- United States

- /

- Medical Equipment

- /

- NYSE:EW

How Edwards Lifesciences' (EW) Next-Gen Heart Valve Launch in Thailand Could Shape Its Growth Outlook

Reviewed by Sasha Jovanovic

- Edwards Lifesciences recently launched its next-generation transcatheter heart valve in Thailand, featuring calcification-resistant tissue and improved sealing design to address the country's rising valvular heart disease burden.

- This initiative not only advances treatment options in Thailand but also underscores the company's focus on global expansion and innovation in cardiovascular care.

- We'll examine how Edwards Lifesciences' upgraded 2025 guidance and new heart valve launch shape its longer-term growth narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Edwards Lifesciences Investment Narrative Recap

For those considering Edwards Lifesciences, belief in the long-term adoption of advanced heart valve therapies and successful geographic expansion is essential. The recent launch of a next-generation transcatheter valve in Thailand reinforces this vision, though it has little near-term impact on the most important short-term catalyst: regulatory progress for TAVR in additional patient populations. The main risk remains the potential for increased operating expenses or margin pressure if revenue growth does not keep pace with investment and competitive costs.

Among the latest corporate developments, the FDA’s approval of the SAPIEN 3 valve for asymptomatic severe aortic stenosis in the US stands out. This ties directly to the pivotal catalyst of expanding TAVR indications, a growth driver that may meaningfully support Edwards’ higher 2025 guidance if adoption meets expectations.

However, investors should also keep an eye on the evolving competitive pressures in international markets like Japan, as...

Read the full narrative on Edwards Lifesciences (it's free!)

Edwards Lifesciences is projected to achieve $7.6 billion in revenue and $1.8 billion in earnings by 2028. This outlook is based on an expected 10.0% annual revenue growth and a $0.4 billion increase in earnings from the current $1.4 billion level.

Uncover how Edwards Lifesciences' forecasts yield a $87.73 fair value, a 14% upside to its current price.

Exploring Other Perspectives

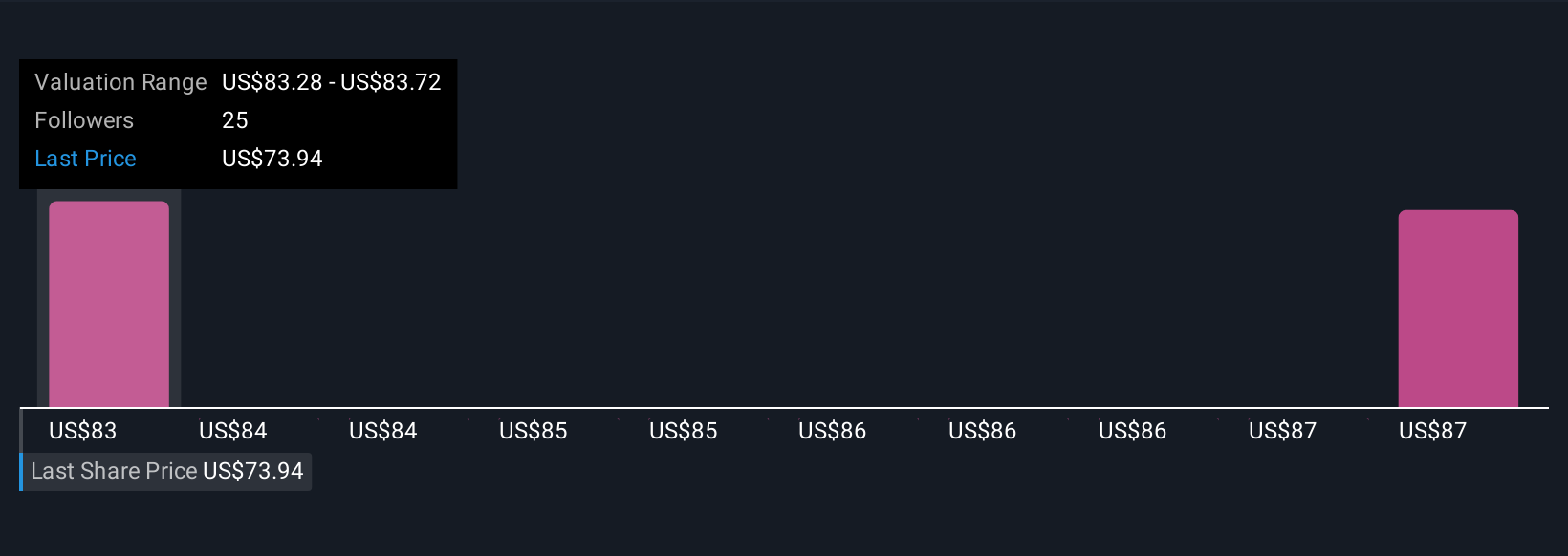

Simply Wall St Community members provided two fair value estimates for Edwards Lifesciences ranging from US$83.18 to US$87.73 per share. With international competition potentially impacting procedure growth, these differing viewpoints invite you to explore how market participants see future performance playing out.

Explore 2 other fair value estimates on Edwards Lifesciences - why the stock might be worth just $83.18!

Build Your Own Edwards Lifesciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edwards Lifesciences research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Edwards Lifesciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edwards Lifesciences' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edwards Lifesciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EW

Edwards Lifesciences

Provides products and technologies to treat advanced cardiovascular diseases in the United States, Europe, Japan, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives