- United States

- /

- Healthcare Services

- /

- NYSE:CVS

What the Expiring Health Insurance Subsidies Could Mean for CVS Health’s True Value

Reviewed by Bailey Pemberton

If you have been eyeing CVS Health stock and wondering what your next move should be, you are not alone. The last month has been anything but quiet for CVS, with shares climbing a hefty 10.7% over 30 days and a notable 6.0% just in the past week. Year to date, CVS boasts an astounding 84.0% return, making investors take notice even if the three-year performance is only flat. For a giant in healthcare, these shifts reflect not just financial momentum but also the way investors are weighing the latest headlines and policy debates.

There have been some curveballs recently, from CVS opting out of COVID vaccine distribution in certain states to headline-grabbing standoffs over insurance subsidies and drug coverage. News about the possible expiration of health insurance subsidies and debates over medication access has created fresh perceptions of both opportunity and risk for CVS. But even with these policy uncertainties in play, the market seems to be warming up to CVS’ long-term prospects, which might explain the stock’s recent uptick.

Of course, when you strip away the headlines and price swings, it makes sense to look under the hood. CVS Health currently lands a value score of 3 out of 6 based on key valuation checks. So it passes some classic under-valuation tests but not all. There is more to this calculation, though, and the real question is which valuation approaches matter most. Before we dig into an even smarter way to measure CVS’s true worth, let’s break down how those common valuation checks stack up for the company right now.

Approach 1: CVS Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting future cash flows and then discounting them back to today’s value. This approach gives investors a sense of what the business might truly be worth based on anticipated cash generated over time, rather than just relying on earnings or market trends.

For CVS Health, the latest Free Cash Flow (FCF) over the last twelve months is $4.58 billion. Analysts forecast robust growth ahead, with FCF expected to reach $13.17 billion by 2029. While analyst predictions cover the next five years, Simply Wall St extrapolates these trends further, projecting continued expansion in cash flows through 2035.

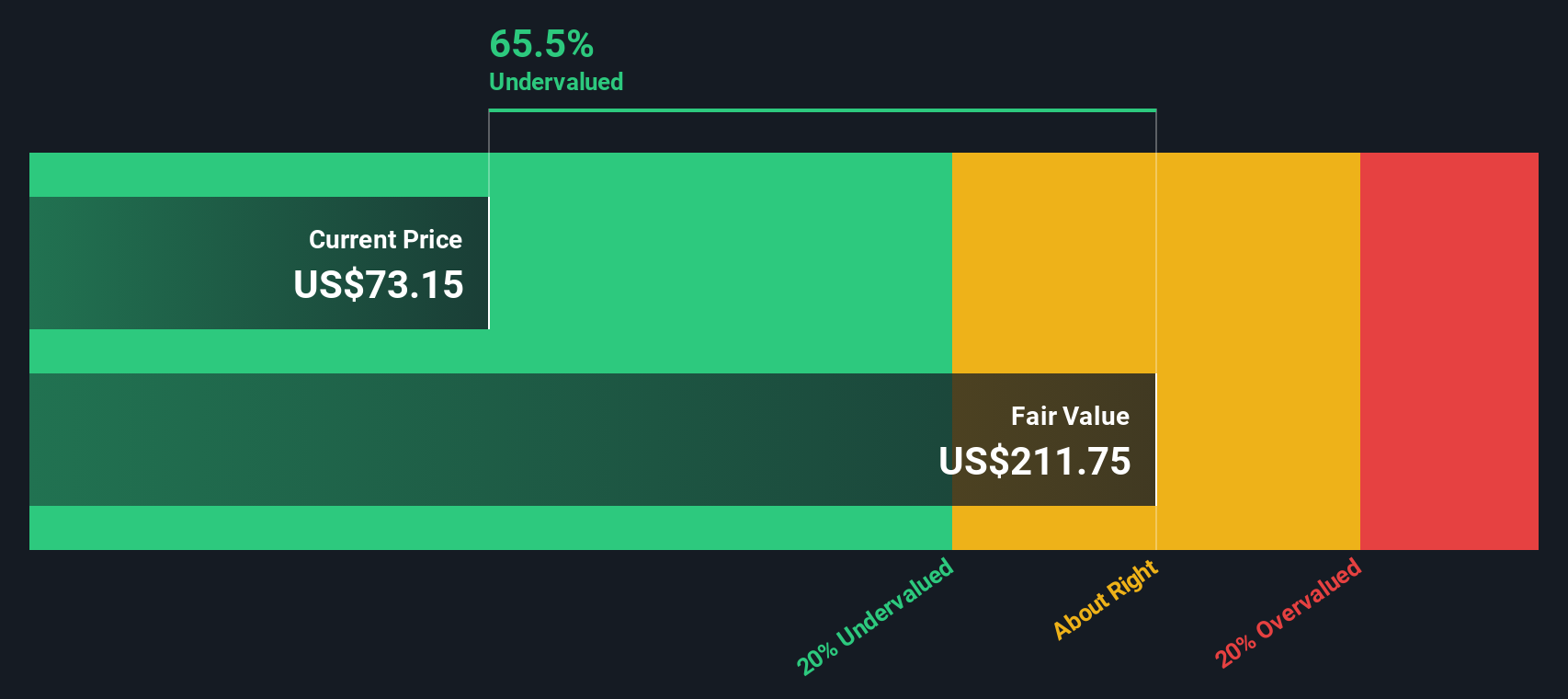

Using these cash flow projections and discounting them to present value, the DCF model places CVS Health’s intrinsic value at $281.78 per share. Compared to where the stock currently trades, this points to an estimated 71.1% discount. In plain terms, the DCF model suggests CVS Health stock is currently undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CVS Health is undervalued by 71.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CVS Health Price vs Earnings

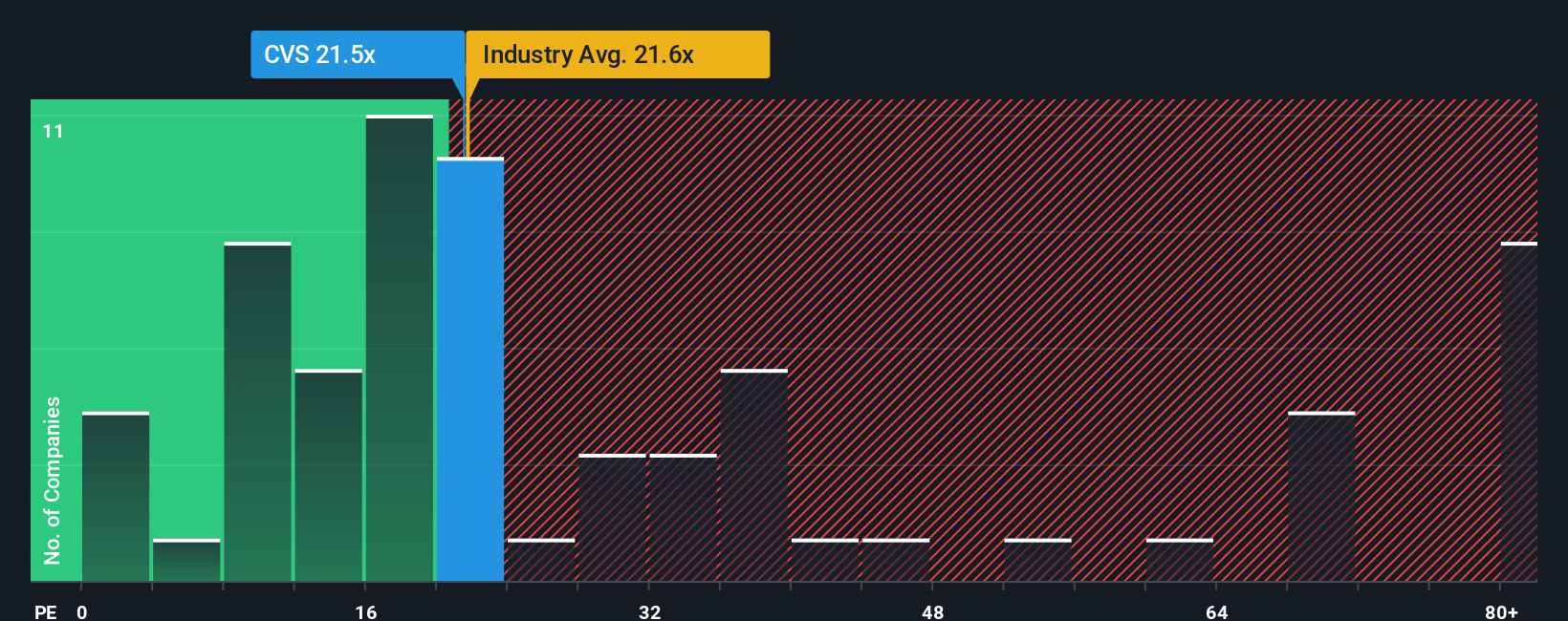

For established, profitable companies like CVS Health, the Price-to-Earnings (PE) ratio is a practical way to gauge whether the stock is trading at a sensible price relative to its current earnings. The PE ratio provides a window into how much investors are willing to pay for each dollar of profit today. That number is shaped by growth outlook and risk appetite. Generally, higher growth expectations or lower perceived risks warrant a higher "normal" PE ratio. The opposite holds true for slower growth or more uncertainty.

CVS Health’s current PE ratio is 22.8x. For context, the broader healthcare industry hovers around 20.9x and its peer group average sits at 19.8x, indicating that CVS is priced slightly above both. That said, Simply Wall St’s Fair Ratio, an in-house benchmark reflecting expected earnings growth, profitability, market cap, and risks, comes in at a much higher 39.3x for CVS Health. Unlike a simple comparison with peers or the industry, which can overlook a company’s unique growth prospects or risk profile, the Fair Ratio aims to capture what investors should truly be willing to pay based on a fuller financial picture.

Comparing CVS’s PE of 22.8x to its Fair Ratio of 39.3x suggests the stock is trading well below what its fundamentals might justify. Despite trading above industry averages, CVS appears undervalued when you factor in its growth, market positioning, and risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CVS Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your own story about a company, connecting your perspective on its future, such as what you expect for CVS Health’s revenue, earnings, or profit margins, to a clear, custom financial forecast and then to a fair value estimate.

Narratives do not just focus on numbers; they blend what you believe is possible for the business with what the numbers say, so you can track both the story and the math together. On Simply Wall St’s Community page, used by millions of investors, you can easily create, share, and follow Narratives for CVS Health and hundreds of other companies.

When you use Narratives, you are empowered to compare your fair value to the current price and decide if now is the right time to buy, hold, or sell. Best of all, Narratives update automatically as new news or earnings change the outlook, so you can always stay in touch with the bigger picture. For example, some investors’ Narratives value CVS at nearly $103 based on high long-term growth, while others have a more cautious view with a fair value around $70, making your decision as dynamic as the news itself.

Do you think there's more to the story for CVS Health? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVS

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives