- United States

- /

- Healthcare Services

- /

- NYSE:CNC

A Piece Of The Puzzle Missing From Centene Corporation's (NYSE:CNC) Share Price

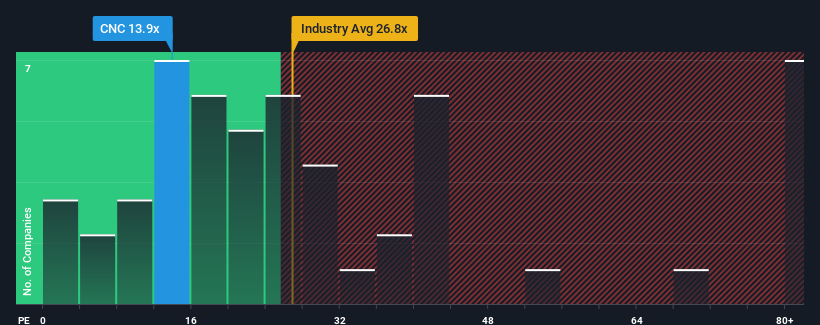

Centene Corporation's (NYSE:CNC) price-to-earnings (or "P/E") ratio of 13.9x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 18x and even P/E's above 32x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Centene certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Centene

Is There Any Growth For Centene?

The only time you'd be truly comfortable seeing a P/E as low as Centene's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 94% gain to the company's bottom line. The latest three year period has also seen a 21% overall rise in EPS, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the analysts watching the company. That's shaping up to be materially higher than the 9.9% each year growth forecast for the broader market.

In light of this, it's peculiar that Centene's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Centene's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Centene with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Centene. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives