- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Glaukos Corporation (NYSE:GKOS) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Glaukos Corporation (NYSE:GKOS) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 34% in the last year.

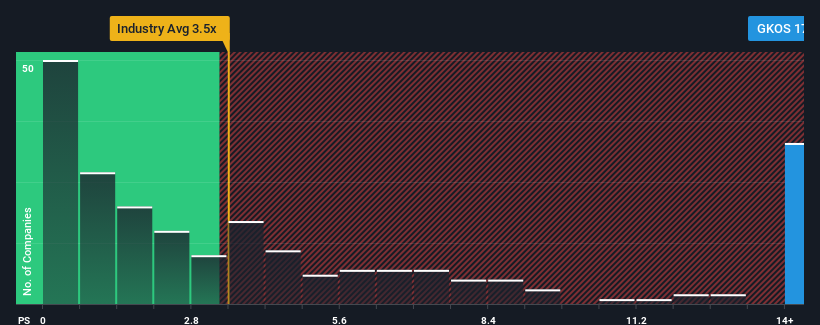

Although its price has dipped substantially, Glaukos may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 17.4x, when you consider almost half of the companies in the Medical Equipment industry in the United States have P/S ratios under 3.5x and even P/S lower than 1.2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Glaukos

What Does Glaukos' P/S Mean For Shareholders?

Recent times have been advantageous for Glaukos as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Glaukos will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Glaukos' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The strong recent performance means it was also able to grow revenue by 30% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 27% per year over the next three years. With the industry only predicted to deliver 9.4% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Glaukos is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Glaukos' shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Glaukos maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Glaukos with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Glaukos, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, develops therapies for the treatment of glaucoma, corneal disorders, and retinal diseases in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026