- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Should Early ACA Rate Hike Approvals Signal a Turning Point for Centene (CNC) Investors?

Reviewed by Sasha Jovanovic

- Earlier this year, Centene reported a US$2.4 billion loss and lowered its 2025 earnings guidance, attributing its challenges to a sicker-than-expected Affordable Care Act insurance pool.

- An important development is that early state approvals for 2026 rate increases are signaling substantial pricing adjustments, which may set the stage for a possible earnings recovery as investors await more details on enrollment and guidance.

- With the prospect of significant ACA rate hikes in 2026, we’ll explore how this could reshape Centene’s investment narrative in the face of near-term losses.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Centene Investment Narrative Recap

To be a Centene shareholder right now, an investor needs to believe that the company can stabilize costs and recover earnings as 2026 ACA rate increases take effect, especially after this year’s US$2.4 billion loss. The recent news of early state approvals for rate hikes directly supports the key catalyst: a potential rebound in profitability from 2026. However, the biggest risk remains unpredictable medical costs and ongoing policy discussions, which could affect margins if not effectively managed in the near term.

The most relevant announcement is Centene’s upcoming Q3 2025 earnings call, scheduled for October 29, which will likely provide updated details on rate approvals and enrollment trends. This event could offer clearer insight into whether rising ACA rates are translating into improved profit guidance, helping investors gauge if the anticipated 2026 recovery remains on track.

Yet, despite signs of future improvement, the continued threat of medical cost volatility is something investors should not overlook if they want to...

Read the full narrative on Centene (it's free!)

Centene's outlook anticipates $195.6 billion in revenue and $2.1 billion in earnings by 2028. This is based on a projected 7.0% annual revenue growth rate, with earnings expected to remain flat at $2.1 billion, showing no change from current levels.

Uncover how Centene's forecasts yield a $34.62 fair value, a 4% downside to its current price.

Exploring Other Perspectives

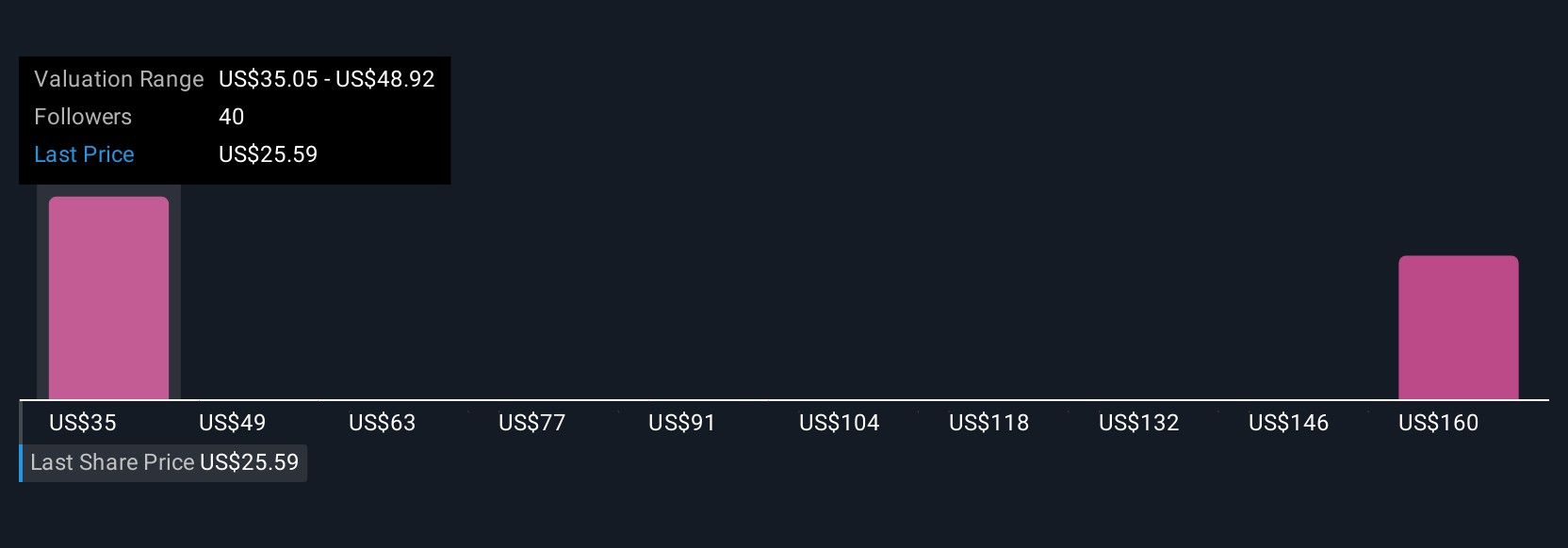

Sixteen members of the Simply Wall St Community estimate Centene’s fair value between US$31.58 and US$183.86. While forecasts for improved Medicaid margins are a catalyst, your takeaway could change dramatically depending on underlying cost trends.

Explore 16 other fair value estimates on Centene - why the stock might be worth 13% less than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives