- United States

- /

- Healthcare Services

- /

- NasdaqCM:VVOS

Fewer Investors Than Expected Jumping On Vivos Therapeutics, Inc. (NASDAQ:VVOS)

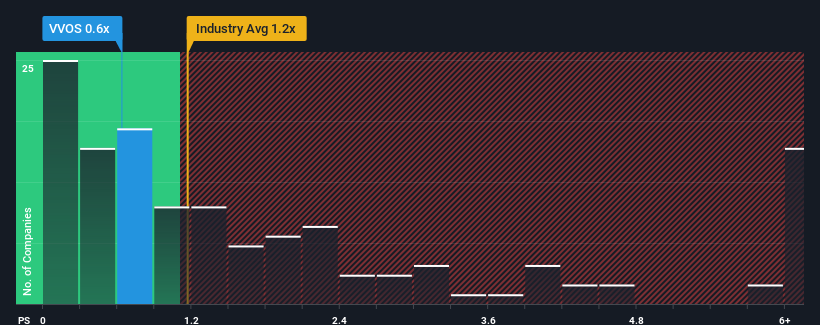

Vivos Therapeutics, Inc.'s (NASDAQ:VVOS) price-to-sales (or "P/S") ratio of 0.6x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Healthcare industry in the United States have P/S ratios greater than 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Vivos Therapeutics

What Does Vivos Therapeutics' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Vivos Therapeutics' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vivos Therapeutics.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Vivos Therapeutics' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 41% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 30% per annum as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 8.6% each year growth forecast for the broader industry.

In light of this, it's peculiar that Vivos Therapeutics' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Vivos Therapeutics currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 5 warning signs for Vivos Therapeutics (1 is a bit unpleasant!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VVOS

Vivos Therapeutics

A medical technology company, develops and commercializes treatment modalities for patients with dentofacial abnormalities, obstructive sleep apnea (OSA), and snoring in adults.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives