- United States

- /

- Medical Equipment

- /

- NYSE:BDX

With EPS Growth And More, Becton Dickinson (NYSE:BDX) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Becton Dickinson (NYSE:BDX). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Becton Dickinson

How Quickly Is Becton Dickinson Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Becton Dickinson has grown EPS by 24% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Becton Dickinson reported flat revenue and EBIT margins over the last year. That's not bad, but it doesn't point to ongoing future growth, either.

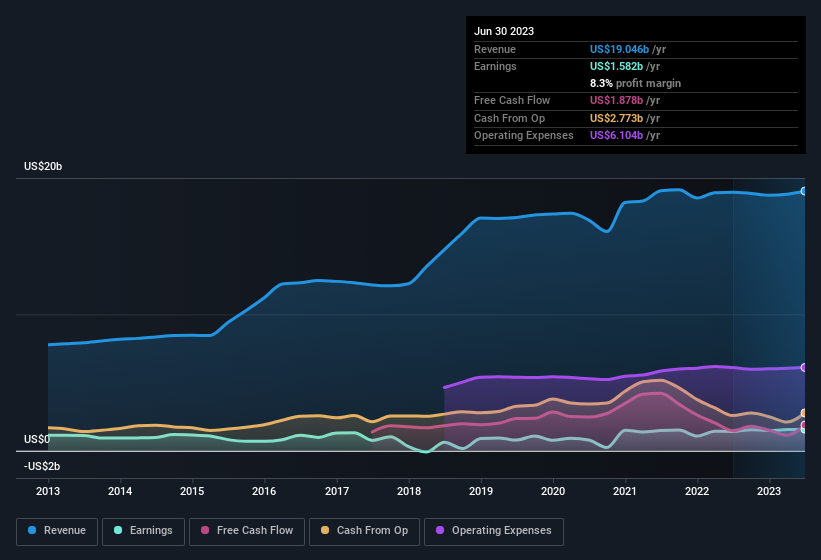

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Becton Dickinson's forecast profits?

Are Becton Dickinson Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$75b company like Becton Dickinson. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth US$113m. This comes in at 0.2% of shares in the company, which is a fair amount of a business of this size. This still shows shareholders there is a degree of alignment between management and themselves.

Is Becton Dickinson Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Becton Dickinson's strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Becton Dickinson's continuing strength. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Becton Dickinson that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives