- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Has Becton Dickinson’s Slump in 2025 Created a Hidden Opportunity for Investors?

Reviewed by Simply Wall St

If you find yourself pondering whether Becton Dickinson stock can make your portfolio healthier, you’re not alone. Even seasoned investors are watching closely, especially after seeing shares dip nearly 18% year-to-date and down almost 20% over the past twelve months. While the stock saw a slight uptick of 0.2% in the past week, that momentum follows months of steady pressure, due in part to industry-wide headwinds and ongoing market shifts that have made investors more cautious about medical device companies in general.

Despite these recent challenges, the longer-term performance tells its own story. Becton Dickinson’s five-year return sits at -8.2%, with a three-year return of -14.0%. Clearly, buyers searching for a turnaround stock will want to look closely at whether the company’s fundamentals support a rebound, or if risks still outweigh the rewards.

When it comes to valuation, the numbers offer another reality check. Becton Dickinson’s value score stands at 0, based on a six-point checklist that considers whether the stock is undervalued in key ways. In other words, it did not pass any of the typical undervaluation tests that many investors look for when hunting for bargains.

So, what do traditional valuation methods reveal, and are they telling the complete story for Becton Dickinson? In the next section, we will dig into the familiar approaches to valuing this healthcare heavyweight and hint at a smarter, more nuanced take for investors who want to look beyond the basics.

Becton Dickinson scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Becton Dickinson Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a stock’s value by projecting its future cash flows and discounting them back to today’s dollars. In Becton Dickinson's case, analysts expect the company to generate Free Cash Flow (FCF) of $2.43 billion over the last twelve months. Forecasts suggest that FCF could increase to $4.23 billion by 2026 and then $3.39 billion in 2027, with further projections extending out a decade. These long-range figures are based on extrapolations rather than direct analyst estimates.

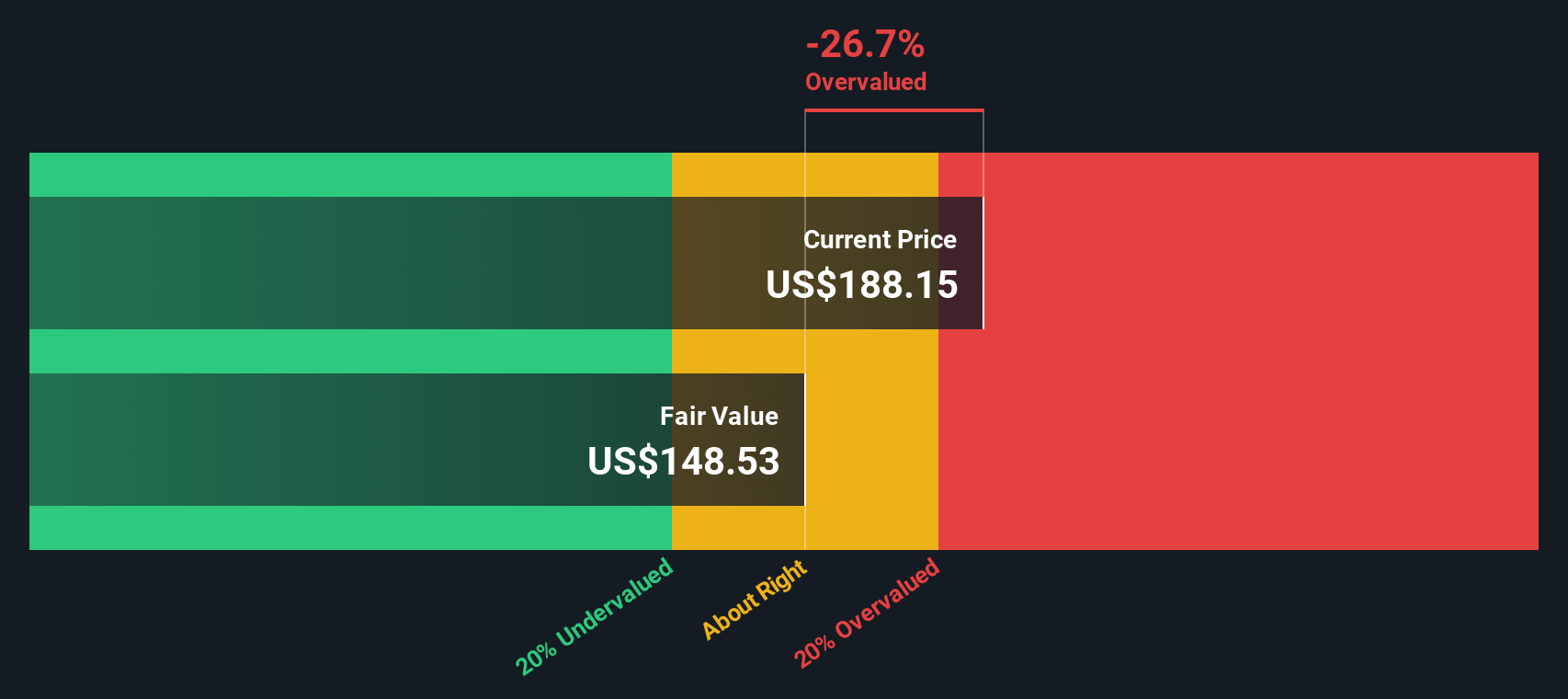

According to this two-stage model, the intrinsic value of Becton Dickinson shares is $150.68. However, the implied discount indicates the current share price is about 23.8% higher than this estimate. This suggests the market is valuing the company’s future cash flows well above what the DCF model supports.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Becton Dickinson.

Approach 2: Becton Dickinson Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies like Becton Dickinson, as it directly relates a company’s share price to its earnings per share. PE is especially useful because it adjusts for profitability and allows investors to compare companies of different sizes within the same industry.

However, determining the appropriate or “normal” PE ratio for a stock involves more than just considering profits. Growth expectations, perceived company risk, and prevailing market sentiment all influence what investors should be willing to pay for each dollar of earnings. Companies that are growing more quickly or that carry lower risks often attract higher PE ratios, while slower-growing or riskier firms tend to see lower multiples.

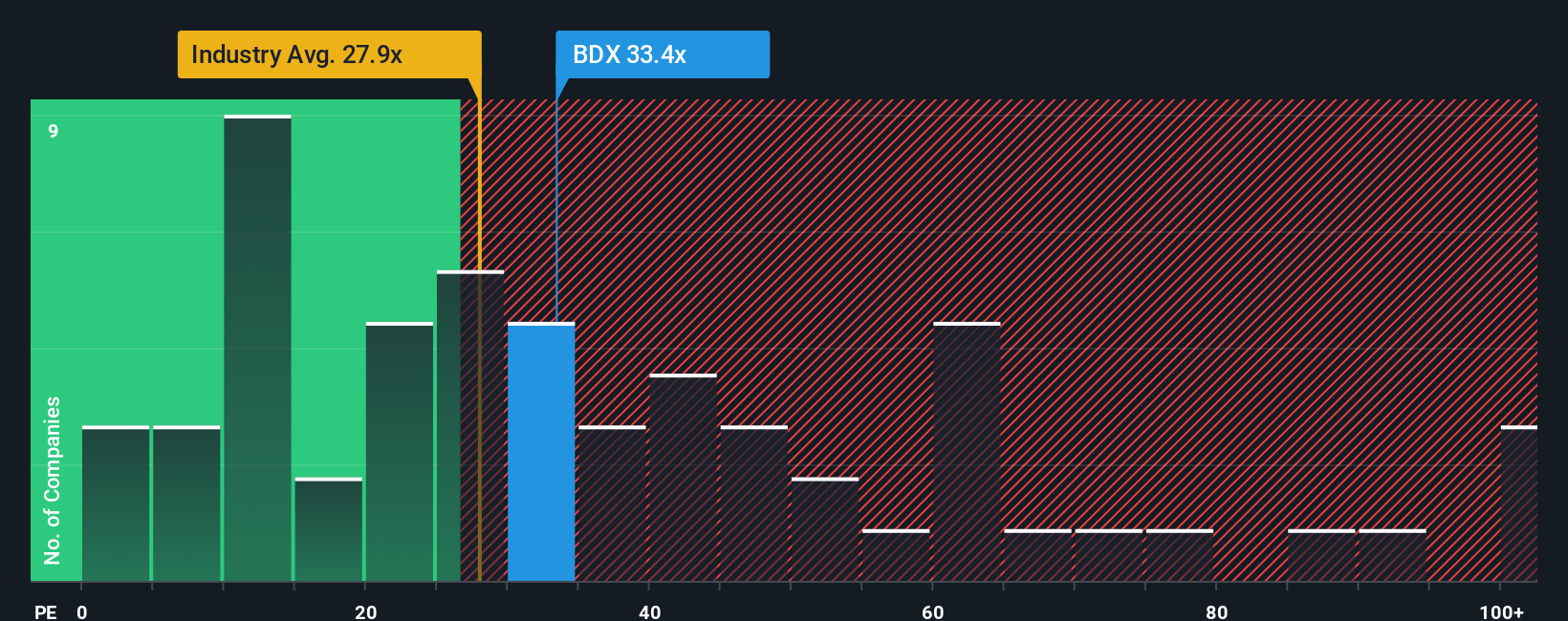

Becton Dickinson currently trades at a PE ratio of 33.7x, which is above both the industry average of 28.4x and its peer group’s average of 31.9x. For a more nuanced perspective, Simply Wall St’s proprietary Fair Ratio incorporates not only industry criteria and peer comparisons but also factors such as company growth, profit margins, market capitalization, and risk profile. This approach provides a more tailored benchmark for valuation than generic industry or peer multiples alone.

The Fair Ratio for Becton Dickinson stands at 31.8x, just below its actual PE. With less than 0.10 difference between these figures, the stock appears to be valued approximately in line with what fundamentals would suggest.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Becton Dickinson Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story that connects your view of a company, including its prospects, risks, and business model, with specific numbers such as your estimated fair value, future revenues, earnings, and profit margins.

Narratives help you move beyond static formulas by linking your perspective on what drives Becton Dickinson’s business to a real financial forecast and then all the way through to a calculated fair value. This framework transforms the numbers into a living, accessible tool that anyone can use, available right now to millions of investors on Simply Wall St's Community page.

One of the key advantages of Narratives is that they adapt dynamically. Whenever new earnings, news, or company updates are released, your fair value and forecast adjust in real time. This keeps your decisions current and helps you confidently evaluate if the price is above or below what you believe the stock is truly worth, guiding when you might buy or sell.

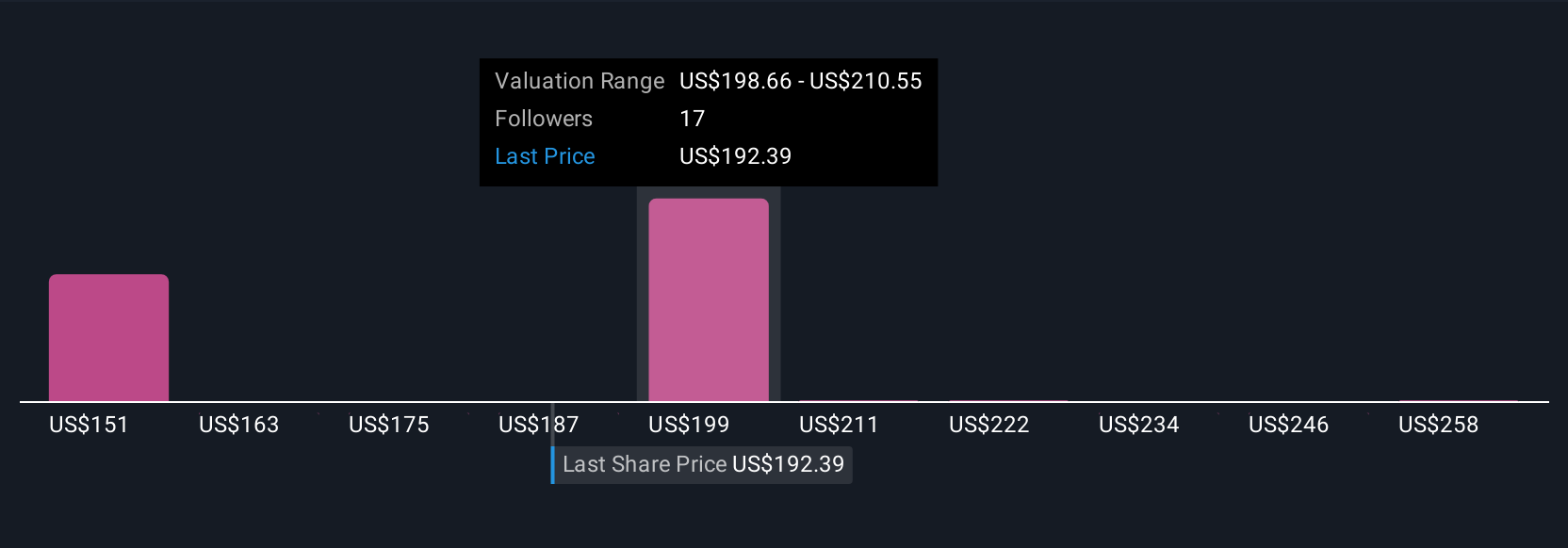

For example, some Becton Dickinson Narratives see a fair value as high as $270, reflecting optimism about new product launches and expanding markets. Others are as low as $183 due to concerns about regulatory risks and headwinds, showing how different stories lead to different estimates, all powered by your own research and expectations.

Do you think there's more to the story for Becton Dickinson? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026