- United States

- /

- Healthcare Services

- /

- NYSE:BKD

Those Who Purchased Brookdale Senior Living (NYSE:BKD) Shares Five Years Ago Have A 91% Loss To Show For It

Brookdale Senior Living Inc. (NYSE:BKD) shareholders are doubtless heartened to see the share price bounce 80% in just one week. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 91% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The million dollar question is whether the company can justify a long term recovery.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Brookdale Senior Living

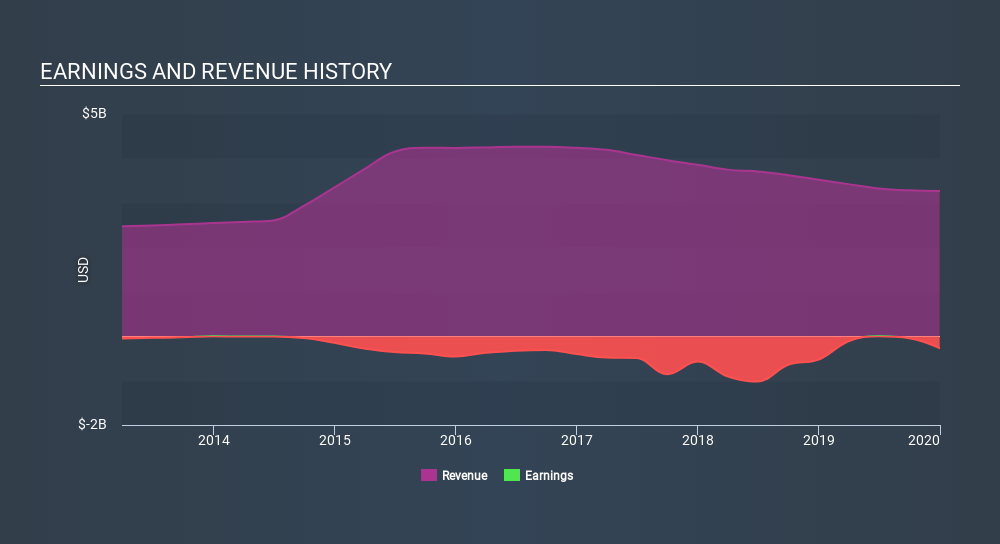

Because Brookdale Senior Living made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Brookdale Senior Living reduced its trailing twelve month revenue by 4.0% for each year. While far from catastrophic that is not good. If a business loses money, you want it to grow, so no surprises that the share price has dropped 39% each year in that time. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Brookdale Senior Living will earn in the future (free profit forecasts).

A Different Perspective

While the broader market lost about 13% in the twelve months, Brookdale Senior Living shareholders did even worse, losing 52%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 39% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Brookdale Senior Living , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:BKD

Brookdale Senior Living

Owns, manages, and operates senior living communities in the United States.

Undervalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives