- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Assessing Becton Dickinson After 15% YTD Drop and Recent AI Partnership Announcement

Reviewed by Bailey Pemberton

If you have been watching Becton Dickinson stock lately and wondering whether it is the right time to buy, hold, or steer clear, you are not alone. The medical technology giant has been a staple for many investors, and its recent price moves are drawing even more attention. In just the past week, shares are up 2.9%, a welcome uptick after a string of less impressive returns. Over the last month, Becton Dickinson is nearly flat at 0.1%. If you look at the year to date, however, the stock is down 15.0%. Taking an even longer view, the declines are more pronounced, including a 17.1% drop over the last year and nearly 10% over both three- and five-year timeframes.

Some of this negative momentum can be linked to broader shifts in the healthcare sector. Investor sentiment has swung between optimism and concerns about regulatory changes and supply chain resilience. Market discussion recently has focused on potential opportunities created by evolving medical technologies, but also on increased competition in key segments.

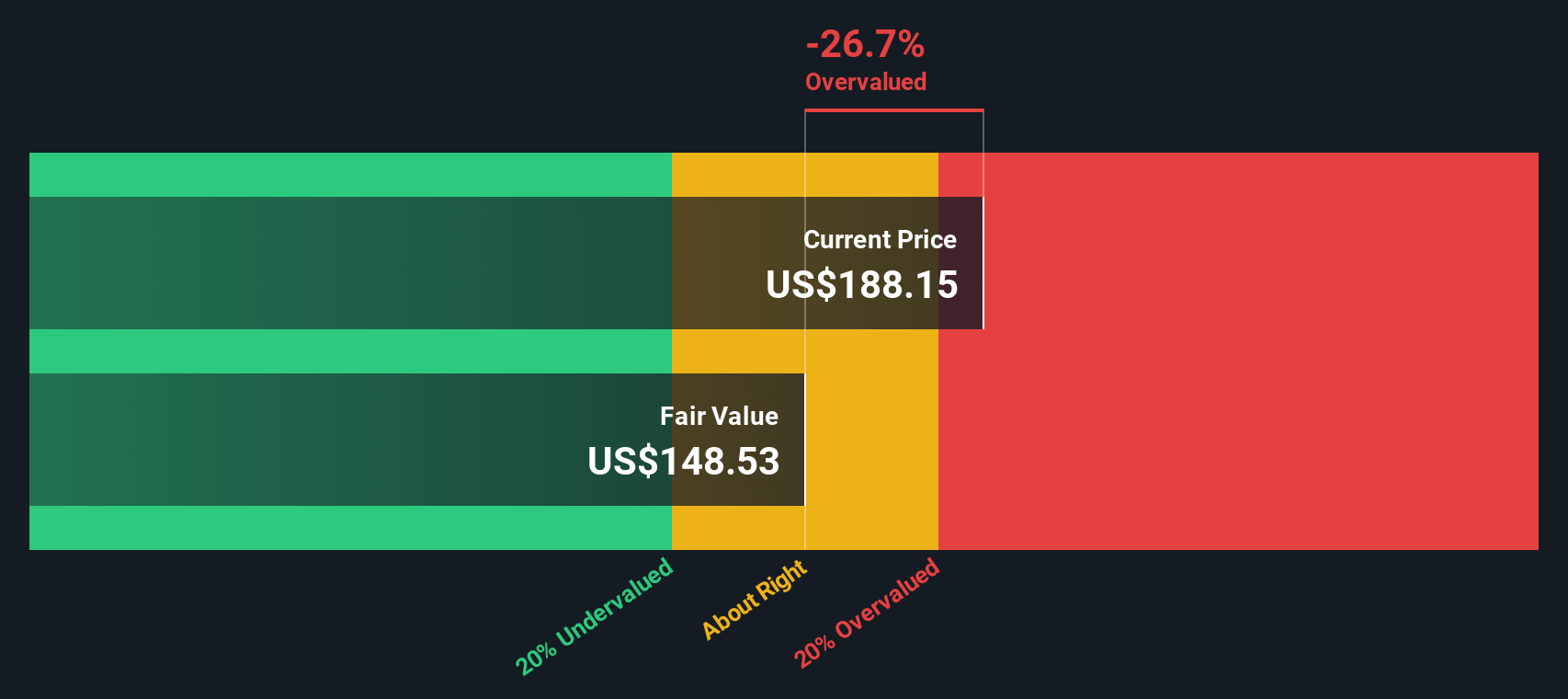

Is the current price an opportunity, or a sign of more challenges ahead? According to a traditional valuation framework, Becton Dickinson scores a 2 out of 6 for being undervalued, meaning it passes just two of the six key checks analysts often consider. Numbers rarely tell the whole story, though. Here is a closer look at how Becton Dickinson is being valued today, and why standard approaches might not capture the bigger picture.

Becton Dickinson scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Becton Dickinson Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and then discounting those amounts back to their value today. It is a popular method for assessing what a business is truly worth, based on its ability to generate cash.

For Becton Dickinson, the current free cash flow stands at $2.43 billion. Analysts expect this figure to continue increasing steadily, with estimates suggesting free cash flow will reach $5.43 billion by 2030. Analyst consensus covers the next five years; future projections beyond that point are extrapolated by Simply Wall St using moderate growth rates.

Based on the latest DCF analysis, the intrinsic value of Becton Dickinson is $341.31 per share. Compared to today's market price, this implies the stock is trading at a 43.6% discount, which means it is considered significantly undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Becton Dickinson is undervalued by 43.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Becton Dickinson Price vs Earnings

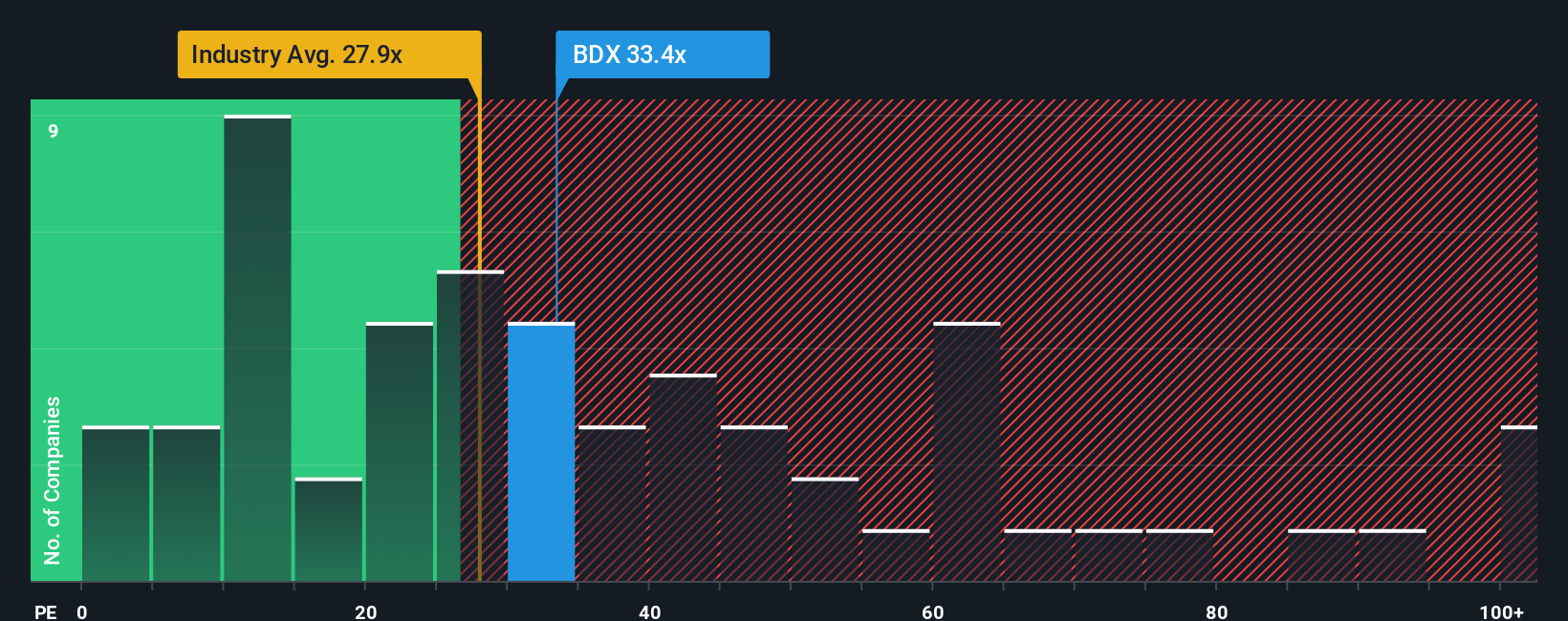

The Price-to-Earnings (PE) ratio is a common metric for valuing profitable companies because it connects a company’s share price with its earnings, giving a quick read on how much investors are willing to pay for each dollar the business earns. For companies with consistent profits like Becton Dickinson, the PE ratio is particularly relevant, as it reflects both the company’s growth prospects and the risks investors perceive in the business.

What counts as a “normal” or “fair” PE ratio depends not only on the company’s recent performance but also on future earnings growth, industry conditions, and broader market risks. Generally, a higher growth outlook or lower risk profile justifies a higher PE.

Becton Dickinson currently trades on a PE ratio of 34.8x. This sits above the Medical Equipment industry average of 30.7x and just above the peer group average of 31.9x. However, benchmarking only to peers or the industry does not always capture the company’s unique circumstances.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, at 32.0x for Becton Dickinson, reflects a blend of the company’s earnings growth outlook, profit margins, business risks, market cap, and its broader industry dynamics. Unlike a simple average, this approach gives a more tailored valuation benchmark for each company.

Comparing the Fair Ratio of 32.0x to Becton Dickinson’s current PE of 34.8x, the stock is trading at a modest premium to its own fundamentals. The difference of 2.8x suggests the stock is slightly overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Becton Dickinson Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personal story about what is driving a company's future, an explanation of how you see Becton Dickinson’s prospects, which ties together your expectations for revenue growth, margins, and fair value estimates. Narratives let you go beyond the numbers by linking your understanding of the company’s business developments, risks, and catalysts directly to a financial forecast and a specific fair value target.

With Narratives, you are not just plugging numbers into a model. You are connecting the company's real-world story to its financial outlook, then seeing how your fair value calculation compares to today’s share price. Narratives are easy to create and update right within Simply Wall St’s Community page, trusted by millions of investors, and they dynamically refresh as new company news or quarterly earnings emerge.

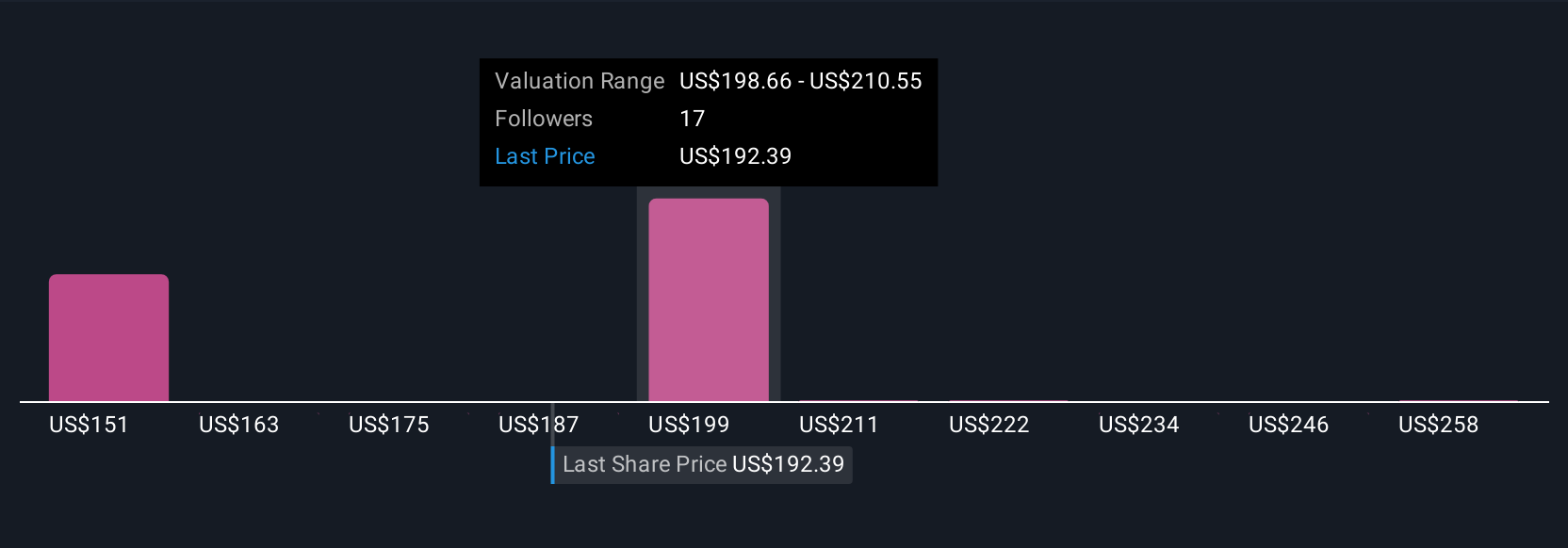

This helps you make more confident buy and sell decisions that actually reflect your view of Becton Dickinson and adjust quickly to changing facts. For example, some investors see significant upside, with fair values around $270 per share based on rapid innovation and margin gains. More cautious views point to a lower $183 fair value amid ongoing regulatory and market headwinds.

Do you think there's more to the story for Becton Dickinson? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives