- United States

- /

- Healthcare Services

- /

- NYSE:CVS

Assessing CVS Health Stock After Coverage Decision on Gilead’s HIV Drug

Reviewed by Bailey Pemberton

Thinking about what to do with CVS Health stock right now? You are definitely not alone. Over the past few weeks, CVS Health has been moving back on investors' radars, with its share price rising 2.3% in the past week and 4.5% over the last month. That kind of steady climb is always eye-catching, especially when you consider the stock is up a solid 22.4% in the past year and a robust 53.4% over five years, even if the three-year return sits a bit lower. Clearly, something is shifting in how investors are viewing CVS, and it is worth digging into why.

Recent headlines point to a mix of both opportunities and challenges. From the ongoing negotiations over health insurance subsidies potentially tied to government funding decisions, to temporary pullbacks on COVID vaccine offerings in key states, and even new choices about which drugs make it onto CVS’s coverage lists, the company is navigating a complicated healthcare landscape. Each of these news stories has the power to shift risk perception, either adding uncertainty or giving investors optimism about CVS’s future positioning in a rapidly changing market.

So, is the stock truly undervalued, or has the market already adjusted for those risks? According to a widely used value score that checks for undervaluation across six key financial markers, CVS scores a 3 out of 6, meaning it clears half the undervaluation tests. Of course, that number only tells part of the story. Next, let us dig into what goes into those valuation methods before I share an even better way to think about CVS Health’s true worth.

Approach 1: CVS Health Discounted Cash Flow (DCF) Analysis

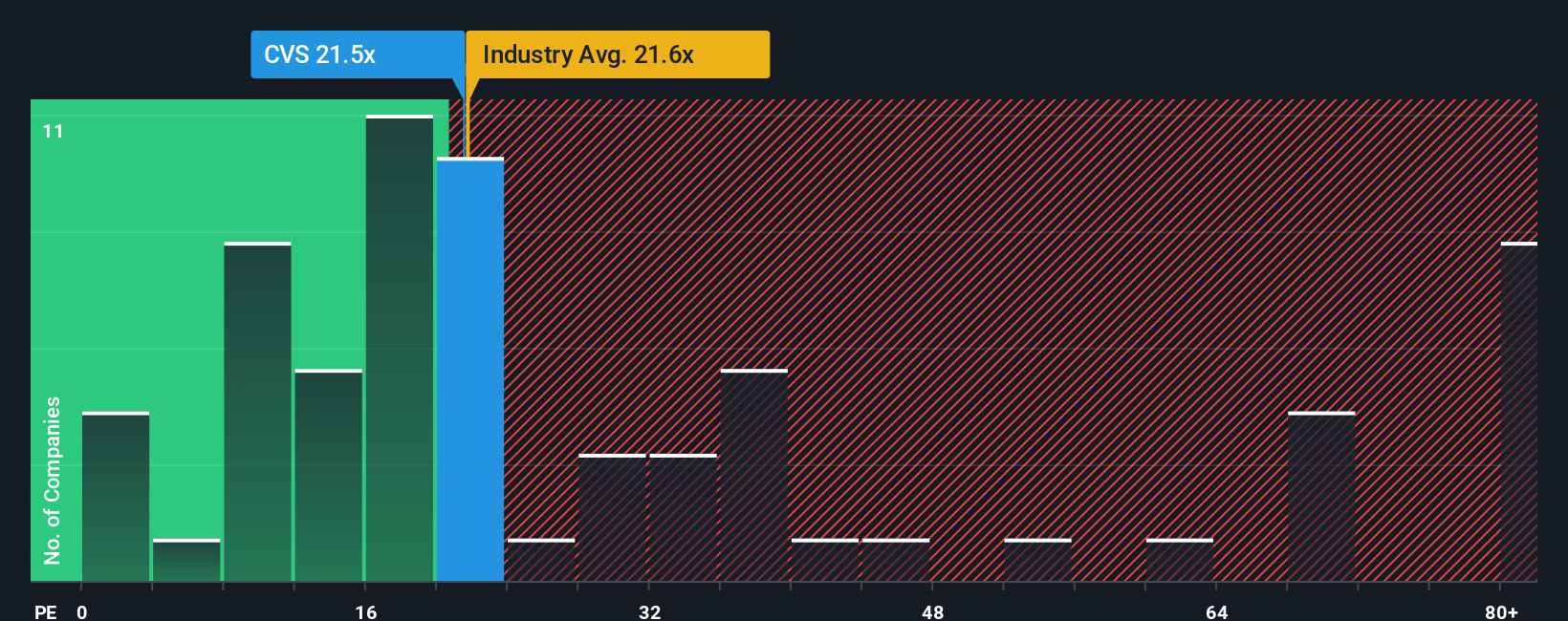

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. For CVS Health, this process involves taking what the company is expected to generate in Free Cash Flow over the coming years and determining what that is worth in today's dollars. This is done using a model known as the 2 Stage Free Cash Flow to Equity.

Currently, CVS Health is generating $4.58 billion in Free Cash Flow. Analyst estimates project this number could rise significantly, with expected Free Cash Flow reaching $13.19 billion by 2029. Notably, the projections beyond five years are industry extrapolations based on observed trends and estimates. The DCF model takes these flows and applies an appropriate discount rate to reflect the time value of money and risk.

According to this DCF analysis, CVS Health’s fair intrinsic value per share is $277.12. Compared to the current market price, this implies the stock is trading at a 72.2% discount to its intrinsic value. In other words, CVS Health stock appears deeply undervalued on this metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CVS Health is undervalued by 72.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CVS Health Price vs Earnings (PE)

For profitable companies such as CVS Health, the Price-to-Earnings (PE) ratio is a highly relevant metric because it compares the company’s share price to its actual earnings. This is a popular tool among investors when assessing what value the market is placing on each dollar of current profit, making it useful for companies with a steady earnings record.

That said, a “normal” or “fair” PE ratio is not set in stone. It is influenced by growth expectations. The faster a company is expected to grow its earnings, the higher its PE can justifiably be. Conversely, companies facing higher risks or slower future growth typically trade on lower PEs. So, looking at PE in isolation can be misleading unless it is considered in the right context.

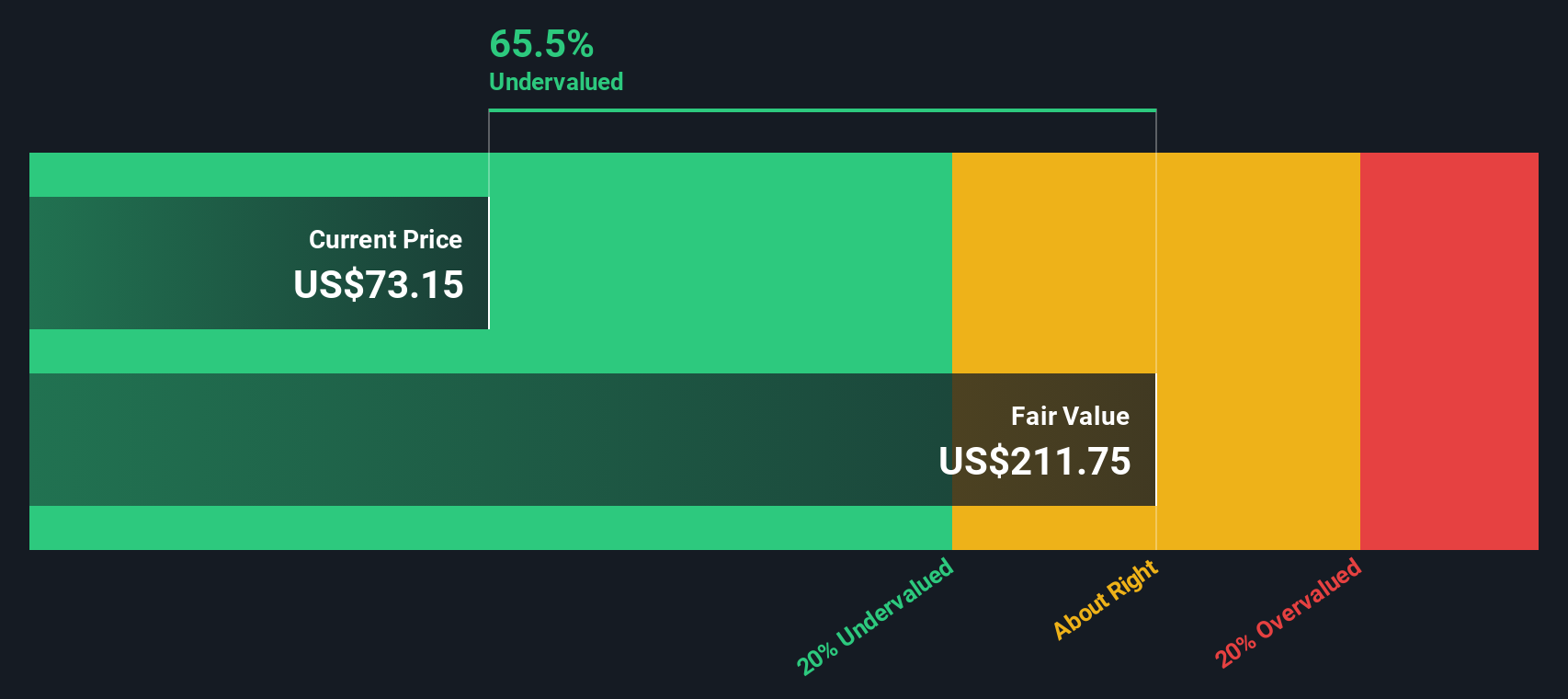

Currently, CVS Health trades at a PE ratio of 21.6x. This is almost identical to the Healthcare industry average of 21.6x and compares to a peer average of 19.9x. However, to deliver a more insightful benchmark, Simply Wall St calculates a unique Fair Ratio for CVS Health, which accounts for a range of real-world variables beyond raw profit, including earnings growth outlook, risk profile, profit margin, industry specifics and scale. In the case of CVS Health, its Fair Ratio is 39.0x, which is substantially higher than its current PE ratio.

Because the Fair Ratio incorporates much more than comparison multiples, it offers a superior gauge of value, especially for companies whose prospects or risks differ from the broad industry. In this case, with CVS’s current PE ratio well below its Fair Ratio, the market appears to be pricing the stock well under what would be expected given its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CVS Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a concise story that encapsulates your personal outlook on a company, combining your assumptions about its future revenue, earnings, and margins into a single financial forecast, and linking this story to an estimated fair value.

Rather than focusing only on ratios or historical data, Narratives empower you to connect the company's real-world challenges and opportunities with your investment thesis. This approach makes it easy for any investor to map their beliefs and expectations to a specific fair value, helping you decide at a glance if the current share price offers opportunity or signals caution.

Narratives are at the heart of the Simply Wall St platform, enabling millions of investors to share, refine, and update their perspectives directly within the Community page. As news or earnings data changes, Narratives update dynamically, keeping your investment thinking fresh and timely with every new development.

For example, some investors see CVS’s fair value as high as $103, reflecting growth optimism, while others model it as low as $62, focused on cost and industry pressures. This demonstrates how diverse Narratives help you weigh what truly matters for your own decision.

For CVS Health, here are previews of two leading CVS Health Narratives:

🐂 CVS Health Bull CaseFair Value: $103.00

Undervalued by 25.1%

Revenue Growth Rate: 18.02%

- Despite recent earnings challenges and uncertainty from restructuring charges and rising costs, the current valuation points to CVS being significantly undervalued, trading with a P/E around 10x, well below sector averages.

- The Health Care Benefits segment is driving robust growth, with revenue up 23% year over year in H1 2024, bolstered by strong government contracts and increased medical memberships.

- A $2B restructuring plan, if executed effectively, could stabilize profitability. The model estimates a substantial upside if CVS successfully implements cost-cutting and integrates healthcare acquisitions.

Fair Value: $62.09

Overvalued by 24.2%

Revenue Growth Rate: 7.0%

- The bullish perspective sees potential in CVS’s diverse operations and moves into provider services, highlighting possible revenue and cost synergies if chronic condition management succeeds.

- The bearish view emphasizes ongoing risks from U.S. healthcare reform debates and retail store foot traffic declines due to online competition, raising questions about long-term stability and growth.

- Profit growth prospects for CVS appear lower than managed care peers because of persistent challenges in its retail segment, putting fair value below the current share price.

Do you think there's more to the story for CVS Health? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVS

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives