- United States

- /

- Healthcare Services

- /

- NYSE:COR

Cencora (NYSE:COR) Eyes Acquisitions and Technology Investments with Potential OneOncology Buyout

Reviewed by Simply Wall St

Cencora (NYSE:COR) has made headlines with its announcement on March 10, 2025, detailing plans for strategic acquisitions and investments in technology infrastructure, aiming to drive future growth. Over the last quarter, the company's share price increased by 10%, a move potentially influenced by these forward-looking strategies. During this period, despite challenging market conditions with the broader market dropping 5%, Cencora's focus on acquisitions and investments may have bolstered investor confidence. Notably, significant actions such as revisions to revenue growth expectations and active share repurchase programs echoed a robust commitment to shareholder value, aligning with the company's overall growth strategy. Additional factors, like satisfying financial updates with increased sales, an ongoing share buyback, and sustained dividends, further demonstrate resilient operations amidst broader market volatility marked by geopolitical tensions, tariff concerns, and economic uncertainty. The contrasting trends emphasize Cencora's proactive maneuvers in a fluctuating landscape.

Unlock comprehensive insights into our analysis of Cencora stock here.

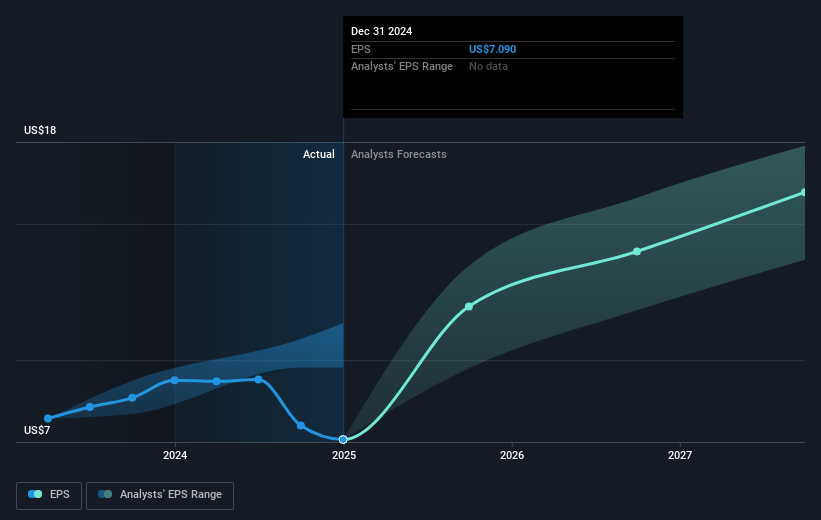

Cencora (NYSE:COR) achieved a total shareholder return of 246.10% over the past five years. This strong long-term performance is reinforced by substantial earnings growth, averaging a significant 33% annually. Although recent financials showed a decline in net income, the company's ability to increase sales—rising to US$81.49 billion—underscores its operational resilience. While facing negative earnings growth of 25.2% over the last year, Cencora outperformed the US Healthcare industry, which saw a 4.4% decline, highlighting its robust positioning.

Contributing factors include active share buybacks, completing repurchases totaling US$1.07 billion, effective capital use for shareholder benefit. Notably, recent revenue growth expectations have been raised, projecting an 8% to 10% increase, providing a positive outlook amidst current economic conditions. The launch of the Accelerate Pharmacy Solutions represents a crucial product development, aiming to enhance operations and expand care, supporting long-term growth. These initiatives collectively emphasize Cencora's commitment to adding shareholder value despite recent challenges.

- See whether Cencora's current market price aligns with its intrinsic value in our detailed report

- Understand the uncertainties surrounding Cencora's market positioning with our detailed risk analysis report.

- Hold shares in Cencora? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives