- United States

- /

- Healthcare Services

- /

- NYSE:ELV

Elevance Health (ELV): Exploring Valuation After Recent Momentum in Share Price

Reviewed by Simply Wall St

See our latest analysis for Elevance Health.

Over the last year, Elevance Health’s short-term price momentum has been strong, with a 19% share price return over the past 90 days and a swift rebound this month, even as its 1-year total shareholder return remains down 14%. This recent upswing hints at renewed optimism about the company’s long-term growth prospects as steady revenue and earnings gains come into focus.

If you’re interested in what else is happening in the sector, consider exploring more healthcare stocks showing momentum and innovation. See the full list for free.

With momentum building and shares still trading below analyst price targets, investors are left to wonder: is this a window to pick up Elevance Health at a bargain, or is market confidence already accounting for coming growth?

Most Popular Narrative: 5.6% Undervalued

With the fair value estimate at $375.05, compared to Elevance Health’s last close at $354.07, market sentiment appears hesitant despite the narrative pointing to further upside. The tension between recent price momentum and a still-attractive discount to consensus fair value sets the stage for a deeper look at the core drivers behind these expectations.

"Strategic investments in digital consumer engagement and Carelon's diversified health services (e.g., pharmacy, care management, behavioral health) are accelerating revenue growth and providing higher-margin, recurring income streams. This should drive both topline and earnings diversity as industry healthcare spending and complexity continue to rise."

Curious how digital healthcare bets could transform Elevance’s revenue game? The real twist lies in the growth engine and margin lift built into these projections. The numbers behind this fair value reveal major assumptions about the scale and mix of future earnings. Dive in to discover the core financial levers and bold analyst forecasts powering this valuation.

Result: Fair Value of $375.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent medical cost inflation or further regulatory changes could present challenges to Elevance Health’s hopes for margin improvement and earnings growth in the coming years.

Find out about the key risks to this Elevance Health narrative.

Another View: What Does the Market Multiple Say?

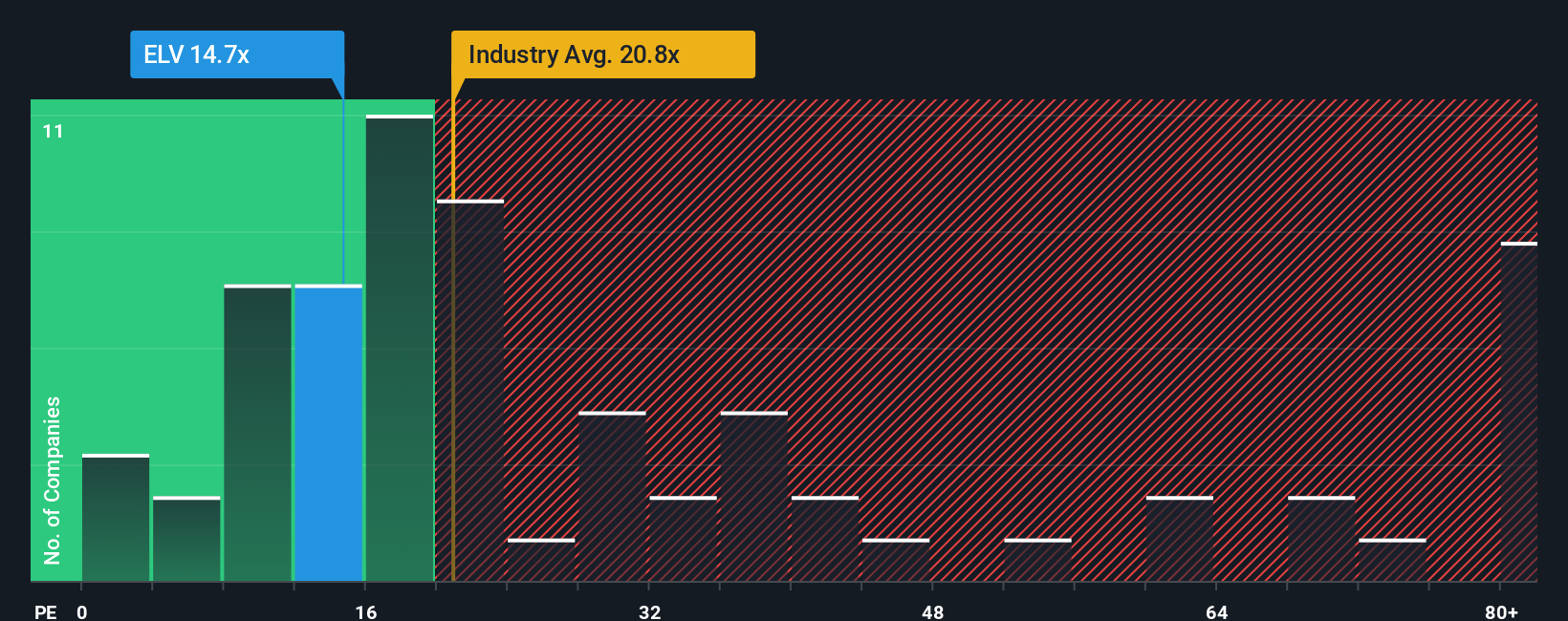

Taking a different approach, let’s compare Elevance Health’s price-to-earnings ratio of 14.9x against the industry average of 21.2x and its peer group at 13.8x. It’s cheaper than most in the sector but not an outright bargain relative to direct peers. The fair ratio sits notably higher at 31.6x, which implies potential upside if the market re-rates the business. Will investors bet on this catch-up, or does modest growth cap the multiple for now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Elevance Health Narrative

Want to dig into the numbers yourself or see things differently? You can build your own Elevance Health story in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Elevance Health.

Looking for More Investment Ideas?

If you want to stay one step ahead, fuel your research by checking out unique stock themes and untapped opportunities that others may be missing.

- Capture strong yields and build steady income streams with these 17 dividend stocks with yields > 3%, where companies deliver impressive dividends above market averages.

- Tap into the potential of tomorrow’s tech leaders by heading to these 24 AI penny stocks, featuring companies driving innovations in artificial intelligence.

- Spot undervalued gems primed for growth. Start with these 877 undervalued stocks based on cash flows to see which businesses the market might be mispricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elevance Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELV

Elevance Health

Operates as a health benefits company in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives