- United States

- /

- Healthtech

- /

- NYSE:CTEV

Claritev (CTEV) Shifts Revenue Forecasts—Is Its Global Expansion Strategy Hitting an Inflection Point?

Reviewed by Simply Wall St

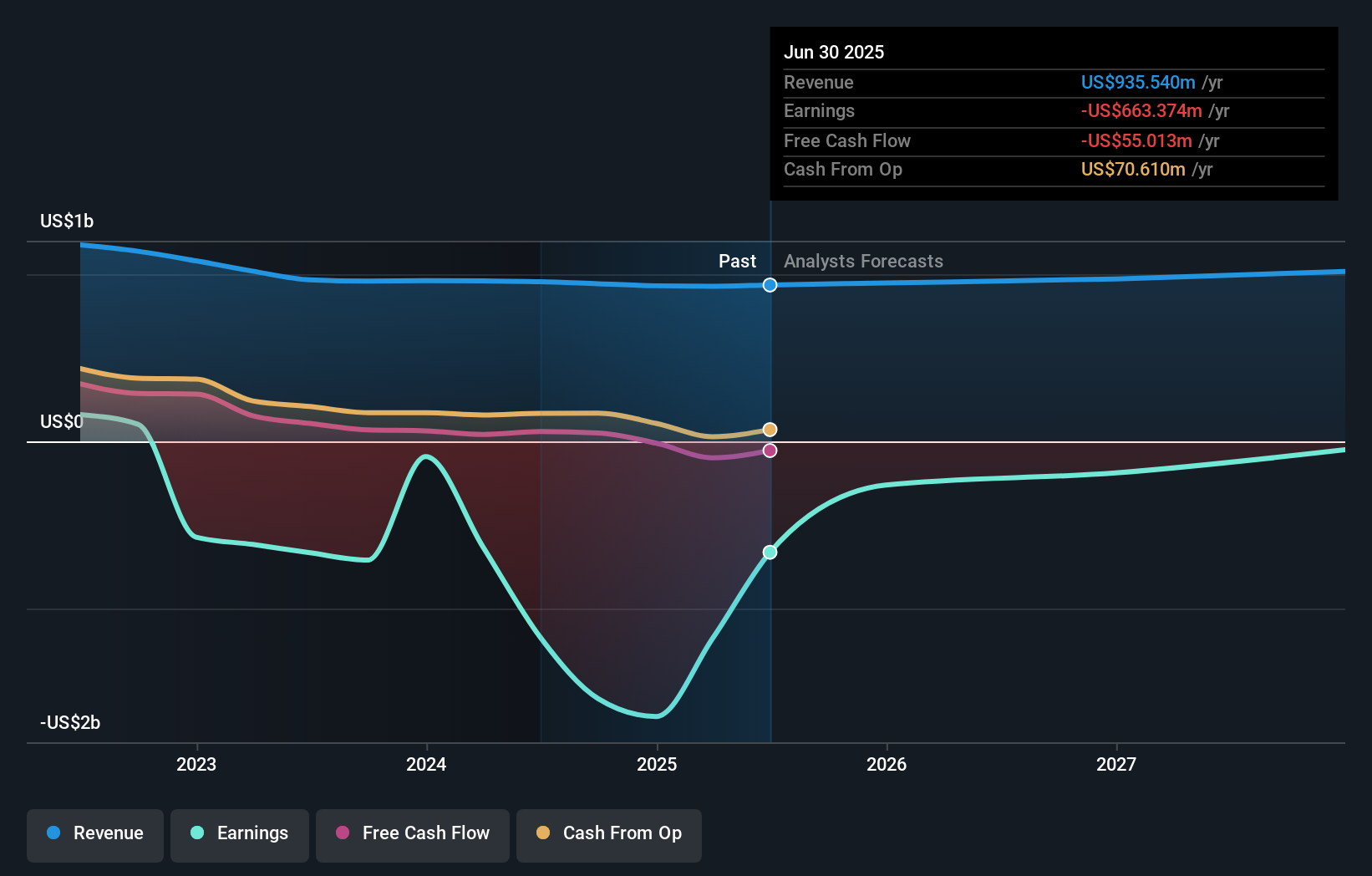

- In the past week, Claritev Corporation reported second-quarter results showing higher sales at US$241.57 million and a sharply reduced net loss of US$62.64 million, while updating its full-year 2025 revenue guidance to between flat and 2% growth from 2024 levels.

- The company’s US$400 million universal shelf registration, covering a range of securities, adds financial flexibility to support potential future initiatives and growth plans.

- We will explore how Claritev’s improving financial results and updated revenue outlook may influence the long-term investment narrative centered on digital transformation and global expansion.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Claritev Investment Narrative Recap

Shareholders in Claritev need to believe that its digital transformation and international expansion can translate recent operational improvements into sustainable growth, despite ongoing losses and dependence on a handful of large healthcare clients. The latest quarterly report shows progress, with higher sales and a much smaller net loss, but management's update to flat-to-2% full year revenue growth suggests only modest short-term acceleration; the single biggest catalyst remains wider adoption of AI-enabled healthcare solutions, while the main risk centers on contract concentration and cost pressures, both of which remain largely unchanged by these announcements.

The most relevant announcement is Claritev's new US$400 million universal shelf registration, which aims to increase financial flexibility for future initiatives. This can support funding for further technology upgrades or expansion, and helps underpin near-term confidence in the company's ability to pursue its digital and geographic growth catalysts, even as revenue guidance stays cautious.

However, in contrast to recent momentum, investors should be aware of how concentrated Claritev's revenue base remains, given that...

Read the full narrative on Claritev (it's free!)

Claritev's outlook anticipates $1.0 billion in revenue and $90.0 million in earnings by 2028. This scenario assumes annual revenue growth of 3.1% and an earnings increase of $753.4 million from the current earnings of $-663.4 million.

Uncover how Claritev's forecasts yield a $70.50 fair value, in line with its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Claritev's fair value anywhere from US$10.98 up to US$162.41. These investor perspectives reflect optimism and skepticism, while ongoing cost pressures present by far the biggest challenge for Claritev’s ability to achieve sustained profitability.

Explore 3 other fair value estimates on Claritev - why the stock might be worth less than half the current price!

Build Your Own Claritev Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Claritev research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Claritev research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Claritev's overall financial health at a glance.

No Opportunity In Claritev?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTEV

Claritev

Provides data analytics and technology-enabled cost management, payment, and revenue integrity solutions to the healthcare industry in the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives