- United States

- /

- Medical Equipment

- /

- NYSE:BAX

Baxter International Inc.'s (NYSE:BAX) Prospects Need A Boost To Lift Shares

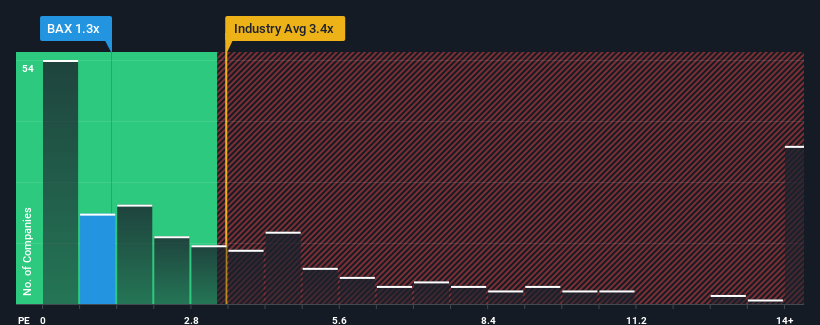

With a price-to-sales (or "P/S") ratio of 1.3x Baxter International Inc. (NYSE:BAX) may be sending very bullish signals at the moment, given that almost half of all the Medical Equipment companies in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Baxter International

What Does Baxter International's P/S Mean For Shareholders?

Baxter International's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Baxter International will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Baxter International.How Is Baxter International's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Baxter International's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.0% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 33% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 2.2% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 9.8% growth each year, the company is positioned for a weaker revenue result.

With this information, we can see why Baxter International is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Baxter International's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Baxter International (including 1 which is a bit concerning).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Baxter International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BAX

Baxter International

Through its subsidiaries, provides a portfolio of healthcare products in the United States.

Undervalued with moderate growth potential.