- United States

- /

- Medical Equipment

- /

- NasdaqGS:XRAY

How Investors Are Reacting To DENTSPLY SIRONA (XRAY) Appointing an Interim CFO With Turnaround Expertise

Reviewed by Sasha Jovanovic

- On November 25, 2025, DENTSPLY SIRONA Inc. announced that veteran finance executive Michael Pomeroy had been appointed interim Chief Financial Officer, while President and CEO Daniel T. Scavilla continues as the company’s principal financial officer until a permanent CFO is named.

- Pomeroy’s track record guiding complex industrial, healthcare, retail, and medical device businesses through growth, turnarounds, and M&A adds experienced financial oversight at a time when DENTSPLY SIRONA is pursuing operational improvement and portfolio refinement.

- We’ll now explore how bringing in an interim CFO with turnaround and M&A experience could influence DENTSPLY SIRONA’s long-term recovery narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DENTSPLY SIRONA Investment Narrative Recap

To own DENTSPLY SIRONA, you need to believe its mix of digital dentistry, implants, and global distribution can return to sustainable growth despite recent revenue pressure and impairments. The interim CFO appointment looks more like a stabilizing move than a change to the near term catalysts, which still hinge on execution of cost reduction programs, tariff mitigation, and reigniting demand in high margin elective categories. The biggest risk remains that weak top line trends and tariff headwinds persist.

The recent Q3 2025 results and updated 2025 guidance, which point to net sales of US$3.6 billion to US$3.7 billion and continued year over year declines, frame the context for this finance leadership change. With fresh impairment charges linked to tariffs and softer volumes in equipment, implants, and prosthetics, an interim CFO with turnaround and M&A experience could be important in preserving balance sheet flexibility while management pushes operational streamlining and digital dentistry initiatives like DS Core.

Yet investors should also weigh how prolonged tariff related cost pressure could affect margins and capital allocation over the next few years...

Read the full narrative on DENTSPLY SIRONA (it's free!)

DENTSPLY SIRONA's narrative projects $3.9 billion revenue and $502.2 million earnings by 2028.

Uncover how DENTSPLY SIRONA's forecasts yield a $12.96 fair value, a 15% upside to its current price.

Exploring Other Perspectives

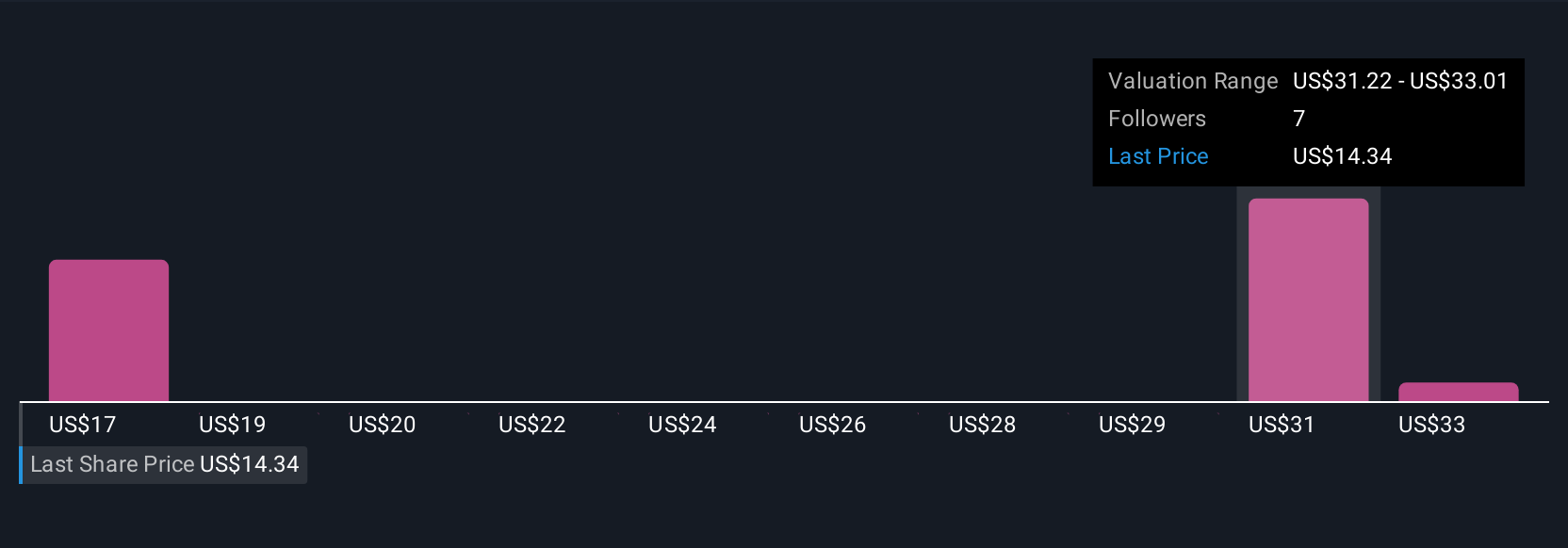

Three members of the Simply Wall St Community currently see fair value for DENTSPLY SIRONA between US$12.96 and US$34.81, reflecting very different outlooks on recovery. Before leaning on any one view, it is worth considering that ongoing sales weakness and repeated impairments have already challenged expectations for a smooth turnaround, which can influence how confidently the company can invest in growth and margin improvement.

Explore 3 other fair value estimates on DENTSPLY SIRONA - why the stock might be worth just $12.96!

Build Your Own DENTSPLY SIRONA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DENTSPLY SIRONA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DENTSPLY SIRONA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DENTSPLY SIRONA's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XRAY

DENTSPLY SIRONA

Develops, manufactures, and markets dental equipment supported by cloud-enabled solutions, dental products, and healthcare consumable products in urology and enterology worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026