- United States

- /

- Medical Equipment

- /

- NYSE:BAX

Baxter International (NYSE:BAX) Sees Sales Slightly Up Despite Reporting US$512 Million Net Loss

Reviewed by Simply Wall St

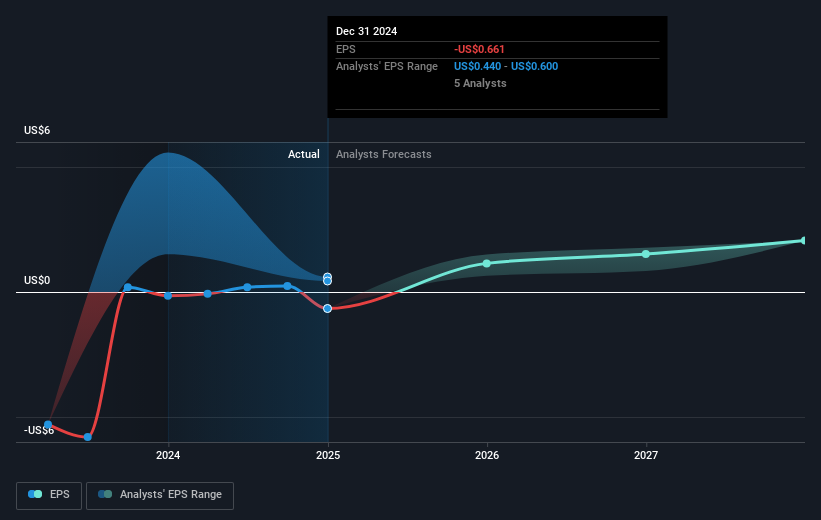

Baxter International (NYSE:BAX) reported a concerning shift from profitability to a significant loss in the fourth quarter, with net income transitioning to a loss of $512 million despite a minor increase in sales. This financial setback was marked by a basic loss per share of $1.00, markedly lower than the previous year's earnings. Nonetheless, amid a fluctuating market landscape, where the Dow Jones dropped 1.5% and the S&P 500 and Nasdaq Composite both saw declines, Baxter's stock experienced a 1.75% price increase over the past week. This movement came despite broader market challenges such as falling stocks in key sectors and economic uncertainties. Walmart's disappointing outlook contributed to a 6% stock decline, while major indices, including the S&P 500, reached record highs before encountering setbacks. Despite a challenging quarter, BAX managed to edge up in such a volatile period, underscoring its resilience amid broader market pressures.

Unlock comprehensive insights into our analysis of Baxter International stock here.

Over the period of the last year, Baxter International's total shareholder return was -24.91%. This marked a significant underperformance compared to its peers, with the US Medical Equipment industry achieving an 11.6% return, and the broader US market seeing a 23.7% gain. A key factor impacting this performance was the company's high Price-To-Earnings ratio of 130.1, significantly outstripping both industry and peer averages, potentially deterring value-focused investors. Additionally, revenue forecasts suggested a decline at an annual rate of 3.2% over the next three years, in contrast to expected market growth, which may have dampened investor enthusiasm.

Moreover, financial setbacks such as a large one-off loss of US$1 billion seemed to weigh heavily on Baxter's results over the past 12 months. The company's management changes, like the retirement of CEO José E. Almeida and appointment of Brent Shafer as interim CEO, also might have contributed to market uncertainties during the year. Despite these challenges, earnings did show a positive growth trajectory of 26% compared to previous years, though it appeared insufficient to offset the broader concerns among investors.

- See whether Baxter International's current market price aligns with its intrinsic value in our detailed report

- Uncover the uncertainties that could impact Baxter International's future growth—read our risk evaluation here.

- Are you invested in Baxter International already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baxter International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAX

Baxter International

Through its subsidiaries, develops and provides a portfolio of healthcare products worldwide.

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives