- United States

- /

- Healthcare Services

- /

- NYSE:ELV

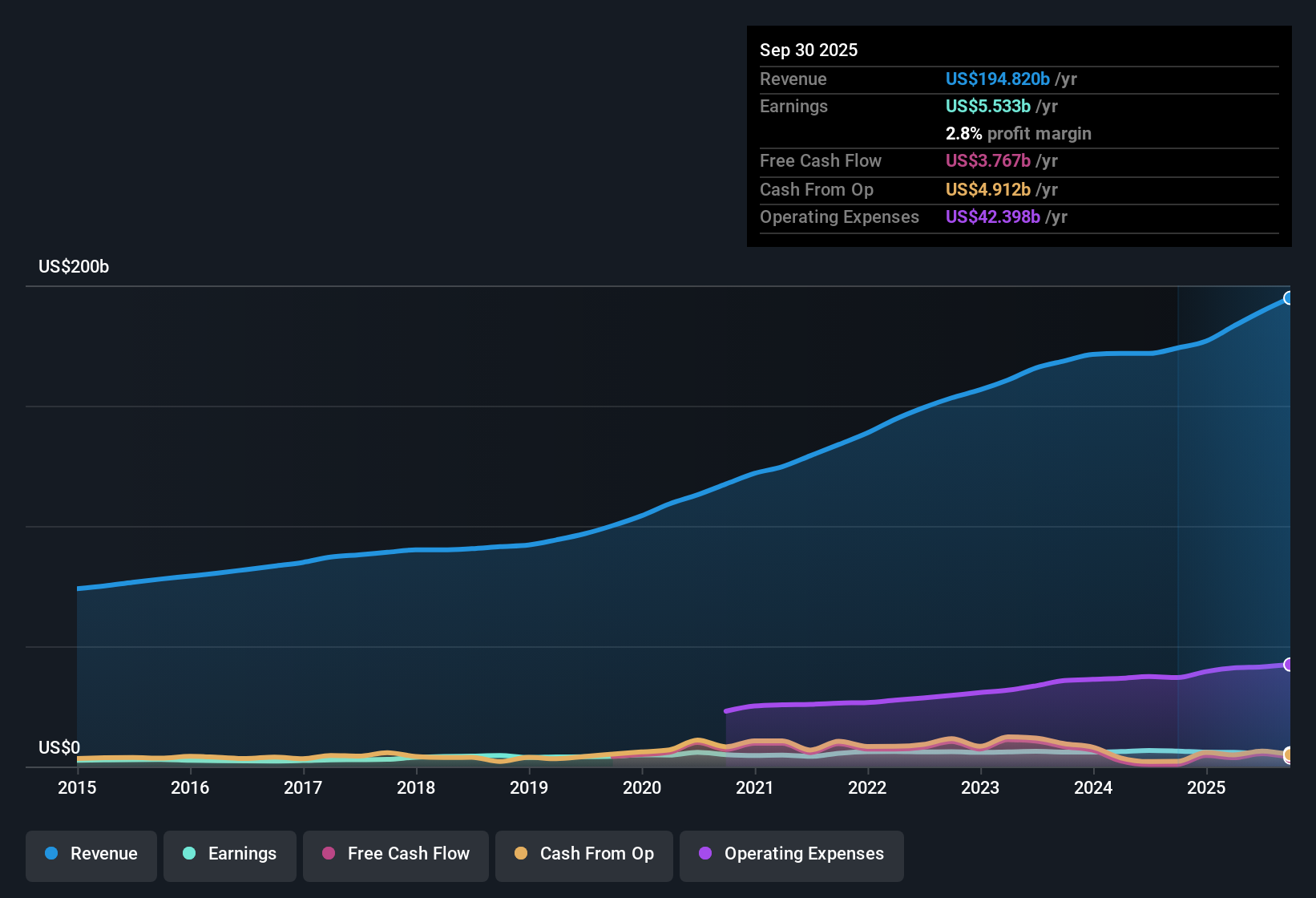

Elevance Health (ELV): Net Profit Margin Falls to 2.8%, Undercutting Bullish Valuation Narratives

Reviewed by Simply Wall St

Elevance Health (ELV) delivered revenue growth forecasts of 3.2% annually, trailing the US market’s expected pace of 10% per year. EPS is projected to rise 10.8% each year, again underperforming the 15.5% growth outlook for the broader market. The company’s net profit margin compressed to 2.8%, down from 3.7% a year ago, and recent negative earnings growth makes year-over-year acceleration less meaningful compared to longer-term trends. Shares are trading at $345.21, well below an estimated fair value of $1,180.22 and offering a compelling 13.9x price-to-earnings ratio relative to industry benchmarks. With moderate growth expectations balanced by attractive valuation metrics and margin pressures, investors will be paying close attention to where Elevance’s trend sits within the healthcare sector.

See our full analysis for Elevance Health.Next, we put these latest numbers side-by-side with the most popular market narratives to reveal where the facts back up the stories and where expectations might need rethinking.

See what the community is saying about Elevance Health

Margin Expansion Hinges on Value-Based Care

- Analysts expect Elevance Health's net profit margin to rise from 2.8% today to 3.2% in three years. This modest improvement relies on shifting more revenue into higher-margin value-based contracts and expanding services like behavioral health.

- According to the analysts' consensus view, this anticipated margin expansion is supported by investments in digitization, AI-powered tools, and risk-based contracts within the Carelon division.

- Consensus narrative notes that Carelon’s focus on value-based behavioral and pharmacy care is designed to make future margins more resilient and earnings less volatile.

- However, analysts also highlight that integration challenges with recent acquisitions could dilute these margin improvements if not managed closely.

- Expectations for steadier margins make upcoming performance in Carelon and service lines critical benchmarks.

Curious if consensus still sees Elevance as a safe bet? Find out what analysts are watching next. 📊 Read the full Elevance Health Consensus Narrative.

Profitability Trails Sector, but Share Buybacks Add Upside

- Analysts project the number of shares outstanding will decline by 2.91% annually in the next three years, a trend which could lift earnings per share despite the company's net profit margin remaining below industry averages.

- The consensus narrative emphasizes that ongoing buybacks and disciplined capital allocation, paired with technology investments, are expected to drive both higher per-share earnings and smoother income streams over time.

- Given ongoing cost pressures and elevated benefit expense ratios, consensus expects buybacks to play a crucial role in delivering EPS growth even if underlying profitability lags the sector.

- Risk remains that without effective cost control, even these shareholder actions may not be enough to offset lagging operational efficiency long-term.

DCF Fair Value Far Above Current Share Price

- Elevance Health’s shares trade at $345.21, which is substantially lower than its DCF fair value estimate of $1,180.22 and 14.9% below the single allowable analyst price target of $389.56.

- Consensus commentary flags that while headline valuation appears attractive versus both fair value and sector multiples, improvement in fundamentals will be needed to bring the traded price closer to these benchmarks.

- Consensus notes the price-to-earnings ratio of 13.9x stands at a discount to the healthcare industry average of 21.8x. This could make the stock more compelling if margins and growth can stabilize.

- Yet, until cost management and margin recovery visibly materialize, investors may remain hesitant, keeping the share price anchored well below analyst and DCF estimates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Elevance Health on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think those figures tell another story? You can shape your own perspective and share your narrative in just a couple of minutes by clicking Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Elevance Health.

See What Else Is Out There

Elevance Health’s earnings growth and margins remain pressured, with profitability trailing sector peers and cost control not yet delivering sustainable operational improvement.

If smoother expansion and resilience sound appealing, use stable growth stocks screener (2097 results) to compare companies with proven, steady growth records and more consistent financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elevance Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELV

Elevance Health

Operates as a health benefits company in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives