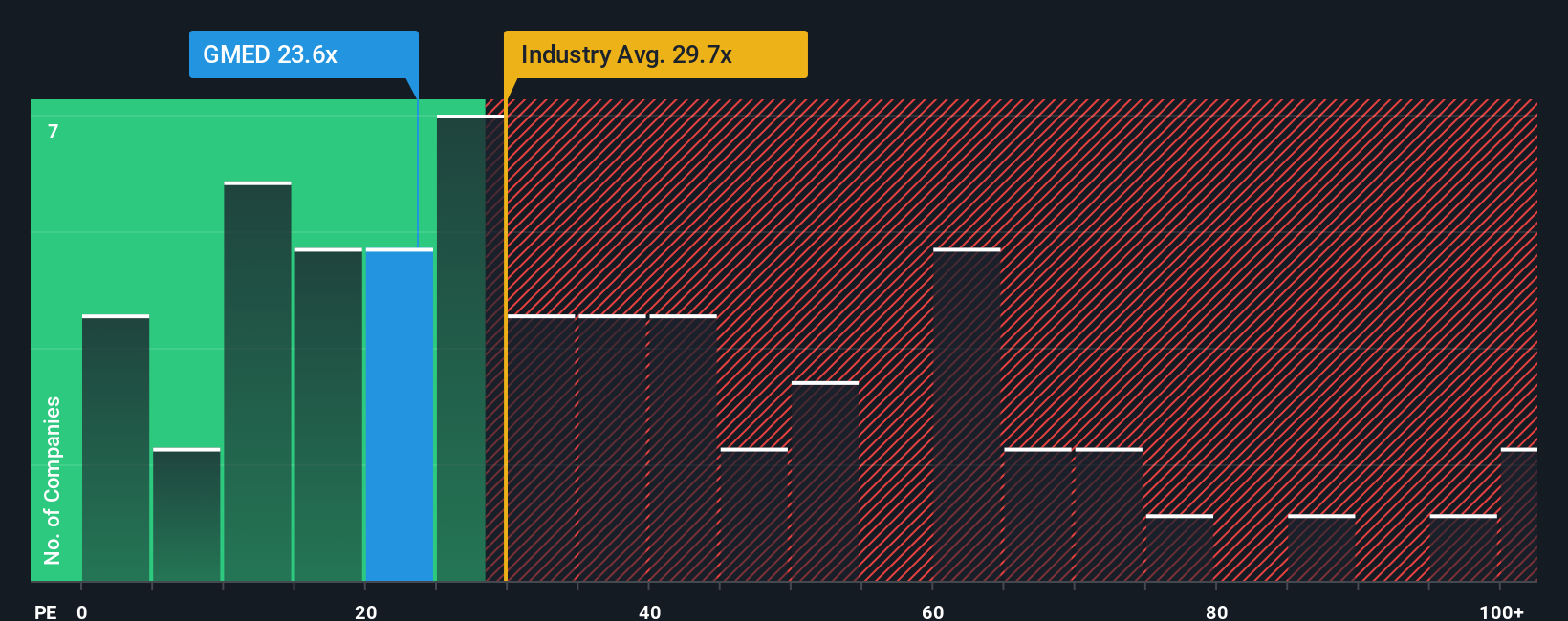

On earnings, Globus Medical looks less forgiving. The current P E of 28.1x sits only fractionally below the US Medical Equipment industry at 28.6x, but above a fair ratio of 24.5x and peers at 53.8x, hinting at limited cushion if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Globus Medical Narrative

If this perspective does not fully align with your own, you can dive into the numbers, shape your own story in minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Globus Medical.

Looking for your next investing move?

Before you move on, set yourself up for the next opportunity by putting the Simply Wall Street Screener to work and uncovering stocks that fit your strategy.

- Tap into resilient income potential by reviewing these 14 dividend stocks with yields > 3% that can help anchor your portfolio through changing markets.

- Position yourself at the frontier of innovation with these 27 quantum computing stocks, where tomorrow's breakthroughs may already be taking shape.

- Strengthen your margin of safety by focusing on these 925 undervalued stocks based on cash flows that may still be trading below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GMED

Globus Medical

A medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026