- United States

- /

- Healthcare Services

- /

- NYSE:CI

Does Cigna Present an Opportunity as Shares Lag Despite Strong Cash Flow Outlook?

Reviewed by Bailey Pemberton

Thinking about what to do with Cigna Group stock right now? You are definitely not alone, and with all the chatter around big health insurers lately, the stakes feel a bit higher. Cigna’s shares have certainly taken investors on a journey: the price dipped by 0.5% over the past week, nudged up 0.9% in the last month, and, if you have been holding on since January, you have seen a healthy 9.0% rise year-to-date. Longer term, the past year has been a bumpy ride, with the stock down 9.2% on a trailing twelve months basis, but step back to the five-year picture and you will see an impressive gain of 76.3%. That is not bad for anyone with a patient outlook.

Some of these movements reflect big-picture shifts in how the market is weighing health insurance risks and growth prospects. Recent fluctuations are partly tied to changing investor sentiment about the broader healthcare sector and evolving regulations, rather than anything specific to Cigna itself. What is grabbing attention now is whether the current price truly reflects the company’s worth or if the market is missing something.

On that front, Cigna comes in with a value score of 6, which means it passes every major undervaluation check analysts look for. That sounds great, but what does it actually mean, and how is it calculated? Next, we will break down the main valuation approaches behind that score. Later, I will share an even sharper way to tell if Cigna is a genuine bargain or a value trap.

Approach 1: Cigna Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's fair value by projecting its future cash flows and then discounting those amounts back to today's dollars. This approach is popular because it focuses on the real money the business is expected to generate for shareholders.

For Cigna Group, the current Free Cash Flow stands at $3.6 Billion. Looking forward, analysts forecast Free Cash Flow to climb to $12.3 Billion by the year 2029. Notably, projections beyond five years shift from analyst estimates to more generalized growth curves, offering a long-term perspective on the company’s cash-generating ability.

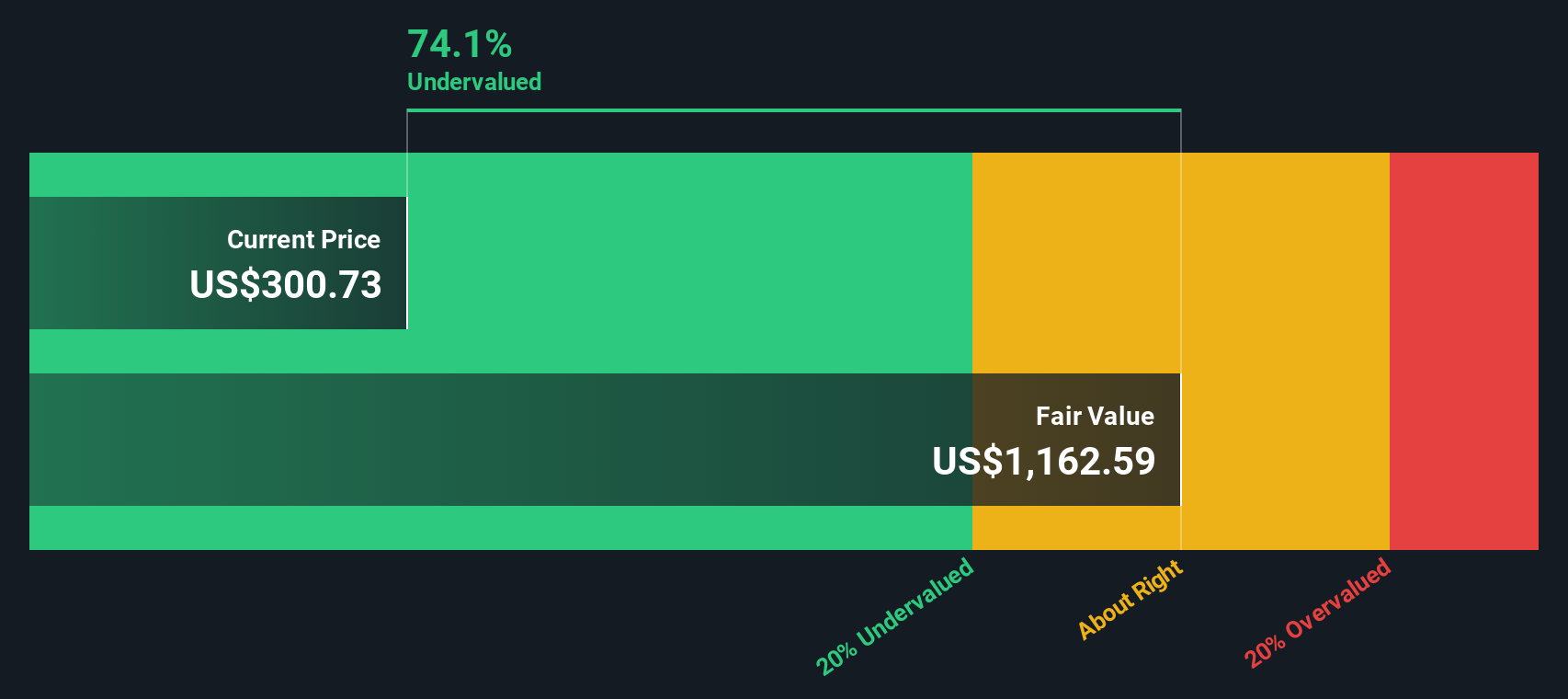

According to the latest DCF valuation, the calculated intrinsic (fair) value per share is $1,113.67. With Cigna's stock currently trading at a price 73.1% below this level, the DCF model signals a significant undervaluation. In other words, the market is pricing the stock much lower than what these conservative future cash flows would suggest it is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cigna Group is undervalued by 73.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Cigna Group Price vs Earnings (PE Ratio)

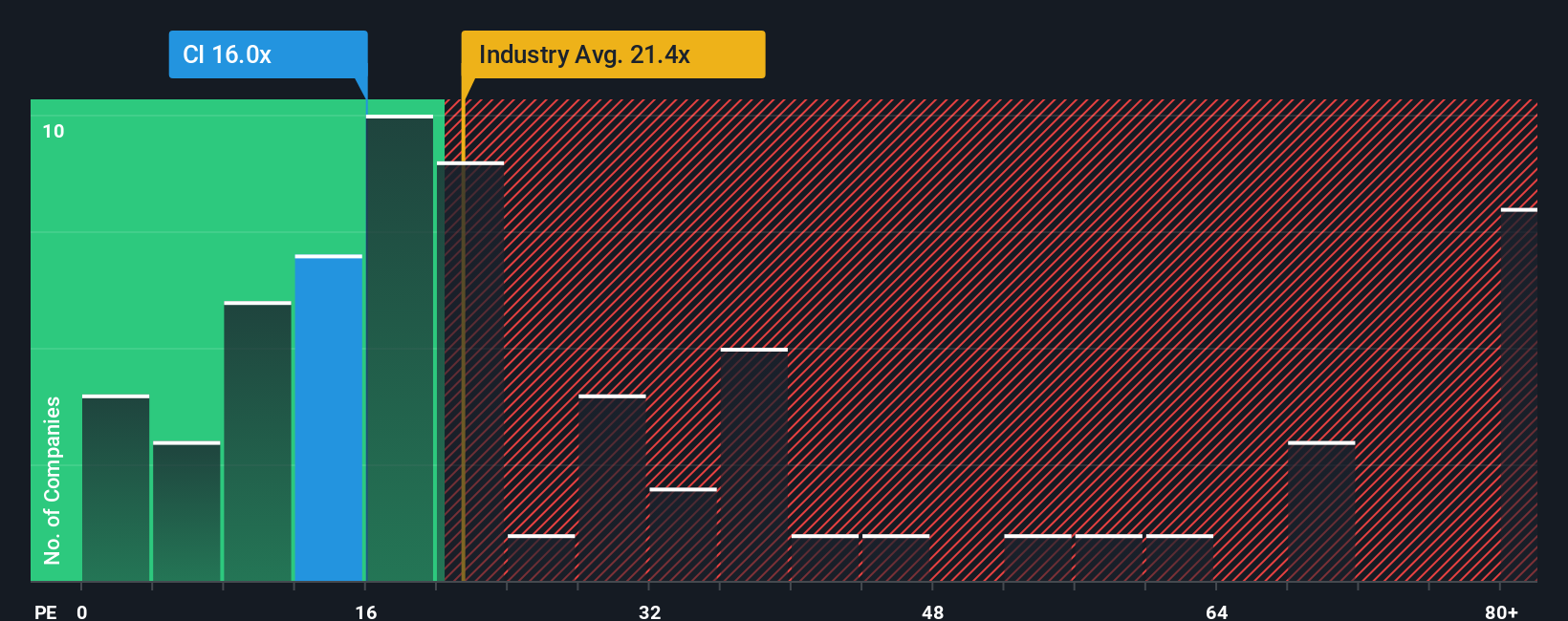

The Price-to-Earnings (PE) ratio is widely used to assess the valuation of profitable companies like Cigna Group. It tells investors how much they are paying for each dollar of earnings, making it an effective snapshot of value, especially for businesses with stable profits.

Several factors shape what a “normal” or “fair” PE should be for a company, including future growth expectations and perceived risk. All else equal, faster-growing or less risky companies tend to justify higher PE ratios, while slower growth or more uncertainty should warrant a lower PE multiple.

Currently, Cigna Group trades at a PE of 15.9x. That is well below the healthcare industry average of 21.2x and also lower than the peer group average of 21.9x, indicating the market is pricing Cigna at a notable discount.

To go deeper, Simply Wall St’s “Fair Ratio” tool estimates what Cigna’s PE should be, factoring in growth outlooks, industry dynamics, margins, market cap, and company-specific risks. This is a more holistic approach than just comparing to peers because it gives a valuation benchmark that fits Cigna’s unique profile. For Cigna, the Fair PE is calculated at 29.9x, much higher than the current multiple. This suggests Cigna is trading well below its fair value based on its fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cigna Group Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply a story you create about Cigna Group’s future, connecting what you believe about the company, such as its strengths, challenges, and industry dynamics, to numbers like future revenue, profit margins, and fair value.

By combining what you know (or believe) with financial data, a Narrative turns your perspective into a specific forecast and a calculated fair value. This helps you make investment decisions that are more aligned with your own views. Narratives are available as an intuitive tool on Simply Wall St’s Community page. Millions of investors are already using it to bring these stories to life, compare their views, and respond faster to new information or earnings announcements, since Narratives update automatically when the data changes.

Using Narratives, you can easily compare a company’s fair value, based on your own or community expectations, to its current share price. This makes it much simpler to decide if now is the right time to buy, sell, or hold. For Cigna Group, for example, some investors see rapidly rising specialty pharmacy and margin expansion boosting the stock to $428, while others, worried about regulatory risks, set a more cautious target at $300.

Do you think there's more to the story for Cigna Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CI

Cigna Group

Provides insurance and related products and services in the United States.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives