- United States

- /

- Healthtech

- /

- NYSE:EVH

Cautious Investors Not Rewarding Evolent Health, Inc.'s (NYSE:EVH) Performance Completely

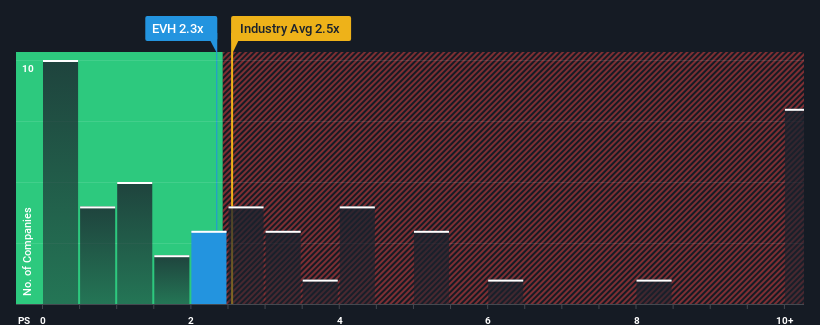

It's not a stretch to say that Evolent Health, Inc.'s (NYSE:EVH) price-to-sales (or "P/S") ratio of 2.3x right now seems quite "middle-of-the-road" for companies in the Healthcare Services industry in the United States, where the median P/S ratio is around 2.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Evolent Health

What Does Evolent Health's P/S Mean For Shareholders?

Recent times have been advantageous for Evolent Health as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Evolent Health.Do Revenue Forecasts Match The P/S Ratio?

Evolent Health's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 50% last year. The strong recent performance means it was also able to grow revenue by 70% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 24% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 19% per annum, which is noticeably less attractive.

With this information, we find it interesting that Evolent Health is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Evolent Health's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Evolent Health's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Evolent Health that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Evolent Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EVH

Evolent Health

Through its subsidiary, provides specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States.

Undervalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives