- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Centene (CNC): Exploring Valuation After a 24% Share Price Surge

Reviewed by Kshitija Bhandaru

See our latest analysis for Centene.

Centene’s impressive 24% jump over the past month stands out against a backdrop of lackluster long-term returns, with a 1-year total shareholder return of -0.49%. That kind of price momentum is fueling renewed interest in the stock, even as its broader performance signals there may still be some skepticism in the market about Centene’s growth story or risk profile.

While Centene’s surge might have sparked your curiosity, now is a perfect moment to explore more healthcare stocks riding their own exciting trends. See the full list for free.

Given Centene’s mixed record and recent surge, the big question is whether the stock remains undervalued and poised for further gains, or if markets have already factored in all the future growth potential.

Most Popular Narrative: 8.5% Overvalued

Centene’s widely followed narrative sets a fair value below the current price, highlighting analyst skepticism compared to the stock’s recent momentum.

Analysts expect the number of shares outstanding to decline by 2.72% per year for the next 3 years. To value all of this in today's terms, we will use a discount rate of 7.54%, as per the Simply Wall St company report.

What is the real driver behind this cautious valuation? The narrative hinges on analyst forecasts, with every key assumption—revenue growth, margins, and future multiples—fueling a sharply debated fair value. Find out which numbers spark this tension and why they are shaping Centene’s outlook!

Result: Fair Value of $33.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent hurdles in Medicaid funding and unforeseen spikes in medical costs could quickly undermine the case for Centene’s narrative-driven valuation.

Find out about the key risks to this Centene narrative.

Another View: Market Multiples Paint a Different Picture

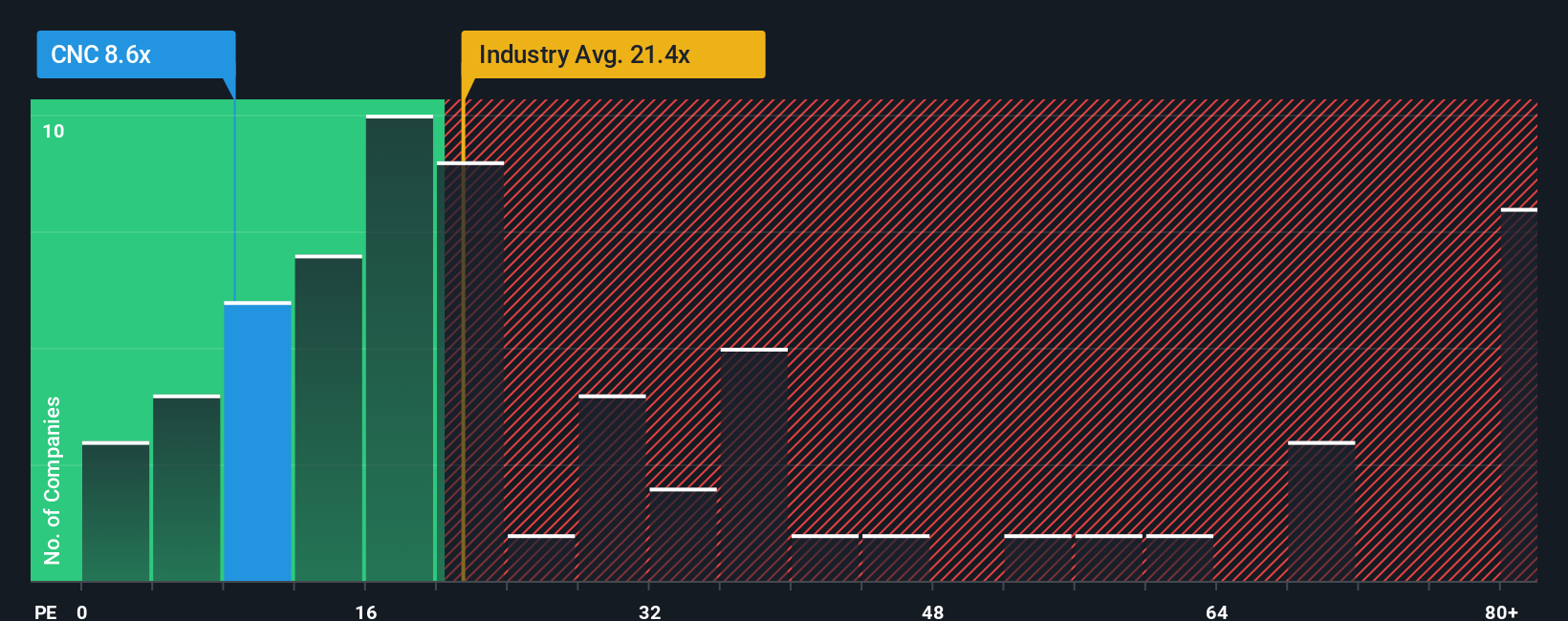

While analyst models point to Centene as somewhat overvalued, a comparison of its price-to-earnings ratio tells another story. Centene trades at just 8.8 times earnings, far below both the US Healthcare industry average of 21.4x and the peer average of 24x. Its ratio is also well under the so-called fair ratio of 38.2x. This gap could indicate there is upside the market is missing, or it could signal risks that are not reflected in the multiples. Which side will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centene Narrative

If you think the numbers tell a different story, or want to test your own assumptions, you can easily shape your own verdict on Centene in just a few minutes. Do it your way.

A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Act now and check out high-potential stocks with game-changing trends instead of waiting on the sidelines. There are valuable ideas just waiting for you.

- Unleash the potential of tech-driven healthcare by starting with these 31 healthcare AI stocks that are pushing the boundaries of AI and medicine.

- Secure your future income by zeroing in on these 19 dividend stocks with yields > 3% delivering reliable yields over 3% for consistent returns.

- Spot tomorrow’s hidden gems and act early with these 904 undervalued stocks based on cash flows before the market catches on to their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026