- United States

- /

- Medical Equipment

- /

- NYSE:ABT

The Bull Case For Abbott Laboratories (ABT) Could Change Following Health Canada Approval of Dissolvable Stent

Reviewed by Sasha Jovanovic

- Abbott Laboratories recently received Health Canada approval for its Esprit BTK Everolimus Eluting Resorbable Scaffold System, a dissolvable stent designed to treat chronic limb threatening ischemia below the knee using a minimally invasive procedure.

- This first-of-its-kind device aims to reduce the need for repeat procedures and improve outcomes for a condition with high rates of amputation and mortality.

- We'll examine how this regulatory milestone, highlighting Abbott's leadership in next-generation vascular devices, may shift the company's investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Abbott Laboratories Investment Narrative Recap

For those considering Abbott Laboratories, the core belief hinges on its ability to innovate in high-growth medical technology while managing risks from diagnostic sales headwinds and global market volatility. The recent Health Canada approval of Abbott’s Esprit BTK System further supports its narrative of leadership in next-generation devices, but this milestone does not materially alter the biggest short-term catalyst: strong new product launches in high-margin segments, nor the ongoing risk from declining COVID testing demand and VBP-related pressure in China.

Among Abbott’s recent announcements, the launch of the FreeStyle Libre 3 Plus sensor in Canada is most relevant. This device strengthens Abbott’s position in diabetes management and parallels the Esprit BTK’s focus on minimally invasive, high-impact innovation, critical for supporting future growth as traditional diagnostics face persistent challenges.

Yet, investors should keep in mind, despite new device momentum, ongoing headwinds in the diagnostics segment remain a risk that could...

Read the full narrative on Abbott Laboratories (it's free!)

Abbott Laboratories is projected to reach $53.3 billion in revenue and $9.4 billion in earnings by 2028. This requires a 7.3% annual revenue growth rate and a $4.5 billion decrease in earnings from the current $13.9 billion.

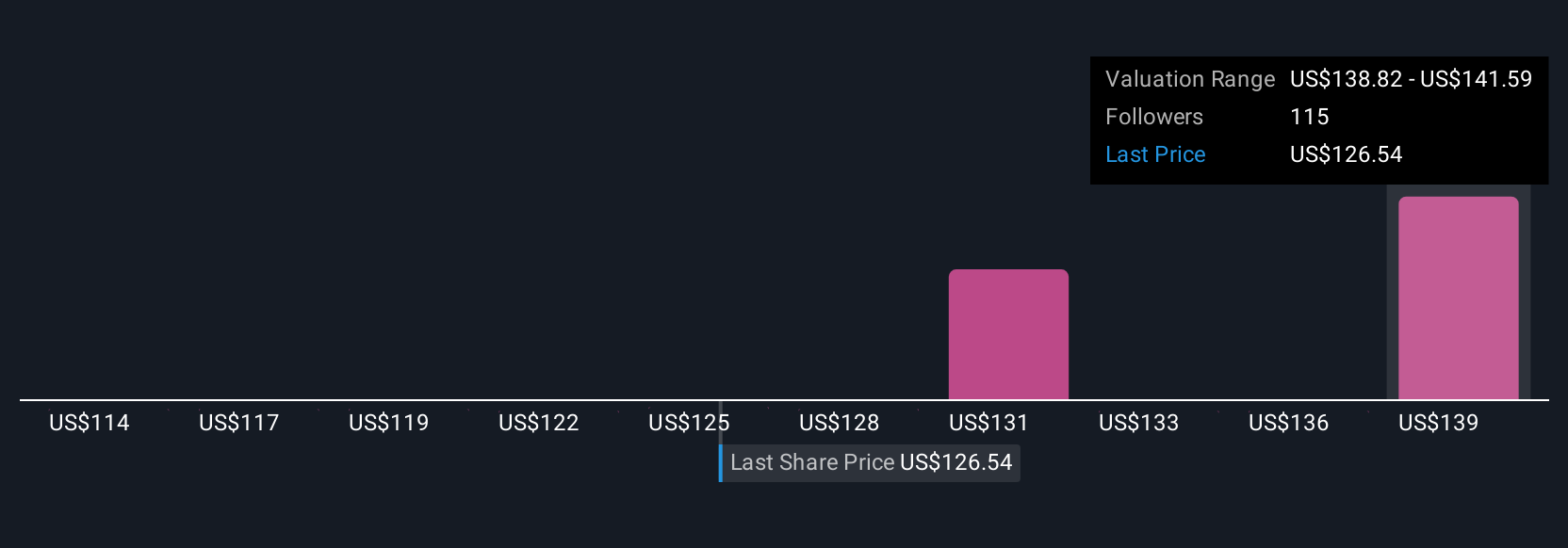

Uncover how Abbott Laboratories' forecasts yield a $142.48 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Twelve members of the Simply Wall St Community valued Abbott between US$93.81 and US$142.48 per share. Many expect innovative launches to offset challenges in diagnostics, so it is worth reviewing a mix of opinions before deciding.

Explore 12 other fair value estimates on Abbott Laboratories - why the stock might be worth 30% less than the current price!

Build Your Own Abbott Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Abbott Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abbott Laboratories' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives