- United States

- /

- Healthcare Services

- /

- NYSE:ELV

Does Elevance Health's (ELV) Buyback and Dividend Boost Offset Medicaid-Related Uncertainties?

Reviewed by Sasha Jovanovic

- Elevance Health announced past third quarter results with revenue of US$50.71 billion and net income of US$1.19 billion, alongside the declaration of a US$1.71 per share quarterly dividend and completion of a substantial share buyback for US$875 million.

- A key insight is that despite year-over-year net income growth in the recent quarter, the company faced ongoing lawsuits and challenges related to Medicaid patient cost trends.

- Given the strong quarterly revenue and share repurchase activity, we'll examine how this financial strength impacts Elevance Health's long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Elevance Health Investment Narrative Recap

To be an Elevance Health shareholder, you need to believe in the company’s ability to deliver stable earnings and margin recovery, even as cost pressures and regulatory shifts challenge the Medicaid and ACA businesses. Third quarter results reflect solid revenue growth and capital returns, but ongoing lawsuits and stubborn medical cost trends remain the key short-term catalyst and risk. The recent updates signal no material change to these challenges at this stage.

A relevant announcement is the completion of the US$875 million share buyback this quarter, which offers incremental support for per share value. However, as cost and rate trends remain central to the company’s future trajectory, this buyback underscores Elevance’s ongoing effort to manage shareholder returns even in a volatile operating environment.

However, persistent Medicaid cost volatility and the risk of inadequate rate recovery are issues investors should stay alert to...

Read the full narrative on Elevance Health (it's free!)

Elevance Health's outlook anticipates $230.4 billion in revenue and $7.4 billion in earnings by 2028. Achieving these levels would require 6.8% annual revenue growth and a $2.0 billion increase in earnings from the current $5.4 billion.

Uncover how Elevance Health's forecasts yield a $375.05 fair value, a 7% upside to its current price.

Exploring Other Perspectives

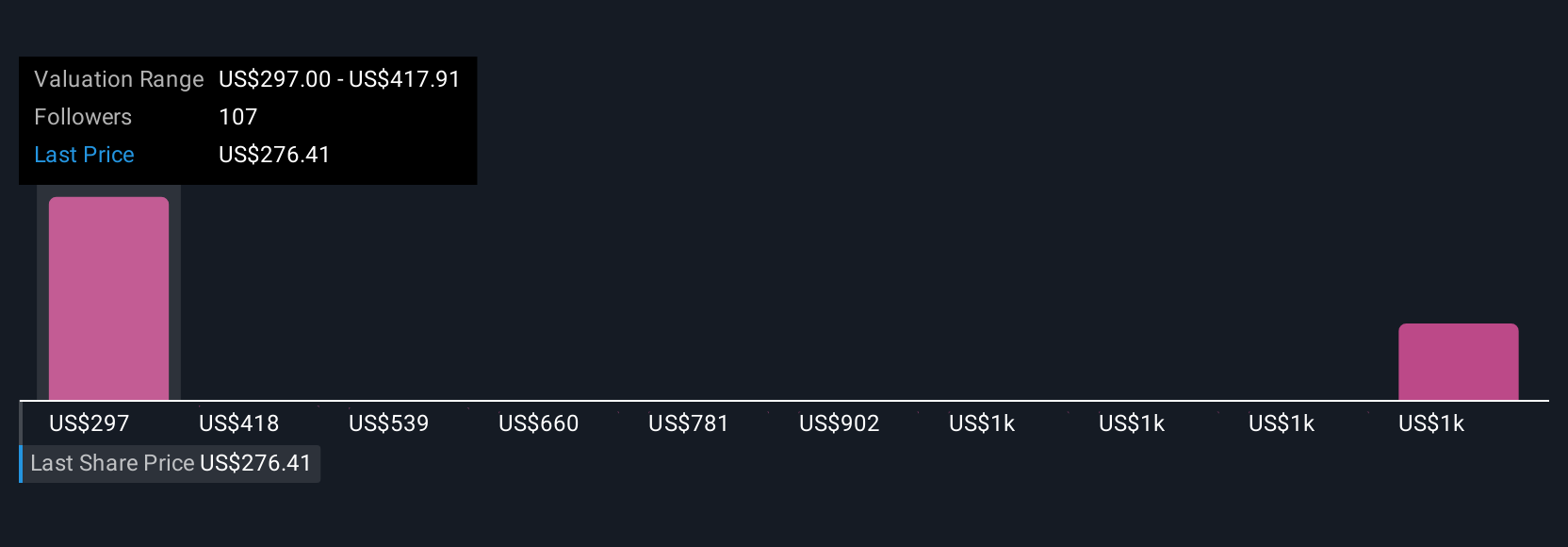

Fifteen members of the Simply Wall St Community have published fair value estimates for Elevance Health, ranging from US$297 to US$1,170 per share. While opinions on value differ widely, persistent risk of delays in Medicaid rate recovery is top of mind for many watching Elevance’s margin outlook.

Explore 15 other fair value estimates on Elevance Health - why the stock might be worth over 3x more than the current price!

Build Your Own Elevance Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elevance Health research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Elevance Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elevance Health's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elevance Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELV

Elevance Health

Operates as a health benefits company in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives