- United States

- /

- Medical Equipment

- /

- NYSE:BDX

A Look at Becton Dickinson’s Valuation Following New Automation and Clinical Initiatives

Reviewed by Kshitija Bhandaru

Becton Dickinson (BDX) has just kicked off two significant initiatives. The company has announced a collaboration with Opentrons Labworks to bring more automation to single-cell research, and has launched its XTRACT Registry for the Rotarex Catheter System.

See our latest analysis for Becton Dickinson.

Becton Dickinson’s latest automation and clinical initiatives come as the company’s share price has lost ground. Its year-to-date price return is now -17.63%. Investors have faced a total shareholder return of -19.47% over the past year, reflecting a period where momentum has faded despite ongoing innovation and steady long-term revenue growth.

If this shift in sentiment has you curious about fresh prospects, explore other healthcare standouts and see the full list for free: See the full list for free.

With shares trading well below their analyst price target and metrics that suggest slowing momentum, investors are now left to wonder if Becton Dickinson stock is a bargain or if the market is already looking ahead to slower growth.

Most Popular Narrative: 10.3% Undervalued

Becton Dickinson closed at $186.56, with the most followed narrative putting its fair value at $208. This sets up a valuation case that challenges current market sentiment.

The pending separation of the Biosciences and Diagnostic Solutions business will transform BD into a pure-play medical technology leader with a consumables-heavy portfolio (greater than 90% of revenue). This will enable higher cash flow predictability and potential margin improvement. Anticipated aggressive share buybacks are also expected to directly support EPS growth.

Curious what powers that valuation? Find out which bold revenue, margin, and buyback assumptions help build a premium price for Becton Dickinson. Get the full breakdown and see the numbers insiders are watching.

Result: Fair Value of $208 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade headwinds and execution risks from the business separation could weigh on future margins and earnings. This may potentially change the outlook ahead.

Find out about the key risks to this Becton Dickinson narrative.

Another View: Multiples Raise Questions

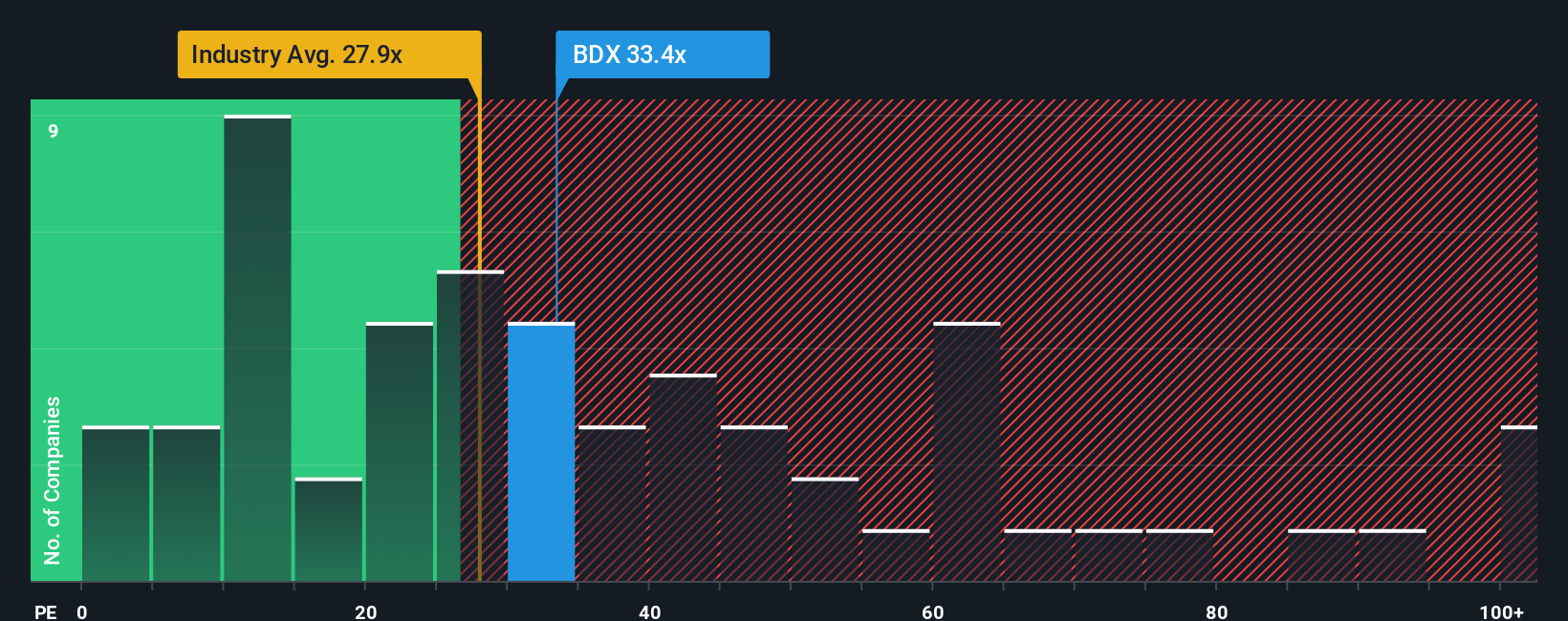

Looking strictly at current price-to-earnings ratios, Becton Dickinson appears expensive. Shares trade at 33.7 times earnings, compared to peer and industry averages around 30x and even a fair ratio of 31.9x. This suggests expectations for greater growth or quality. However, are those expectations too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Becton Dickinson Narrative

If you see things differently or want to dive into the numbers yourself, you can build your perspective in just a few minutes. Do it your way

A great starting point for your Becton Dickinson research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

You don’t want to miss the next winning trend. Take charge and use the Simply Wall Street Screener to spot stocks primed for growth and potential.

- Accelerate your search for tech disruptors with these 24 AI penny stocks that harness artificial intelligence and continually push the boundaries of what is possible.

- Maximize your yield by targeting these 19 dividend stocks with yields > 3% offering substantial payouts and stable performance for income-focused investors.

- Unlock the potential of tomorrow’s markets by spotting these 3581 penny stocks with strong financials on the verge of breakout growth and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026