- United States

- /

- Healthcare Services

- /

- NYSE:AGL

agilon health, inc. (NYSE:AGL) Stock's 43% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, agilon health, inc. (NYSE:AGL) shares are down a considerable 43% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 84% loss during that time.

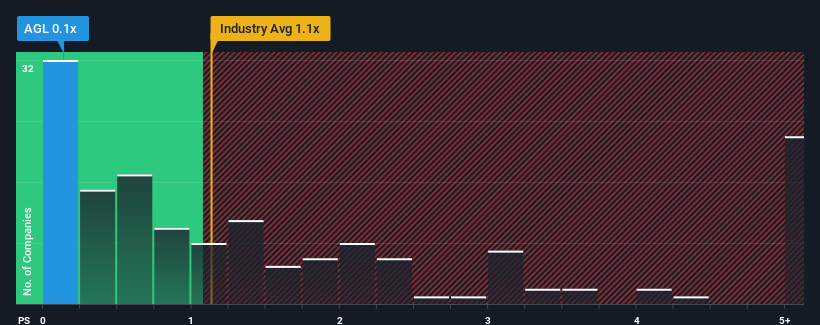

After such a large drop in price, it would be understandable if you think agilon health is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' Healthcare industry have P/S ratios above 1.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for agilon health

What Does agilon health's P/S Mean For Shareholders?

agilon health certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think agilon health's future stacks up against the industry? In that case, our free report is a great place to start.How Is agilon health's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like agilon health's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 54%. The latest three year period has also seen an excellent 231% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 21% each year during the coming three years according to the analysts following the company. With the industry only predicted to deliver 7.2% per annum, the company is positioned for a stronger revenue result.

With this information, we find it odd that agilon health is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On agilon health's P/S

agilon health's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at agilon health's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware agilon health is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AGL

agilon health

Provides healthcare services for seniors through primary care physicians in the communities of the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives