- United States

- /

- Medical Equipment

- /

- NasdaqCM:ZJYL

Jin Medical International Ltd.'s (NASDAQ:ZJYL) Shares Climb 372% But Its Business Is Yet to Catch Up

Despite an already strong run, Jin Medical International Ltd. (NASDAQ:ZJYL) shares have been powering on, with a gain of 372% in the last thirty days. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

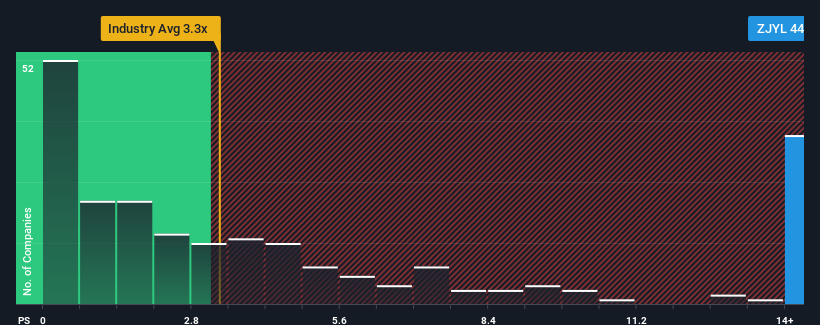

After such a large jump in price, Jin Medical International may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 44.6x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios under 3.3x and even P/S lower than 1.3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Jin Medical International

How Jin Medical International Has Been Performing

As an illustration, revenue has deteriorated at Jin Medical International over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Jin Medical International, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Jin Medical International?

In order to justify its P/S ratio, Jin Medical International would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 4.0% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 15% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

This is in contrast to the rest of the industry, which is expected to grow by 8.8% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Jin Medical International is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Jin Medical International's P/S

Jin Medical International's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Jin Medical International revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 2 warning signs for Jin Medical International that you need to take into consideration.

If these risks are making you reconsider your opinion on Jin Medical International, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Jin Medical International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ZJYL

Jin Medical International

Engages in the design, development, manufacture, and sale of wheelchair and other living aids products for people with disabilities, the elderly, and people recovering from injury.

Proven track record with adequate balance sheet.