- United States

- /

- Healthcare Services

- /

- NYSE:CAH

The Bull Case For Cardinal Health (CAH) Could Change Following Global Launch of Kendall SCD SmartFlow System

Reviewed by Sasha Jovanovic

- Earlier this month, Cardinal Health announced the international launch of the Kendall SCD SmartFlow™ Compression System, expanding availability to regions including Europe, Australia, New Zealand, Brazil, and Korea, with broader rollout to the Middle East, Africa, Asia, and Latin America.

- This development marks a substantial commercial milestone by introducing proprietary compression technology designed to improve patient outcomes and safety across a global market.

- We'll explore how the global launch of the Kendall SCD SmartFlow™ impacts Cardinal Health's investment narrative and future growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cardinal Health Investment Narrative Recap

To be a shareholder in Cardinal Health, you must believe in the company's ability to drive consistent growth through global expansion in healthcare products and operational efficiency. The international launch of the Kendall SCD SmartFlow™ Compression System is a meaningful commercial move, but its immediate impact on major catalysts, like distribution efficiency and supply chain optimization, is likely limited. The biggest risk remains persistent global supply chain pressures and government pricing scrutiny, which could affect near-term operating margins.

Among recent company news, the opening of a new forward distribution center in Indianapolis stands out in relation to commercial catalysts. This move supports Cardinal Health’s ongoing push for enhanced distribution capabilities, intended to enable reliable, high-volume pharmaceutical delivery, especially as demand grows globally, though supply chain and regulatory risks remain a key watchpoint.

In contrast, investors should also be aware that further cost volatility tied to tariffs and supply chain disruption could still impact margins...

Read the full narrative on Cardinal Health (it's free!)

Cardinal Health is projected to achieve $288.0 billion in revenue and $2.2 billion in earnings by 2028. This outlook is based on a 9.0% annual revenue growth rate and a $0.6 billion increase in earnings from the current $1.6 billion.

Uncover how Cardinal Health's forecasts yield a $180.46 fair value, a 15% upside to its current price.

Exploring Other Perspectives

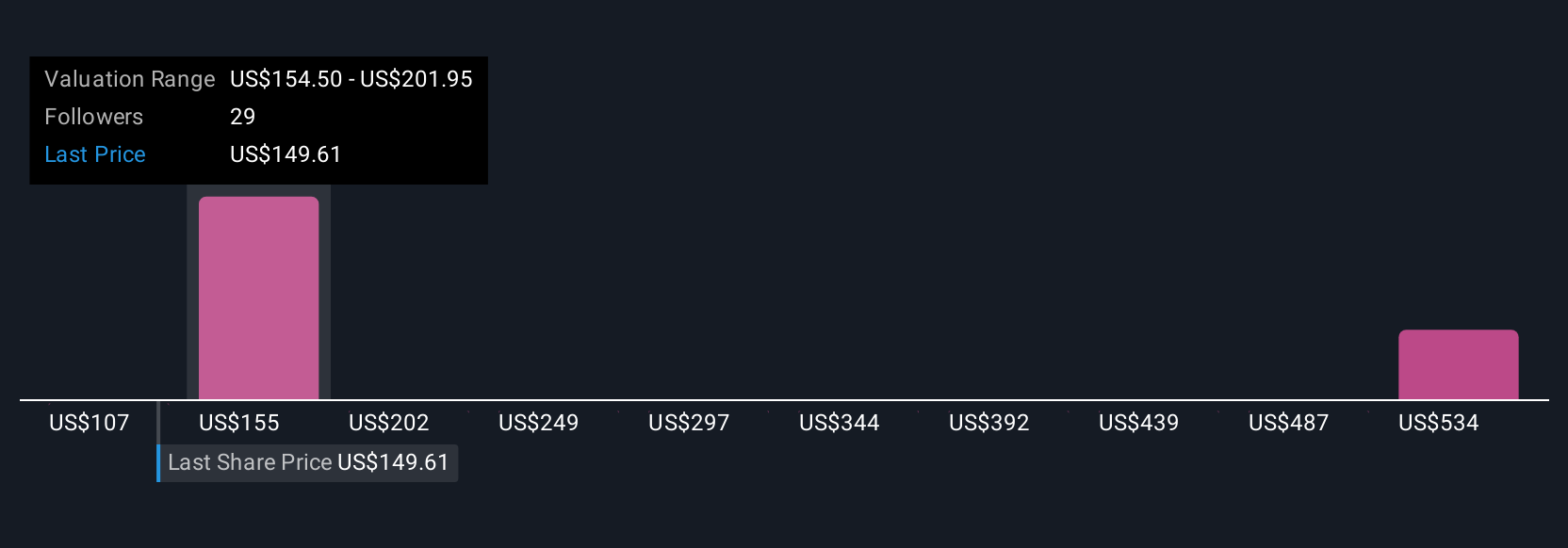

Three Simply Wall St Community fair value estimates for Cardinal Health range widely from US$168.25 to US$584.46 per share. While several participants see substantial upside, global supply chain and regulatory challenges could create more debate about earnings resilience, explore multiple viewpoints to understand the full spectrum of market sentiment.

Explore 3 other fair value estimates on Cardinal Health - why the stock might be worth over 3x more than the current price!

Build Your Own Cardinal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cardinal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cardinal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cardinal Health's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives