- United States

- /

- Biotech

- /

- NasdaqGS:ARQT

High Growth Tech Stocks In The United States To Watch

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a significant rise of 23% in the last year, with earnings expected to grow by 15% annually in the coming years. In this context, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AVITA Medical | 33.38% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.23% | 56.37% | ★★★★★★ |

| TG Therapeutics | 29.99% | 44.07% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Arcutis Biotherapeutics (NasdaqGS:ARQT)

Simply Wall St Growth Rating: ★★★★★☆

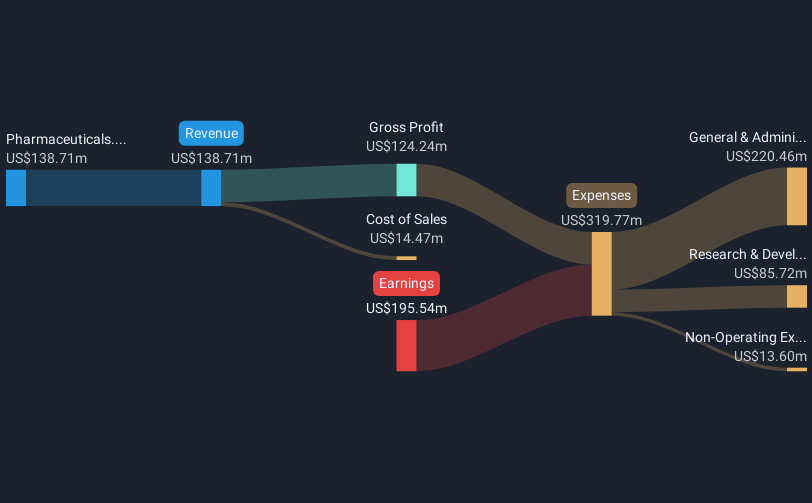

Overview: Arcutis Biotherapeutics, Inc. is a biopharmaceutical company dedicated to developing and commercializing treatments for dermatological diseases, with a market cap of approximately $1.84 billion.

Operations: Arcutis Biotherapeutics focuses on the development and commercialization of dermatological treatments, generating revenue primarily from its pharmaceuticals segment, which amounts to $138.71 million.

Arcutis Biotherapeutics, a firm in the biotech sector, is navigating through an unprofitable phase with significant R&D investments aimed at groundbreaking dermatological treatments. Despite a current lack of profitability, Arcutis has demonstrated robust revenue growth at 29.8% annually and forecasts earnings to surge by approximately 59.6% per year. The company's recent submission of a supplemental New Drug Application for ZORYVE cream highlights its commitment to expanding treatment options for inflammatory skin conditions, potentially enhancing its market position upon successful approval. This strategic focus on specialized, high-demand medical solutions could set Arcutis on a path to future profitability and industry prominence despite present challenges like shareholder dilution and substantial insider selling over the past three months.

- Take a closer look at Arcutis Biotherapeutics' potential here in our health report.

Understand Arcutis Biotherapeutics' track record by examining our Past report.

ExlService Holdings (NasdaqGS:EXLS)

Simply Wall St Growth Rating: ★★★★☆☆

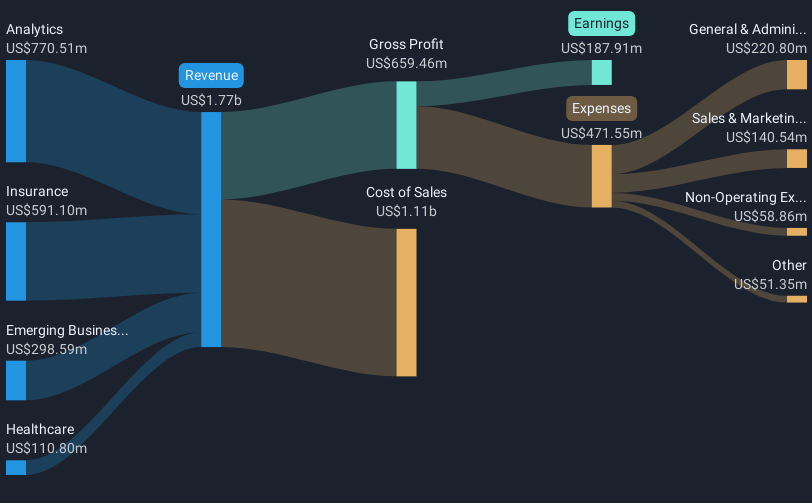

Overview: ExlService Holdings, Inc. is a company that provides data analytics and digital operations solutions both in the United States and internationally, with a market capitalization of $7.10 billion.

Operations: ExlService Holdings generates revenue primarily through its Analytics, Insurance, Healthcare, and Emerging Business segments, with Analytics contributing $770.51 million. The company's diverse service offerings cater to various industries across global markets.

ExlService Holdings, a contender in the professional services sector, is demonstrating notable financial agility with an 11.6% annual revenue growth and a more robust earnings increase of 15.3% per year. Recent strategic moves include a substantial share repurchase program, where $190 million was spent to buy back 3.28% of its shares, underscoring confidence in its operational stability and future prospects. Moreover, the launch of the EXL Enterprise AI Platform, developed on NVIDIA’s framework, marks a significant step towards integrating advanced GenAI solutions into diverse client workflows—potentially revolutionizing how businesses leverage technology for efficiency and growth.

- Click to explore a detailed breakdown of our findings in ExlService Holdings' health report.

Evaluate ExlService Holdings' historical performance by accessing our past performance report.

Evolent Health (NYSE:EVH)

Simply Wall St Growth Rating: ★★★★☆☆

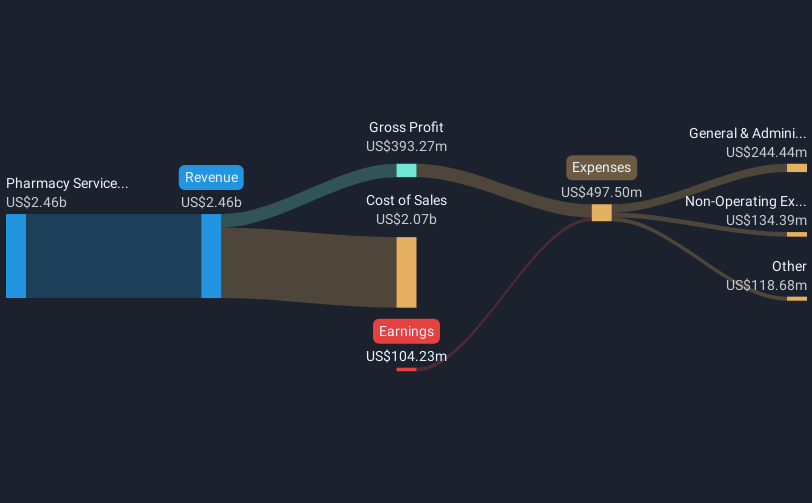

Overview: Evolent Health, Inc., via its subsidiary Evolent Health LLC, provides specialty care management services in oncology, cardiology, and musculoskeletal markets across the United States with a market capitalization of approximately $1.38 billion.

Operations: Evolent Health LLC generates revenue primarily from its Pharmacy Services segment, which amounts to $2.46 billion. The company focuses on specialty care management in specific medical fields within the U.S.

Evolent Health, amidst a volatile market, shows promise with a 12.4% annual revenue growth and an expected earnings surge of 63.5% per year. The recent expansion of its strategic partnership with Humana to streamline oncology services highlights its innovative approach in healthcare technology, enhancing patient care efficiency and approval processes. With R&D investments aligning with industry advancements and Dr. Von Nguyen's appointment as CMO poised to infuse fresh expertise into their operations starting January 2025, Evolent is strategically positioning itself to capitalize on tech-driven healthcare solutions.

- Navigate through the intricacies of Evolent Health with our comprehensive health report here.

Gain insights into Evolent Health's historical performance by reviewing our past performance report.

Make It Happen

- Investigate our full lineup of 233 US High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARQT

Arcutis Biotherapeutics

A biopharmaceutical company, focuses on developing and commercializing treatments for dermatological diseases.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives