- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Glaukos (GKOS): Valuation Spotlight as Goldman Sachs Highlights Pharma Growth Pivot and Innovative Pipeline

Reviewed by Kshitija Bhandaru

Glaukos (GKOS) is drawing fresh attention after Goldman Sachs initiated coverage, emphasizing the company’s evolution from a pure device player into a hybrid device and ophthalmic pharmaceutical firm. This shift could influence future growth dynamics.

See our latest analysis for Glaukos.

Glaukos’s year has been marked by strategic milestones, such as breaking ground on its new Alabama manufacturing hub, but recent share price returns remain muted, with the stock essentially flat over the past year. The company’s multi-year transformation and product pipeline have kept long-term total shareholder returns positive. However, momentum has cooled lately as investors weigh optimism about new growth drivers against modest recent performance.

If you’re interested in what’s next for healthcare innovators, you might want to explore the full landscape—see the latest picks with our See the full list for free..

With Wall Street projecting robust growth and the stock trading at a discount to analysts' targets, the question remains: is Glaukos undervalued and primed for upside, or is the market already anticipating its next chapter?

Most Popular Narrative: 27.5% Undervalued

At $87.41, Glaukos’s share price sits well below the narrative’s fair value estimate of $120.64, indicating a notably bullish view among consensus watchers. The narrative presents a scenario with strong expectations for the company’s future market expansion and profitability trajectory.

Strong ongoing adoption and utilization of iDose TR, a first-of-its-kind procedural pharmaceutical with a unique profile, suggests the early stages of a paradigm shift toward interventional glaucoma therapies. This represents a substantial long-term opportunity given the aging population and rising prevalence of glaucoma, likely driving robust multi-year revenue and market expansion.

Want to know what is fueling this ambitious price target? The narrative points to bold growth rates and significant margin gains, betting on major prescription shifts and a revenue surge that is uncommon in this sector. Can Glaukos meet those targets? Find out what could influence the valuation and why this story stands out in the sector.

Result: Fair Value of $120.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing competition and ongoing reimbursement challenges could stall Glaukos’s momentum. This may test the confidence behind the current bullish narrative.

Find out about the key risks to this Glaukos narrative.

Another View: Multiples Suggest Glaukos Is Expensive

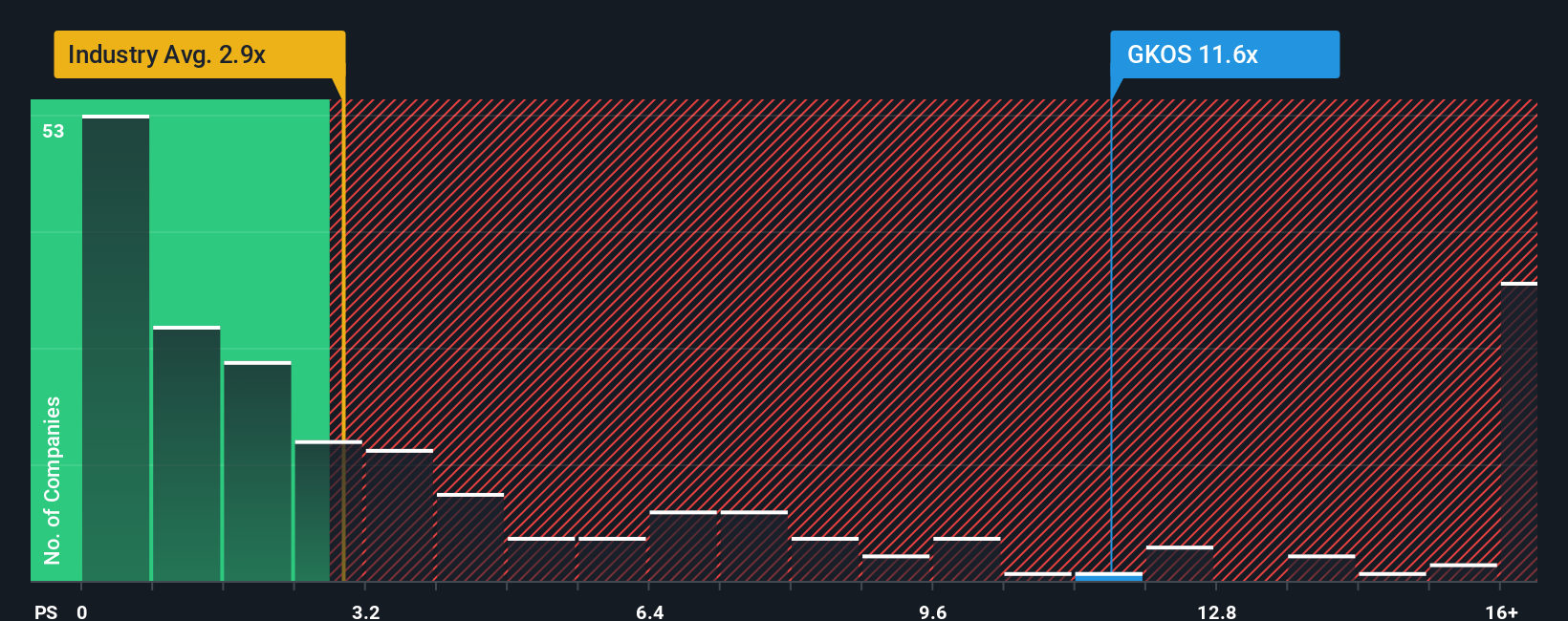

A look at Glaukos’s price-to-sales ratio tells a different story. At 11.6x, it is significantly higher than both its peer average of 3.7x and the Medical Equipment industry average of 2.7x. Even against its own fair ratio of 7.2x, Glaukos trades at a substantial premium. Could current optimism already be reflected in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Glaukos Narrative

If you see things differently or want to shape your own perspective using the latest figures, you can craft your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Glaukos.

Looking for more investment ideas?

Sharpen your portfolio with new opportunities and don't let unique growth trends or income streams slip past you. Use these powerful tools to level up your search:

- Boost your potential with high-yield opportunities by checking out these 19 dividend stocks with yields > 3%, featuring companies offering impressive returns above market averages.

- Unearth hidden growth plays by tapping into these 24 AI penny stocks to see which innovators are redefining industries with artificial intelligence breakthroughs.

- Strengthen your portfolio against the crowd by zeroing in on genuine bargains through these 895 undervalued stocks based on cash flows, packed with stocks trading below their true value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, develops therapies for the treatment of glaucoma, corneal disorders, and retinal diseases in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives