- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Centene (CNC): Reviewing Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Centene (CNC) shares have seen some movement lately, prompting investors to take a closer look at recent trends and underlying performance. Since healthcare stocks often respond to sector shifts, Centene’s numbers can offer fresh insights for the months ahead.

See our latest analysis for Centene.

Centene’s stock has bounced around this year, with a strong 21.2% share price return over the last 90 days but still sitting well below where it started the year. Looking at the bigger picture, the one-year total shareholder return stands at -50.1%. While recent momentum is building, long-term investors are still waiting for a recovery.

If you want to see what other companies in healthcare have been up to, it’s a great time to browse our curated list: See the full list for free.

But after this prolonged slide and a recent uptick, is Centene now trading at an attractive valuation? Or is the market already factoring in every bit of its future growth potential?

Most Popular Narrative: 5% Overvalued

Centene’s last close price of $36.36 trades modestly above the most popular narrative’s fair value estimate of $34.63, setting a stage for diverging market and analyst expectations.

Management's outlook around Marketplace rate refiling and a return to ACA profitability supports positive revisions to long-term EPS estimates. If margin improvements materialize as expected, 2026 EPS could potentially range from $2.75 to $4.50.

There is a hidden formula behind this price target. It relies on future profit margins, ambitious earnings projections, and a controversial profit multiple. The full narrative reveals which bold assumptions drive this valuation and could explain Centene’s resilience in a shifting healthcare landscape. Don’t miss the numbers that might surprise you.

Result: Fair Value of $34.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as shifting healthcare policy and unexpected spikes in medical costs could quickly challenge Centene’s current growth narrative and analyst optimism.

Find out about the key risks to this Centene narrative.

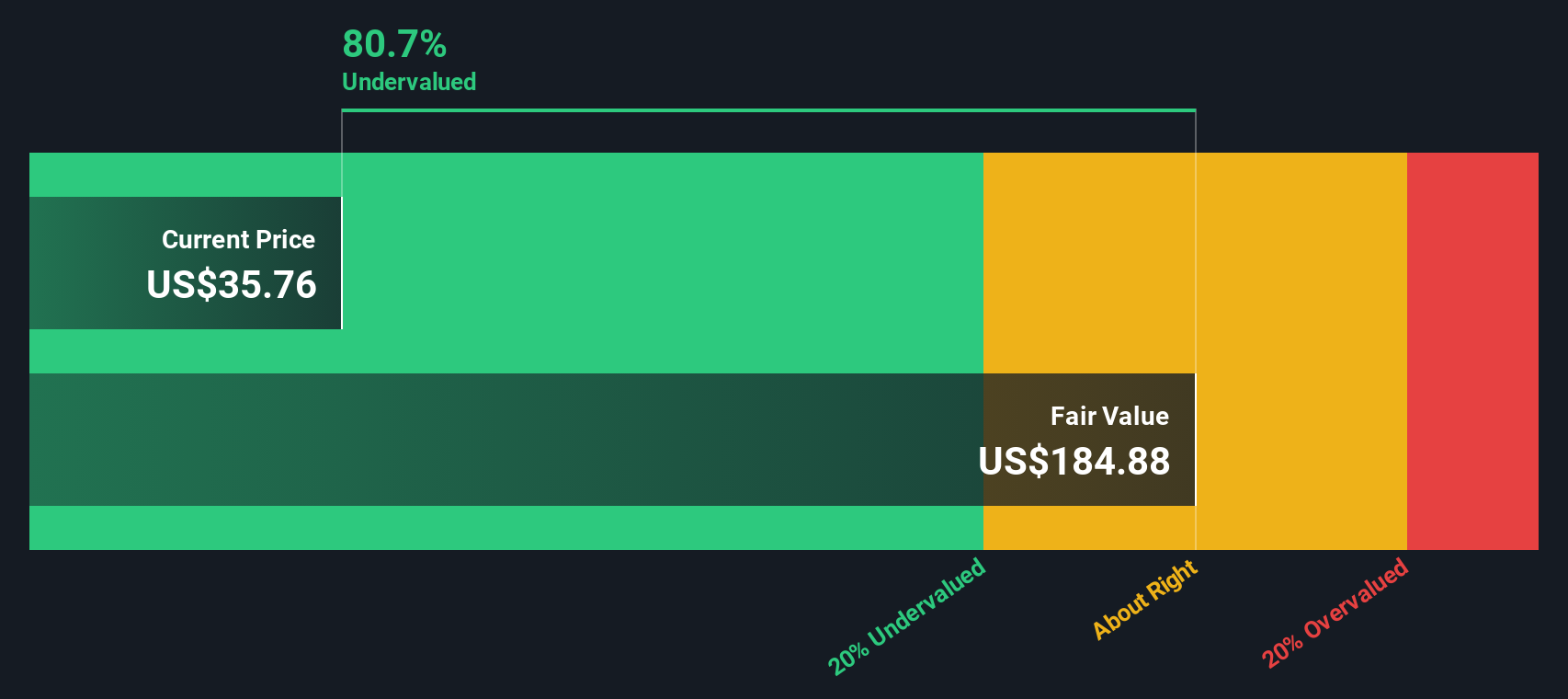

Another View: Discounted Cash Flow Model Paints a Sharply Different Picture

While the most popular narrative signals Centene is overvalued based on its fair value estimate, our DCF model tells a very different story. It calculates that Centene is trading substantially below fair value, suggesting the market may be underestimating Centene’s long-term cash flows. Which method deserves more trust? Forward-looking cash flow estimates or classic price comparisons?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Centene Narrative

If the conclusions here don’t reflect your outlook or you would rather dive deeper on your own, it’s quick and easy to put together your own perspective and see where it leads. Do it your way.

A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities. There are standout companies waiting to transform your portfolio right now. Make sure you’re seeing what others are missing, and act before the crowd.

- Unlock steady income with high yields and dependable returns by tapping into these 18 dividend stocks with yields > 3%, featuring companies built for resilient cash flow.

- Stay ahead in powerful tech trends and seize innovation-led growth by targeting these 25 AI penny stocks, where AI advancements are changing the investment game.

- Capitalize on value opportunities others might overlook by checking out these 893 undervalued stocks based on cash flows, a path to stocks trading beneath their true cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.