- United States

- /

- Healthcare Services

- /

- NYSE:AGL

Investors Give agilon health, inc. (NYSE:AGL) Shares A 40% Hiding

agilon health, inc. (NYSE:AGL) shareholders won't be pleased to see that the share price has had a very rough month, dropping 40% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

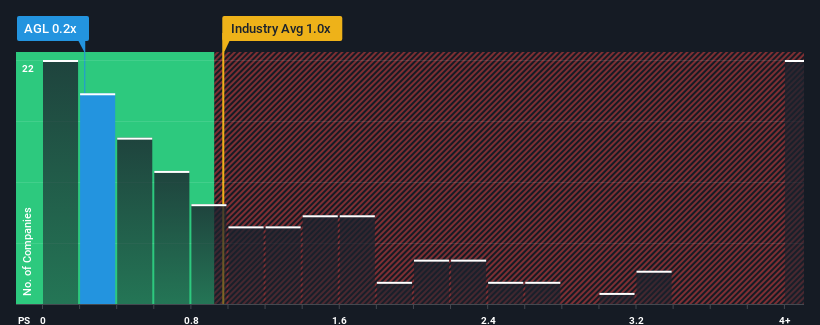

After such a large drop in price, given about half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1x, you may consider agilon health as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

We've discovered 2 warning signs about agilon health. View them for free.Check out our latest analysis for agilon health

What Does agilon health's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, agilon health has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on agilon health will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like agilon health's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Pleasingly, revenue has also lifted 189% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 11% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 7.9% each year growth forecast for the broader industry.

In light of this, it's peculiar that agilon health's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

agilon health's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

agilon health's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for agilon health you should be aware of.

If you're unsure about the strength of agilon health's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade agilon health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AGL

agilon health

Provides healthcare services for seniors through primary care physicians in the communities of the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives