- United States

- /

- Healthcare Services

- /

- NYSE:BKD

How Investors Are Reacting To Brookdale Senior Living (BKD) Rising November Occupancy And Operational Gains

Reviewed by Sasha Jovanovic

- Brookdale Senior Living recently reported that its consolidated weighted average occupancy for November 2025 reached 82.5%, up 300 basis points year over year but slipping slightly from October, while fourth quarter to date occupancy of 82.6% was 80 basis points higher than the full third quarter.

- An interesting detail for investors is that same community occupancy rose 250 basis points year over year to 82.8%, suggesting that operational improvements are lifting performance even across communities already in the portfolio.

- We’ll now examine how November’s year-over-year occupancy gains of over 200 basis points influence Brookdale’s longer-term investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Brookdale Senior Living Investment Narrative Recap

To own Brookdale, you generally need to believe that rising occupancy can eventually overcome persistent losses, high leverage and a shrinking revenue base. November’s 300 basis point year over year occupancy gain supports that core occupancy thesis, but it does not materially change the biggest near term swing factor, which is whether higher occupancy can translate into sustainable margin improvement before refinancing and balance sheet risks become more pressing.

The most relevant recent update alongside November’s report is Brookdale’s third quarter 2025 earnings release, which showed US$813.17 million in revenue and a net loss of US$114.73 million. Putting those results next to the latest occupancy metrics helps frame the central question for investors: whether ongoing operational gains at the community level can begin to narrow losses and support the longer term recovery story.

Yet even with occupancy moving higher, investors should be aware of Brookdale’s elevated leverage and the refinancing risks that start to come into focus...

Read the full narrative on Brookdale Senior Living (it's free!)

Brookdale Senior Living's narrative projects $3.3 billion revenue and $176.3 million earnings by 2028. This requires 2.3% yearly revenue growth and a $418.9 million earnings increase from $-242.6 million today.

Uncover how Brookdale Senior Living's forecasts yield a $11.44 fair value, a 8% upside to its current price.

Exploring Other Perspectives

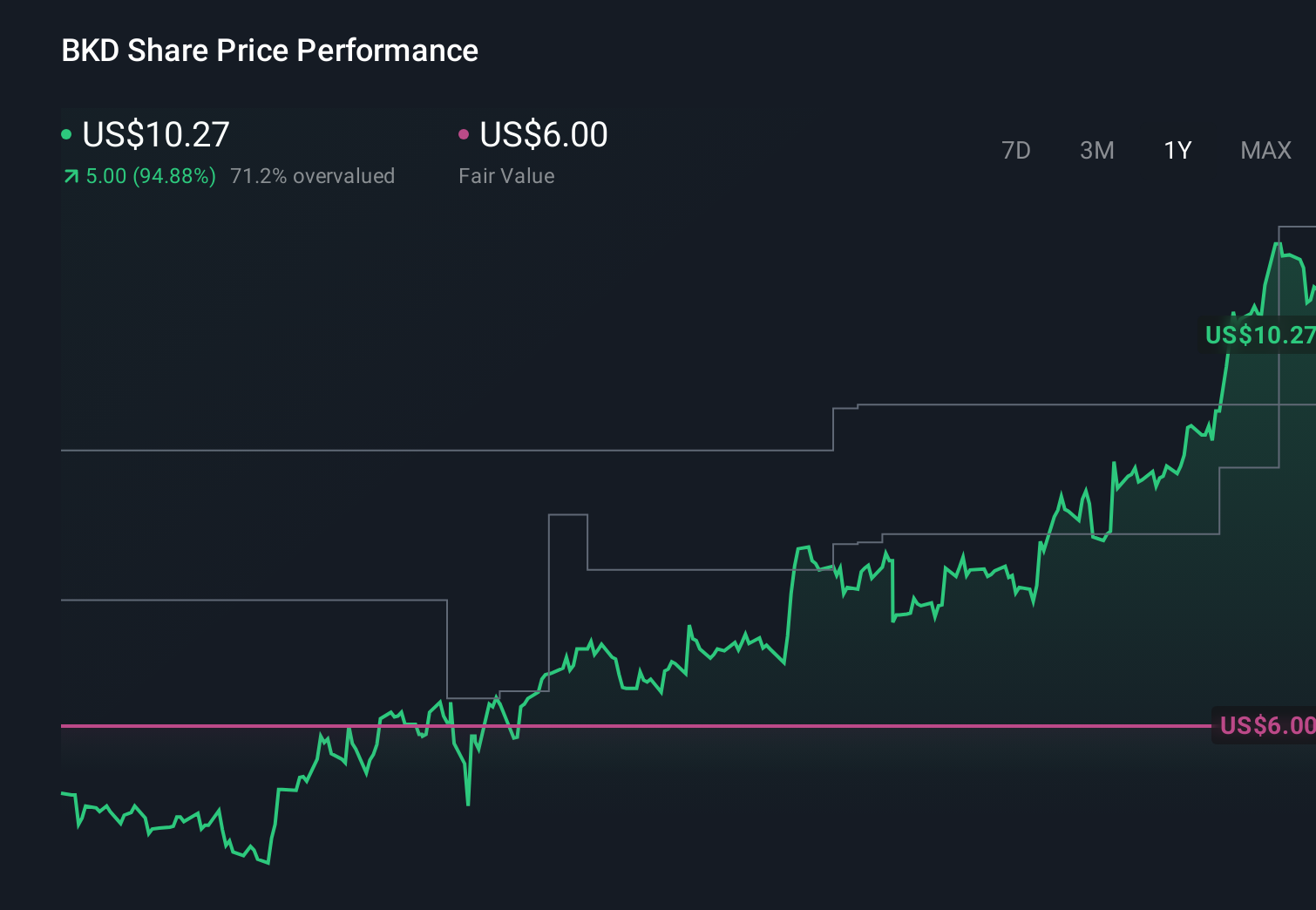

Simply Wall St Community members have only two fair value estimates for Brookdale, ranging from US$6.00 to about US$16.74, underscoring how far apart individual views can be. As you weigh those opinions against the recent occupancy gains, it is worth testing how sensitive your own view is to Brookdale’s ability to grow margins before its high debt load becomes a bigger constraint.

Explore 2 other fair value estimates on Brookdale Senior Living - why the stock might be worth 43% less than the current price!

Build Your Own Brookdale Senior Living Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookdale Senior Living research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Brookdale Senior Living research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookdale Senior Living's overall financial health at a glance.

No Opportunity In Brookdale Senior Living?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookdale Senior Living might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKD

Brookdale Senior Living

Owns, manages, and operates senior living communities in the United States.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026