- United States

- /

- Healthcare Services

- /

- NYSE:ELV

Why Anthem (NYSE:ANTM) has the Fundamental Potential to Keep Delivering on the Long-Term

Anthem, Inc. ( NYSE:ANTM ) seems to have been a great long-term investment, as evident by the stock being up 257% in five years. Additionally , the share price has risen 14% in thirty days, resulting from the latest earnings release. We will go over the performance of the bottom line as it relates to providing free cash flows to investors, and see how the future potential fares.

To get a clearer picture of the fundamentals, you could check the most recent data by reading our company report .

Looking at the latest Q3 earnings report, we see that the company is delivering:

- Revenue: US$35.8b (up 15% from 3Q 2020).

- Net income: US$1.51b (up from US$1.29b in 3Q 2020).

- Profit margin: 4.2% (up from 0.7% in 3Q 2020). The increase in margin was driven by higher revenue.

On a cautionary note, over the last 3 years on average, earnings per share has increased by 9% per year, but the company’s share price has increased by 18% per year, which means it is tracking significantly ahead of earnings growth.

While past performance provides us with a good baseline, the price of a security is in the future potential of the company.

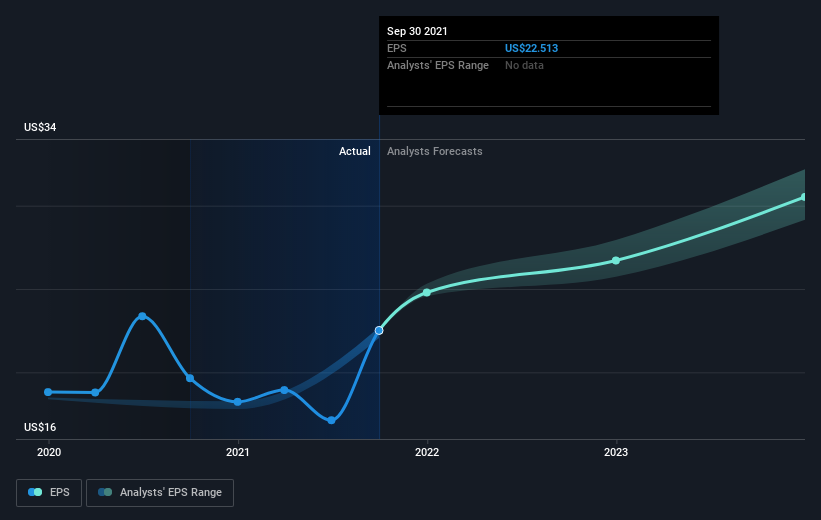

In the chart below, we can see that analysts are expecting more net income growth in the future, which shows that there is more upside potential by way of improving margins backed by growth.

Another way, to evaluate the performance is to compare the net income to the cash flows. We can do this by analyzing the accrual ratio.

The accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

See our latest analysis for Anthem

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

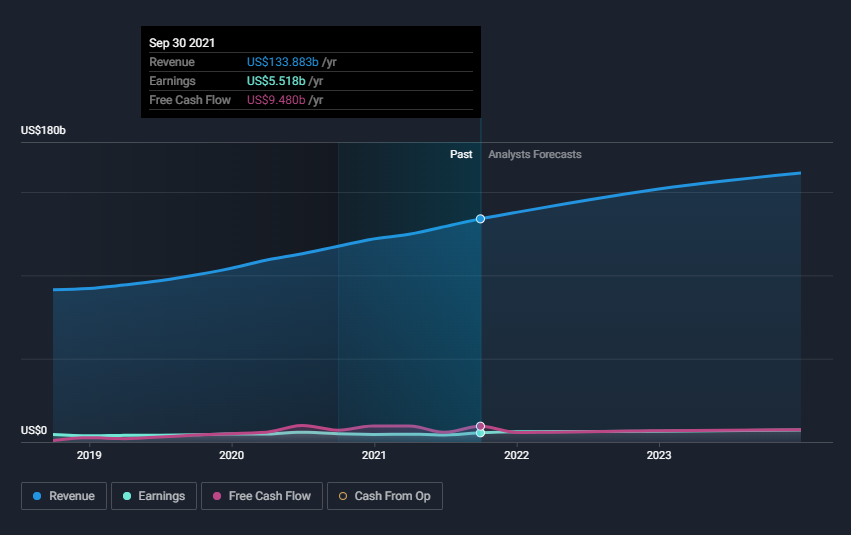

In the chart below, we will see the difference between free cash flows and earnings. The cash flows are arguably more important as they are the thing that is attributable to investors, while earnings are a reflection of accounting approaches which can be somewhat subjective.

For the year to September 2021, Anthem had an accrual ratio of -0.16.

That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. Indeed, in the last twelve months it reported free cash flow of US$9.5b, well over the US$5.52b it reported in profit.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return .

The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested.

So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return.As it happens, Anthem's TSR for the last 5 years was 280%, which exceeds the share price return mentioned earlier.

This shows us that dividends are also a meaningful contributor to shareholder returns, and as the company is still growing, it opens the possibility of a dividend rise in the future.

Key Takeaways

Anthem shareholders have received a total shareholder return of 47% over the last year, which includes dividends.

The company earnings are solid, and have improved over the years. More importantly, the company is converting as much or more than it earns into free cash flows, which is a great leading indicator of future financial performance.

Analysts are seeing improvements in both revenue and earnings growth in the future, so it is fair to be optimistic on the long-term success of the stock.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade Elevance Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elevance Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:ELV

Elevance Health

Operates as a health benefits company in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives