- United States

- /

- Hospitality

- /

- NasdaqGS:SABR

Exploring 3 Undervalued Small Caps In United States With Insider Activity

Reviewed by Simply Wall St

In the United States, while the market has experienced a slight 1.0% decline over the past week, it has shown robust growth of 38% over the past year with earnings projected to increase by 15% annually. In this environment, identifying stocks that are potentially undervalued and exhibit insider activity can offer intriguing opportunities for investors seeking to capitalize on future growth potential.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.6x | 0.9x | 43.53% | ★★★★★★ |

| Hanover Bancorp | 9.6x | 2.2x | 46.74% | ★★★★★☆ |

| Franklin Financial Services | 9.4x | 1.8x | 37.47% | ★★★★☆☆ |

| HighPeak Energy | 11.6x | 1.5x | 37.70% | ★★★★☆☆ |

| Citizens & Northern | 13.6x | 2.9x | 43.56% | ★★★☆☆☆ |

| Guardian Pharmacy Services | 79.6x | 1.0x | 41.41% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -111.76% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -49.90% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.6x | -192.80% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

SNDL (NasdaqCM:SNDL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SNDL operates in the liquor and cannabis industries, with a focus on retail and operations, and has a market capitalization of CA$1.20 billion.

Operations: SNDL generates revenue primarily from liquor retail, cannabis retail, and cannabis operations. The company has seen its gross profit margin fluctuate, reaching 23.52% in the most recent period. Operating expenses, including general and administrative costs, have been significant factors impacting financial outcomes.

PE: -7.0x

SNDL, a small company in the U.S., is navigating challenges with unprofitability and reliance on external borrowing. Recent leadership changes include J. Carlo joining the board, while Taranvir Vander retires after enhancing SNDL's liquor division. Despite reporting a reduced net loss of CAD 5.77 million for Q2 2024 compared to CAD 32.52 million previously, profitability remains elusive over the next three years. The company's strategic moves could influence its future path amid industry dynamics and internal restructuring efforts.

- Click to explore a detailed breakdown of our findings in SNDL's valuation report.

Assess SNDL's past performance with our detailed historical performance reports.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre operates as a technology solutions provider for the global travel and tourism industry, with a focus on offering services through its Travel Solutions and Hospitality Solutions segments, and has a market capitalization of approximately $1.55 billion.

Operations: Sabre's primary revenue streams are derived from its Travel Solutions and Hospitality Solutions segments, with Travel Solutions contributing significantly more. The company's gross profit margin has shown fluctuations, reaching as high as 81.41% in 2020 before stabilizing around the mid-50s to mid-60s percentage range in recent periods. Operating expenses, including research and development costs, consistently impact the company's financial performance.

PE: -3.2x

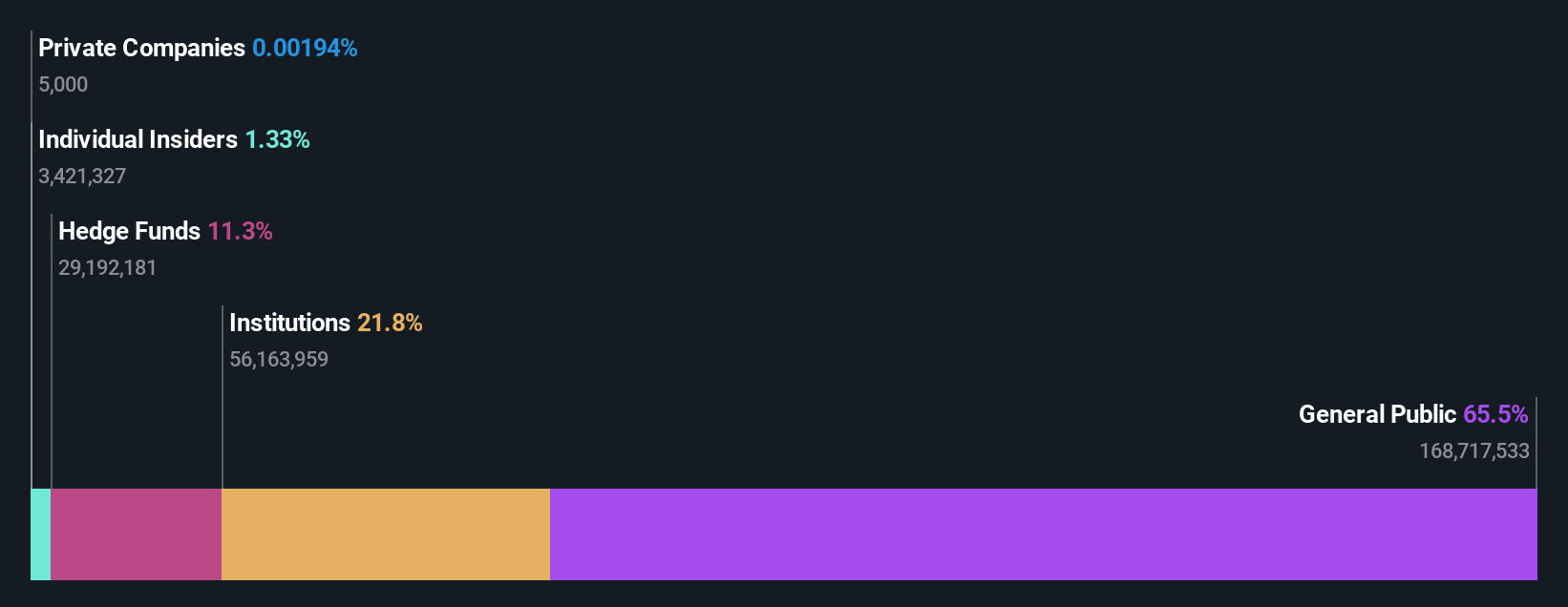

Sabre, a technology company in the travel sector, is capturing attention with its strategic agreements and innovative solutions. Recently, it partnered with Riyadh Air to implement SabreMosaic™ Offer Optimization technology, enhancing personalized offers using AI. This aligns with its multi-year distribution deals with Arajet and PLAY airlines, expanding global reach. Insider confidence has been reflected through recent share purchases by executives over the past year. With a forecasted earnings growth of 90% annually, Sabre remains an intriguing prospect in this category.

Varex Imaging (NasdaqGS:VREX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Varex Imaging is a company that designs and manufactures X-ray imaging components for medical and industrial applications, with a market cap of approximately $0.92 billion.

Operations: Varex Imaging generates revenue primarily from its Medical and Industrial segments, with recent figures showing $601 million from Medical and $231.7 million from Industrial. The company's gross profit margin has seen fluctuations, with a notable trend of decreasing to 26.33% in October 2020 before rising to around 32.16% by June 2024. Operating expenses have consistently been a significant part of the cost structure, including research and development expenses which reached $86.9 million in October 2024.

PE: 15.2x

Varex Imaging, a small company in the medical imaging sector, is drawing attention for its potential value. Despite recent drops from several S&P indices on September 7, 2024, insider confidence remains evident with CFO Shubham Maheshwari purchasing 10,000 shares for US$108,200. This suggests belief in future growth despite challenges like decreased earnings and sales reported on August 1. The company's upcoming revenue guidance for Q4 ranges between US$190 million and US$210 million.

- Take a closer look at Varex Imaging's potential here in our valuation report.

Understand Varex Imaging's track record by examining our Past report.

Summing It All Up

- Click this link to deep-dive into the 52 companies within our Undervalued US Small Caps With Insider Buying screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SABR

Sabre

Operates as software and technology company for travel industry in the United States, Europe, Asia-Pacific, and internationally.

Fair value with moderate growth potential.