- United States

- /

- Healthcare Services

- /

- NYSE:COR

Cencora (COR): Evaluating Valuation After Global Expansion and Alliance Healthcare Acquisition

Reviewed by Simply Wall St

Cencora (COR) recently filed its 10-K report, highlighting significant financial growth and the strategic impact of its Alliance Healthcare acquisition. These actions have expanded Cencora’s presence in pharmaceutical distribution, attracting investor interest in its global ambitions.

See our latest analysis for Cencora.

Following the Alliance Healthcare deal and global expansion efforts, Cencora’s momentum has accelerated. Its share price is up 64.2% year-to-date and the total shareholder return over the past three years stands at an impressive 118%. Investors are clearly taking notice of Cencora’s growing scale, and momentum continues to build as international operations expand and specialty pharma gains traction.

If you’re looking to ride this wave of opportunity, now’s a great moment to discover See the full list for free.

With shares soaring and strong earnings growth, the question now is whether Cencora’s success story still offers value for new investors, or if the market has already fully priced in its future potential?

Most Popular Narrative: 3.4% Undervalued

With Cencora closing at $368.93 and the fair value pegged at $382.07 in the most widely followed narrative, the stage is set for a valuation debate influenced by upgraded margin forecasts and evolving business dynamics.

Cencora's ongoing investment in digital infrastructure and advanced analytics positions the company to capitalize on the accelerating digitization of healthcare and regulatory requirements such as the Drug Supply Chain Security Act. These initiatives are expected to improve supply chain efficiency and transparency, which may support higher net margins and operating income over time.

Can Cencora's profit engine really justify its above-market future multiple? See the valuation blueprint and discover which key assumptions analysts are banking on, including bold margin and earnings estimates that may surprise you.

Result: Fair Value of $382.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, policy shifts or compressed margins from increased generic drug adoption could quickly challenge the optimistic earnings outlook that is currently priced into Cencora’s shares.

Find out about the key risks to this Cencora narrative.

Another View: Are High Market Multiples Sending a Warning?

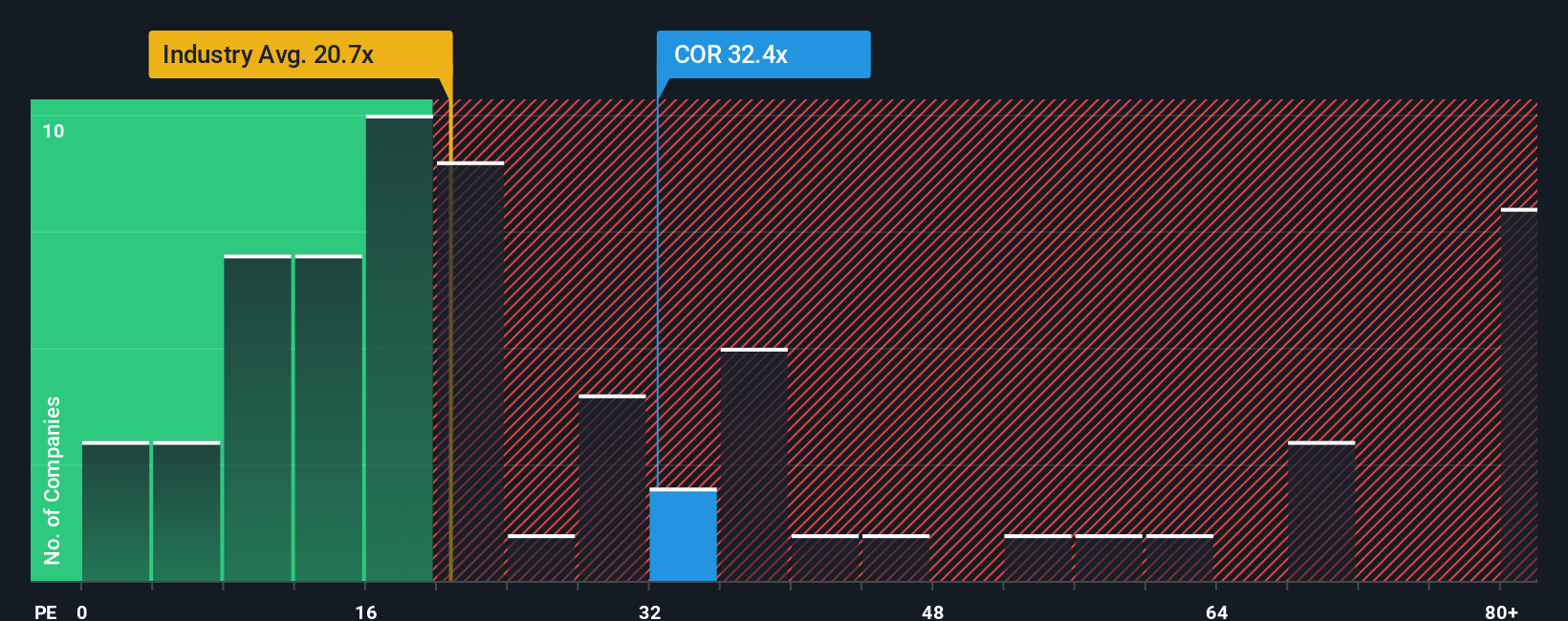

While the fair value estimate points to Cencora still being undervalued, today's earnings ratio of 46.1x looks steep compared to both the US Healthcare industry average (22.8x) and its peer group (23.7x). Even when measured against its own fair ratio of 33.6x, the current valuation stands out. Could this premium be signaling greater risk, or is the market right to price in stronger growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cencora Narrative

If you see things differently or want to dig into the numbers on your own terms, you can easily craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step confidently into your next smart move and expand your investment horizons with stocks that combine growth, innovation, and fresh opportunities waiting just for you.

- Capture big yield potential by tapping into these 15 dividend stocks with yields > 3% featuring companies with robust dividend payouts and stable returns.

- Spot tomorrow’s artificial intelligence frontrunners by searching these 25 AI penny stocks where ambitious innovators are transforming industries with real-world AI solutions.

- Capitalize on market value gaps and find smart bargains using these 921 undervalued stocks based on cash flows with stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.