- United States

- /

- Healthtech

- /

- NYSE:EVH

Further weakness as Evolent Health (NYSE:EVH) drops 7.5% this week, taking one-year losses to 68%

Even the best stock pickers will make plenty of bad investments. Anyone who held Evolent Health, Inc. (NYSE:EVH) over the last year knows what a loser feels like. The share price is down a hefty 68% in that time. Even if you look out three years, the returns are still disappointing, with the share price down60% in that time. Shareholders have had an even rougher run lately, with the share price down 27% in the last 90 days.

If the past week is anything to go by, investor sentiment for Evolent Health isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Evolent Health

Because Evolent Health made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Evolent Health increased its revenue by 38%. We think that is pretty nice growth. Meanwhile, the share price tanked 68%, suggesting the market had much higher expectations. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

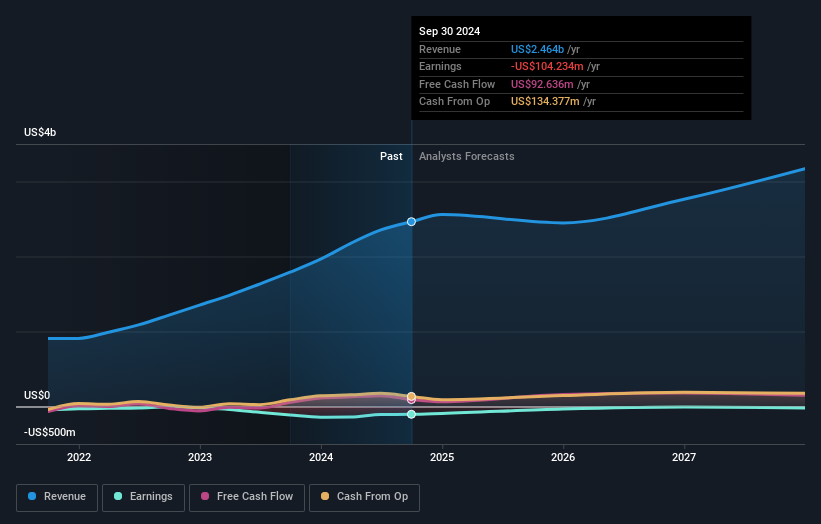

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Evolent Health is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Evolent Health stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Evolent Health shareholders are down 68% for the year, but the market itself is up 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Evolent Health you should be aware of.

We will like Evolent Health better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Evolent Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EVH

Evolent Health

Through its subsidiary, Evolent Health LLC, offers specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives