- United States

- /

- Healthcare Services

- /

- NYSE:CVS

CVS Health (CVS) Valuation in Focus After New $200 Wegovy Copay Plan Shifts Drug Pricing Landscape

Reviewed by Kshitija Bhandaru

CVS Health (CVS) just made waves by introducing a $200 copay plan for Novo Nordisk's Wegovy. This change is set to start in 2026. The program aims to broaden coverage and help insurers and patients cut costs.

See our latest analysis for CVS Health.

The Wegovy move isn’t the only big headline for CVS Health this year, with the company also announcing a scale-back of Medicare Advantage offerings and rolling out new zero-copay plans through Aetna. Despite a mix of competitive pressures and market shifts, momentum appears to be stabilizing. CVS’s total shareholder return of 0.3% over the past year reflects a business holding steady as it navigates industry changes, while the current share price of $77.49 continues to trade at a discount compared to peers.

If the evolving healthcare landscape has you thinking about where innovation could lead next, it might be the perfect time to browse the latest opportunities in See the full list for free.

But given lingering uncertainties and CVS’s recent strategic moves, investors might wonder whether the stock is still trading at a meaningful discount or if the market has already factored in its growth prospects. Is there a real buying opportunity here, or is future upside already reflected in the price?

Most Popular Narrative: 5.6% Undervalued

With CVS Health’s most widely-followed narrative putting fair value at $82.07, that is slightly above its last close of $77.49. Investors are considering a modest discount and evaluating how aggressive the long-term assumptions are.

Integration of recent and ongoing acquisitions (such as Aetna, Oak Street, and Signify Health) along with vertical alignment between insurance, pharmacy, and care delivery provides substantial cross-selling and synergy opportunities. These factors support long-term operating margin and earnings growth as margin recovery initiatives gain traction.

What if the main factor behind this valuation is a significant shift in earnings, driven by newly integrated businesses and digital health initiatives? Interested in the bold assumptions and influential projections built into those future profits? Unlock the full narrative for all the details behind this fair value assessment.

Result: Fair Value of $82.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pharmacy reimbursement pressures and ongoing margin challenges in health care delivery could limit profitability and threaten the growth assumptions behind the bullish case.

Find out about the key risks to this CVS Health narrative.

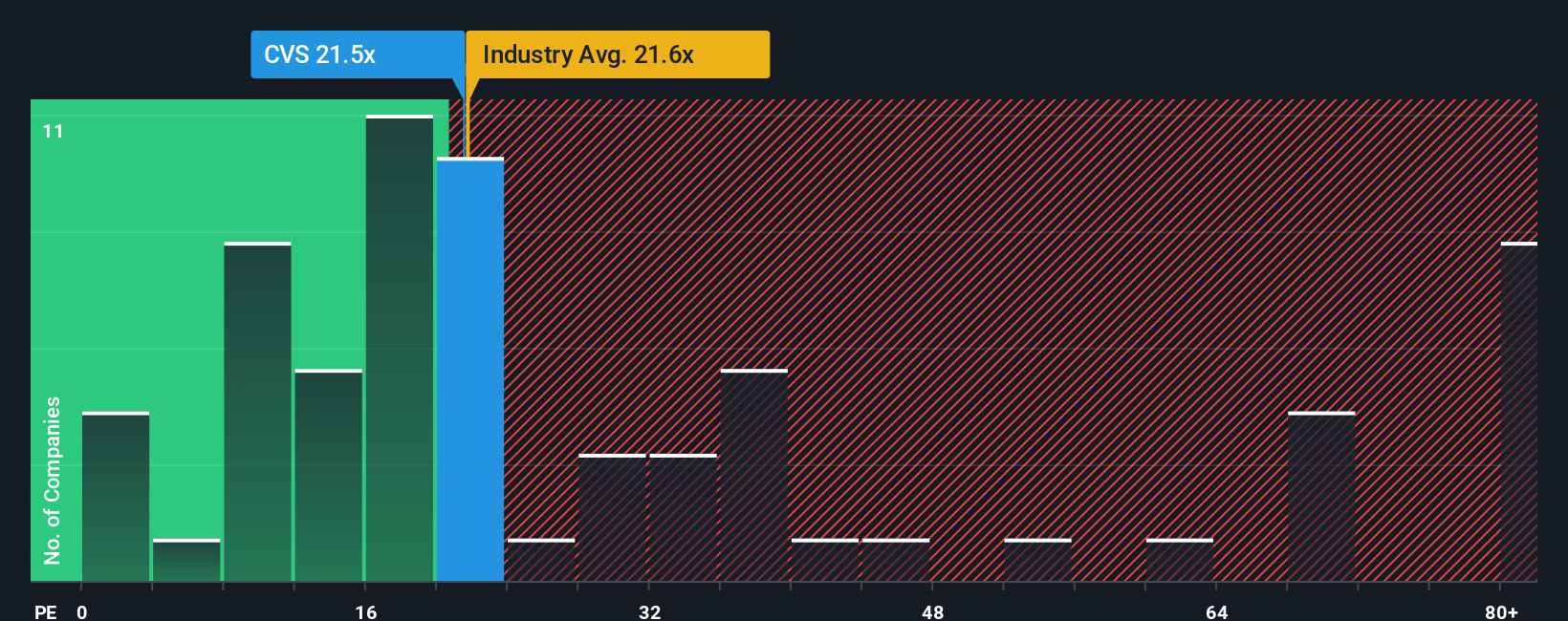

Another View: Market Ratios Paint a Different Picture

Switching perspectives, the current price-to-earnings ratio for CVS stands at 21.7x, which is more expensive than both its industry average of 21.4x and its peer group at 19.8x. However, compared with the fair ratio of 39.1x, there could be upside if the market rerates. Does this premium hint at renewed confidence or future disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CVS Health Narrative

If the current outlook does not fit your perspective, you can dive into the numbers yourself and craft a personal take in just minutes, or Do it your way.

A great starting point for your CVS Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not wait while others get ahead. Multiply your chances by acting now and browsing three top themes that catch market momentum.

- Boost your returns with steady income. Check out these 19 dividend stocks with yields > 3% offering yields above 3% for those seeking consistent cash flow.

- Seize the upside of technological transformation and see which innovators are leading breakthroughs with these 24 AI penny stocks.

- Tap into explosive potential by examining these 3567 penny stocks with strong financials showing standout financial strength and future growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVS

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success