- United States

- /

- Medical Equipment

- /

- NasdaqCM:ZJYL

Why Investors Shouldn't Be Surprised By Jin Medical International Ltd.'s (NASDAQ:ZJYL) 31% Share Price Surge

Those holding Jin Medical International Ltd. (NASDAQ:ZJYL) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 79% share price decline over the last year.

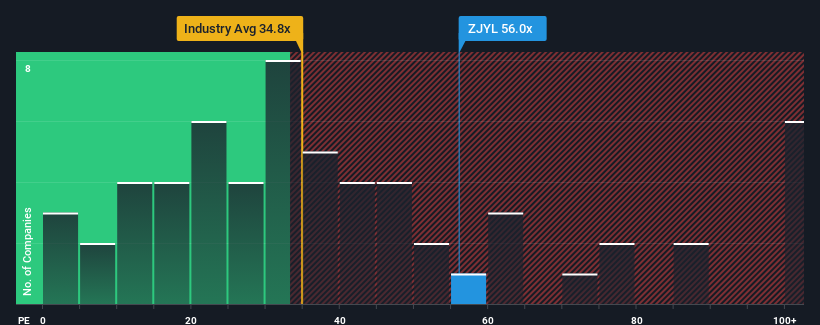

Since its price has surged higher, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Jin Medical International as a stock to avoid entirely with its 56x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Jin Medical International's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Jin Medical International

Does Growth Match The High P/E?

In order to justify its P/E ratio, Jin Medical International would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 158% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 15% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Jin Medical International is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Jin Medical International's P/E

The strong share price surge has got Jin Medical International's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Jin Medical International maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Jin Medical International that you should be aware of.

Of course, you might also be able to find a better stock than Jin Medical International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ZJYL

Jin Medical International

Engages in the design, development, manufacture, and sale of wheelchair and other living aids products for people with disabilities, the elderly, and people recovering from injury.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives